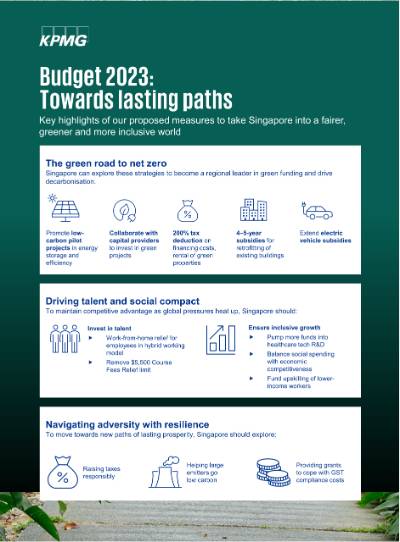

Raising taxes responsibly

Singapore will need to demonstrate how it can raise tax revenue responsibly and sustainably as it pursues growth amid competing economic challenges. The country will need to ensure its tax system remains progressive without disproportionately impacting lower-income groups or businesses. Hence, we are proposing the following measures.

- Target to have a percentage of collections from Pillar Two measures channelled into a pool of funds used to attract and retain investments from global and local multinational corporations (MNCs)

- Increase the number of expenditure-based tax incentives, which can take the form of expanding the list of IP categories that qualify for writing-down allowances

- Redesign existing research and development (R&D) tax incentives to a Qualified Refundable Tax Credit scheme for minimal impact under the GloBE rules

- Increase grant caps of existing programmes such as the Research and Innovation Scheme for Companies and Training Grants for Companies

To encourage investments in green technologies, the Government can consider introducing enhanced allowances on a broader range of capital expenditure incurred in relation to energy efficiency and emissions reduction solutions. It can also explore incentives for individuals and businesses purchasing certified energy-efficient appliances.

The Government can also set up a one-stop emissions reduction portal to ensure companies can easily access available incentives and tap into resources effectively.

We are proposing for the Government to offer additional grant funding for large emitters to develop lower-carbon solutions or above-the-line credits for specific sustainability-related investments. As many of these companies are likely above the 750 million-euro threshold of the GloBE rules, any incentives offered to switch to lower-carbon solutions should not be negated by the global minimum tax and domestic top-up tax regime.

GST-registered businesses may face inconveniences with a staggered hike as they will have to tweak enterprise resource planning systems, price displays and more on two occasions. To support businesses that may be struggling with various GST compliance costs, the Government can consider providing grants targeting these concerns.

Grants can also be offered to a specific group of businesses, such as non-profit organisations and charities, which are not able to recover the GST paid on their businesses in full, and consequently bear the brunt of higher GST.

Over the past year, there has been much discussion and debate on whether Singapore should introduce new forms of wealth taxes (such as those on net wealth or inheritance). To provide greater certainty to the market, the Government could consider clarifying whether it will indeed be introducing new forms of wealth taxes soon and what this might mean for the country.

New markets, new businesses

To further boost Singapore’s status as a global business hub, local enterprises must continue to reinvent themselves, strengthen R&D efforts and grow their overseas presence. At the same time, Singapore must continue to be an attractive place for top talents to attract fresh business ideas and new technologies.

Support for Singapore’s digital asset ecosystem

Our research reveals that some of the most common areas of innovation included non-fungible tokens (NFT) and decentralised finance (DeFi). We propose to further enhance policies and incentives to enable these.

Singapore should further promote the use of digital accelerators or hackathons which bring together industry advisory boards to guide and sponsor fintechs to solve industry wide problem statements. To keep up with the evolution of digital asset classes, the industry should continue to study the changing landscape and look into providing certainty in the regulatory and tax treatment of new investment products such as crypto and digital assets.

Strengthening Singapore’s funds domiciliation framework

There is scope for Singapore to increase its competitiveness as a funds domiciliation location and anchor itself as a global hub for investors and asset managers. The Government can consider the following measures:

- Consider zero-rating investment advisory or management fees charged to Singapore funds or allow a 100% remission from a GST perspective to achieve alignment with similar fees charged to offshore funds

- Assess the revision and modernisation of Singapore trust law to attract more ultra-high net worth/high-net worth individuals to set up Singapore trust and build up the sophistication and capabilities of the Singapore trustee eco-system

- Combine Singapore’s fund tax incentives provided under Sections 13O and 13U into a single incentive to achieve streamlining of the schemes

- Provide grants to asset management professionals, wealth managers and professional firms to attract the right talent, especially in ESG investment and philanthropy

Financial support to transform supply chain, embed ESG

Many companies are rethinking the sustainability of their supply chains, including the labour involved, cost efficiency and their carbon footprint. Consequently, they are looking to invest in the digitalisation of workflows and processes to be more efficient and sustainable. The Government can support these initiatives by:

- Enhancing deductibility of expenses incurred on supply chain digitalisation and transformation

- Providing consulting grants for businesses embarking upon supply chain transformation and digitalisation

- Implementing a special taxation regime and/or financing for companies involved in investment, development and trade of renewable energy, hydrogen (or other green alternatives) and carbon credits

Establishing a supply chain taskforce

The Government could explore setting up a national supply chain disruption taskforce, with the aim of improving business engagement and keeping closer tabs on business performance, including industry growth, value-add per actual working hour and unit business cost.

The taskforce can focus its work on the more vulnerable manufacturing, construction and logistics industries to enable them to achieve faster and more effective responses to disruptions.

Financial support for businesses to grow for tomorrow

While most businesses would have regained their footing since the pandemic, some could still be concerned about a possible economic downturn and how they can open new revenue streams in the future while embarking on cost cutting control measures.

These measures could help the business landscape become more sustainable, innovative and future-ready.

- Increase support level of the Enterprise Development Grant (EDG) for overseas M&A activities to up to 90% for smaller and medium enterprises (SMEs) and up to 70% for non-SMEs for an initial period of two years. This is up from the current level of up to 70% for smaller enterprises and up to 50% for larger enterprises.

- Expand the EDG to cover businesses looking to bring products that are currently being sold in Singapore to overseas markets, to help businesses penetrate overseas markets

- Offer enhanced support of up to 80% under the Productivity Solutions Grant (PSG) for companies to adopt advanced manufacturing solutions

- Increase EDG support for sustainability and ESG initiatives by up to 90% for SMEs and up to 70% for non-SMEs to encourage companies to factor ESG considerations into their planning. This is up from current levels of up to 70% for SMEs and up to 50% for non-SMEs

Tax rebates, incentives to cope with rising costs

- A one-off 10% corporate income tax rebate to help businesses tide through the economic uncertainty, while increasing the number of instalments companies can take to pay their income tax liabilities

- Expanding the coverage of current R&D tax incentives to cover costs incurred for overseas R&D activities

- Helping businesses invest in their employees and capture employment opportunities in the local market with an additional 100% deduction on training expenses, with similar conditions to the Productivity and Innovation Credit (PIC) scheme for qualifying training expenditure

Co-funding to raise cybersecurity capabilities

As the rate of digital adoption among business continues to grow, cyberattack risks have also become more prominent. The Government should provide co-funding and grants that encourage local businesses to take up cybersecurity projects to strengthen their capabilities. This could be in the form of enhanced support of up to 80% for cybersecurity solutions under the PSG.