The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

Serbian Ministry of Finance (“MF”) has adopted the Rulebook on arm’s length interest rates for 2019 (“the Rulebook”). The Rulebook was published in the Official Gazette of Serbia No. 13/2019 dated 28 February 2019. The Rulebook contains the prescribed interest rates applicable to taxpayers who had or will have related party financing during 2019.

The Rulebook is effective as of 8 March 2019 and will be in force until 31 December 2019.

Impact of the Rulebook to transfer pricing documentation for 2019 and application of Double Tax Treaties

According to the provisions of Articles 59, 60 and 61 of the Corporate Income Tax Law (“the CIT Law”), in determining arm’s length interest expense/revenue, taxpayers can:

- use interest rates as prescribed by the MF Rulebook or

- apply general OECD based methods for assessment of arm’s length interest as prescribed by the CIT Law.

Taxpayers may opt only for one of the above options. Selected option needs to be consistently applied to all intercompany loans.

Prescribed interest rates should be applied to interest income/expense recognized during 2019 regardless of the period from which loan(s) originate.

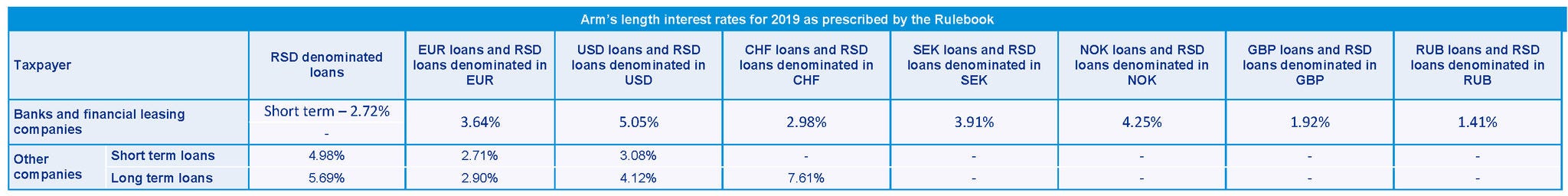

The Rulebook prescribes separate interest rates for long-term and for short-term borrowings for all non-finance entities and a single interest rate for banks and finance leasing companies (except for RSD denominated loans where interest rate is prescribed only for short term loans).

In determining the amount of interest which is subject to beneficiary rates prescribed by the applicable Double Tax Treaty (“DTT“), taxpayers may also use prescribed rates or apply general OECD based methods. Unlike to the calculation of transfer pricing adjustments, taxpayers may apply prescribed rates and general methodology interchangeably in determining potential withholding tax exposure.

Arm’s length interest rates for 2019 as prescribed by the MF

What impact may this have on your business?

In general, decreasing trend of interest rates for other companies when compared to 2018 is present, except for long term financing in RSD where slight increase was recorded. On the other hand, in case of Banks and financial leasing companies, increasing trend is present (except for financing in CHF, RUB and short term financing in RSD).

It is necessary to review if new interest rates for 2019 are aligned with interest rates currently used in your related party financial instruments. In addition, companies exposed to significant / long-term related party financing should consider applying general OECD based methods for assessment of arm’s length interest as prescribed by the CIT Law, as such approach may be more beneficial and provide increased level of certainty in relation to future tax treatment.

If you have any questions or you need assistance of our tax professionals, please contact us at tax@kpmg.rs

KPMG will continue to monitor all relevant developments in this complex area, and inform you about possible impact of these events on business operations.

Tax Alerts

Our regular newsletter provides you with updates on the latest changes of tax and accounting regulations as soon as a new rule is being approved.