On 11th April 2022, the Monetary Authority of Singapore (MAS) announced changes to Section 13O and Section 13U — two tax incentive schemes commonly used to establish family office structures in Singapore. These changes came into effect on 18th April 2022.

Read on for a summary of these schemes, aimed at addressing the needs of high-net-worth families hoping to establish single family offices (SFOs) in Singapore, and find out how the updates will affect these entities.

Ties that bind: Establishing a single family office in Singapore

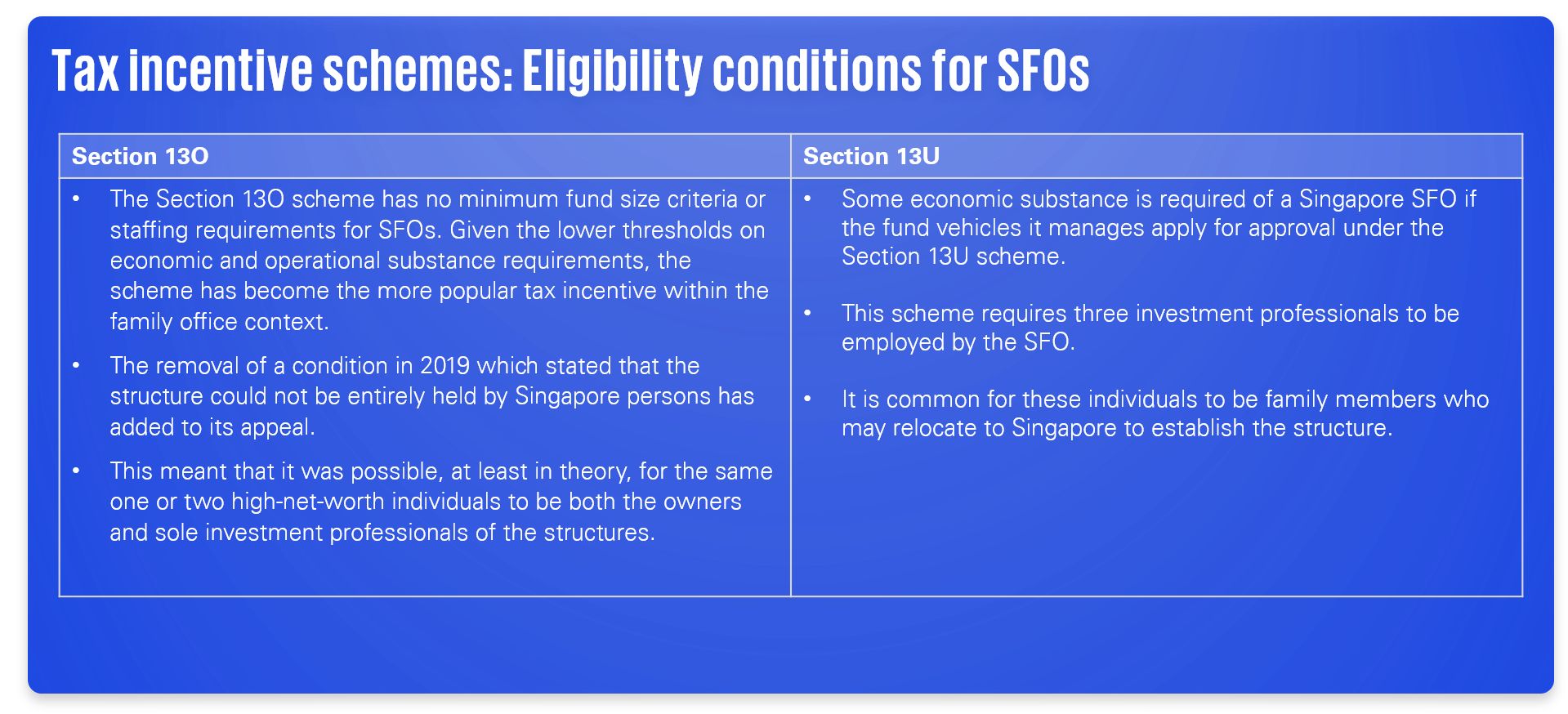

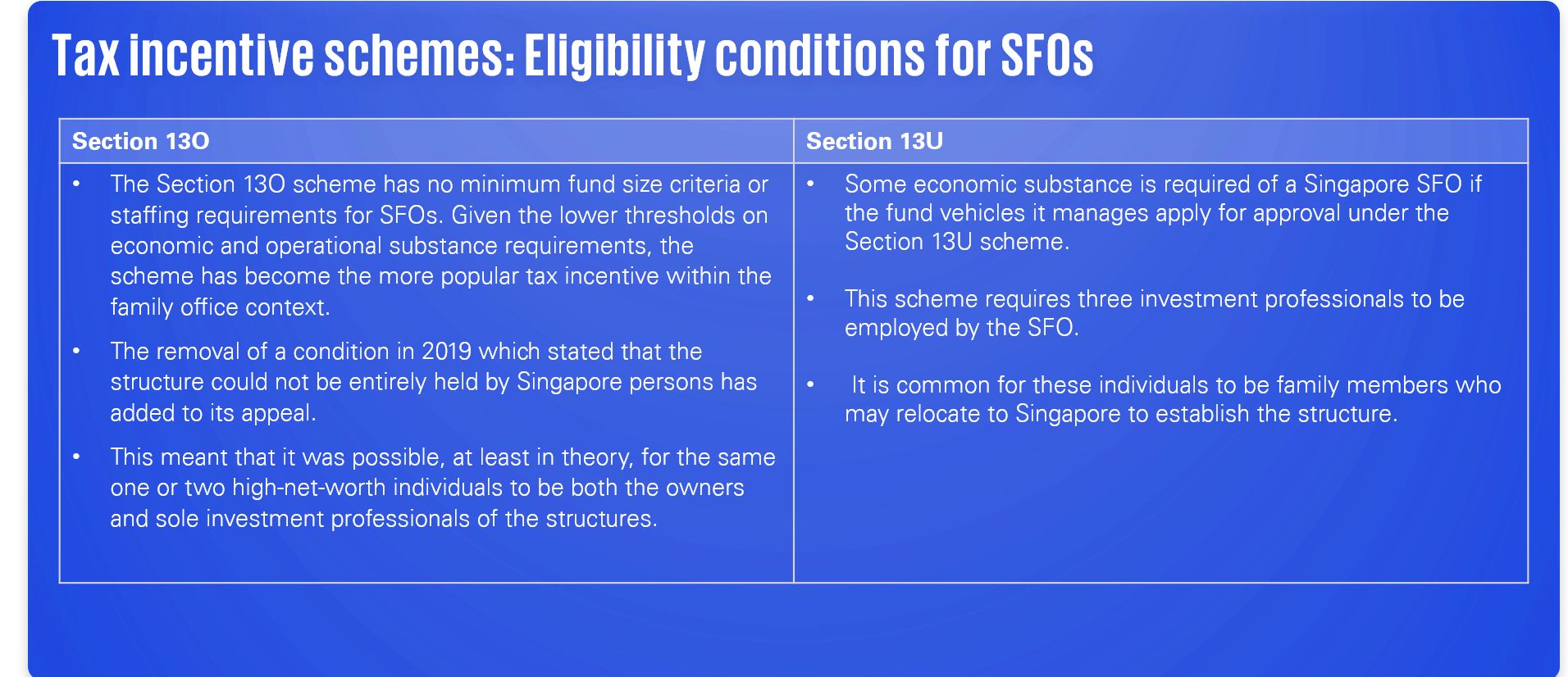

Initially developed in an institutional funds context, Sections 13O and 13U have become a common feature in the design of private wealth structures over the years. These structures typically involve the appointment of a Singapore family office to provide investment management services on either a discretionary or non-discretionary basis.

An SFO providing services to the wealth structure of only one family can be exempt from regulation under the Securities and Futures Act 2001. This means that such SFOs — in theory, with only a single local director — can be established in Singapore with minimal substance requirements.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Family first: Laying the foundations for a healthier economy

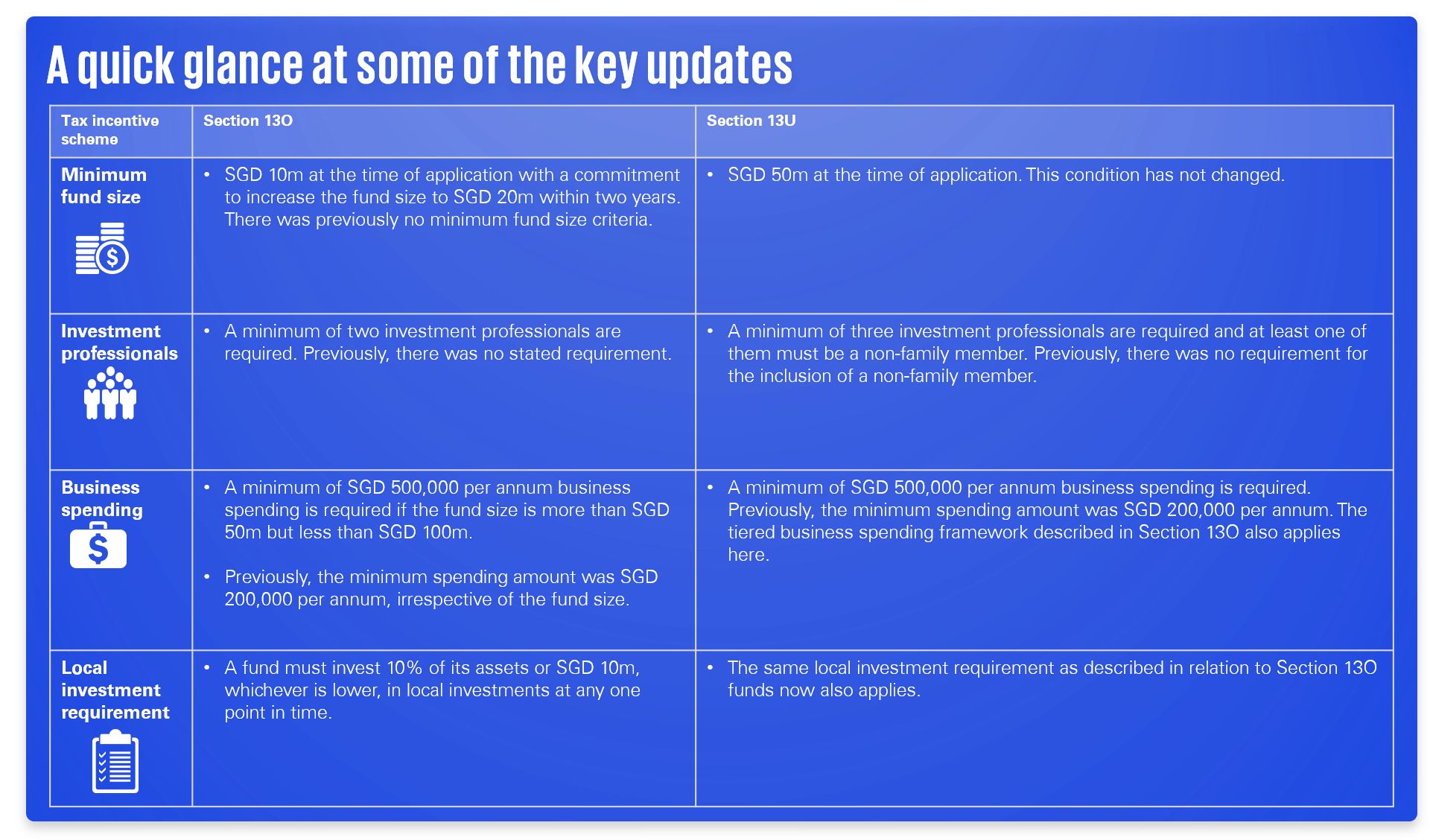

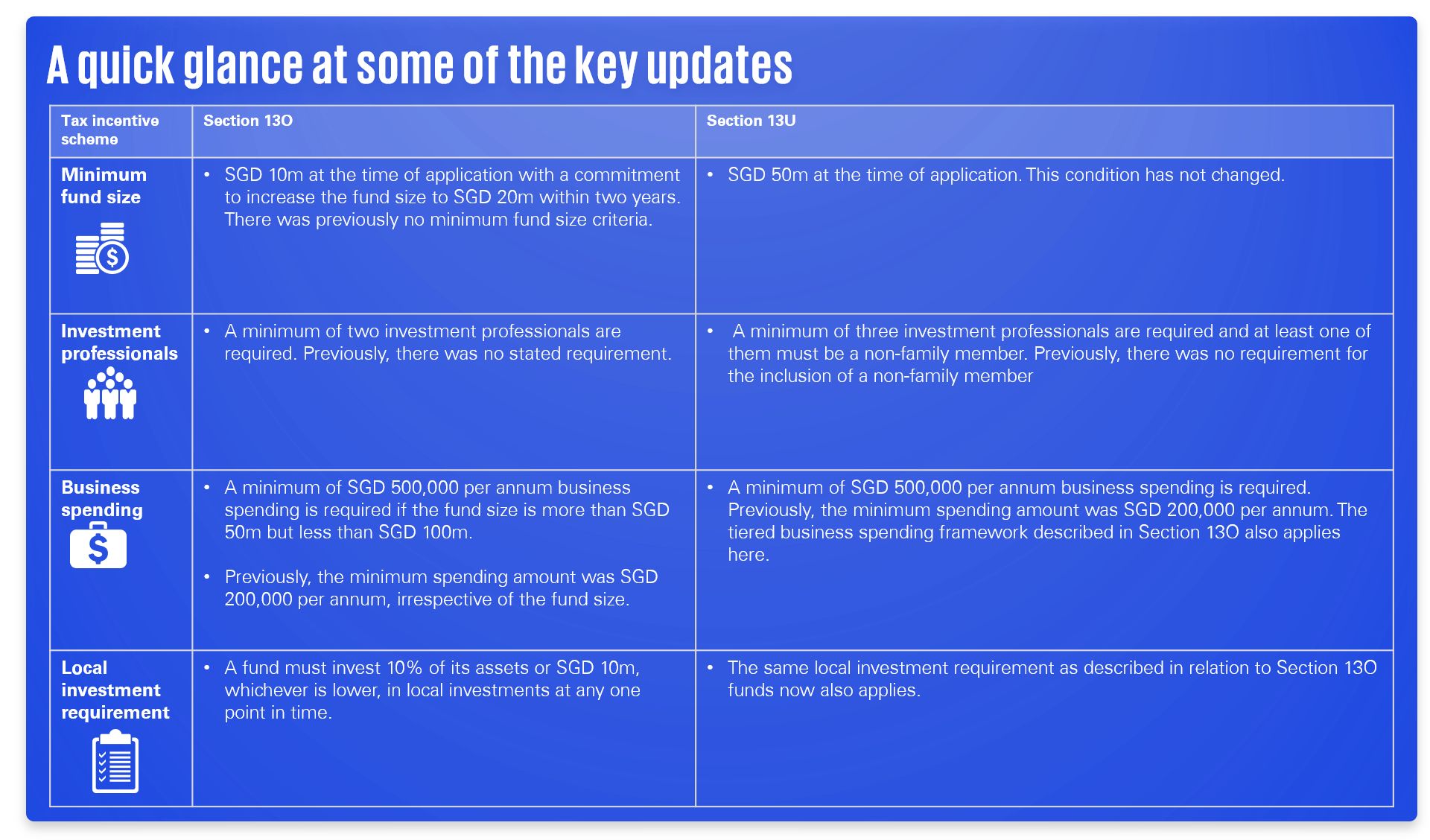

From introducing a local investment requirement to an increased threshold for business spending, the recent administrative changes announced by the MAS will help to ensure that SFO tax incentives translate to a more holistic and robust local ecosystem. Here is a breakdown of some of the changes to Sections 13O and 13U.

Connect with us

Partner, Real Estate & Asset Management, Tax

KPMG in Singapore

Email