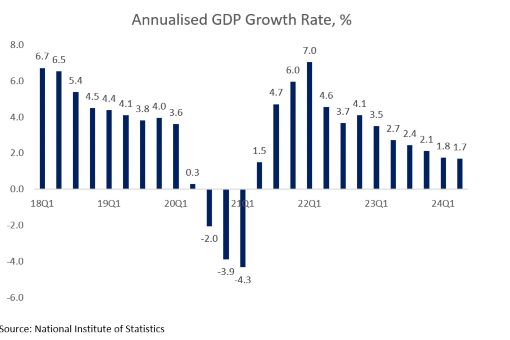

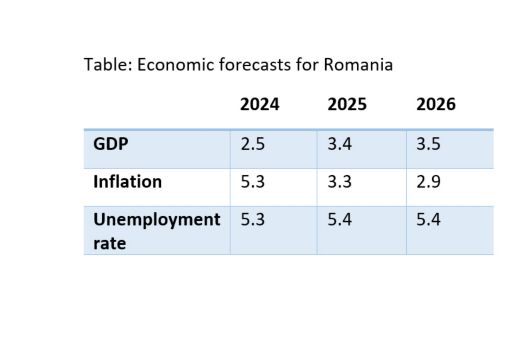

The economy is poised to keep growing in 2025 driven largely by consumption. Investment is also set to play a prominent role in supporting growth, helped by the cut in interest rates and the expected inflows coming via EU’s Recovery and Resilience Facility. The construction sector, in particular, is expected to be a beneficiary of investment flows. However, despite a relative upbeat perspective on domestic consumption, activity across most economic sectors is forecast to remain rather subdued in the short term. Growth has been gradually slowing down over the last two years as diminished external demand, the increase in taxes, and heightened geopolitical risk eventually took their toll. Net taxes amounted to 0.5% of GDP the first semester of 2024, accounting for more than two thirds of the whole growth.

With multiple elections held in 2024, economic policy was geared disproportionately towards increases in disposable incomes. Minimum wages rose by a staggering 45% over the last two years alone, increasing pressures on companies’ costs, notably on those operating in relatively low margin sectors such as retail, agriculture, or textiles. Public pensions cost also rose substantially in the autumn of 2024. The surge in disposable incomes will support consumption in 2025. But it will come with the cost of a reduction in competitiveness and higher upwards pressure on inflation.

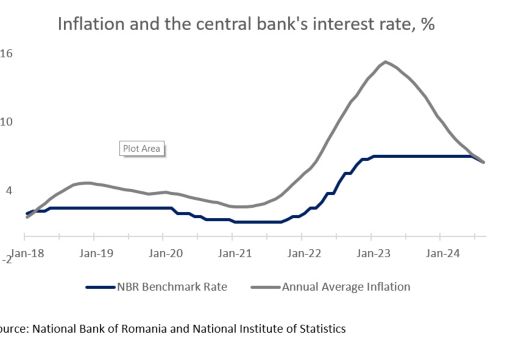

Annual inflation continued its downward trend, reaching 5% at the end of August, almost half the rate it was a year ago. Services inflation was still running double the rate of both food and non food components, fuelled by rapid wage growth and labour shortages.

Despite the stickiness in services inflation which, incidentally, is a phenomenon observed across most of the EU countries, the National Bank of Romania (NBR) embarked on a policy easing cycle. It cut its benchmark interest rates twice in a row, from a post-pandemic high of 7% to 6.5% in September 2024. Lower commodity prices, the drop in core inflation and the deceleration in economic activity were factors supporting the monetary easing decision.

Inflation is now forecast to drop back within the NBR’s inflation targeting band of 1.5%-3.5% by the end of 2025. Real interest rates, which turned marginally positive again in 2024, are forecast to remain so in 2025 as inflation keeps falling. With the economy expected to grow slightly below its potential, the NBR’s monetary policy stance will remain loose in the quarters ahead.

The reduction in benchmark interest rates had a knock-on effect on consumer’s credit reference rate and is expected to reignite the demand for household loans, which, in real terms, came to an almost standstill at the end of July.

The labour market remains tight with employment expected to edge up slightly towards the end of 2024, after increasing during the first half of the year. Unemployment rate rose to 5.4% in July as double digit wage rises and a slowdown in demand were building up pressures on companies’ profit margins. Average unemployment rate is projected to increase marginally to 5.4% in 2025 with companies’ appetite for new hirings set to be dented by higher labour costs and increased fiscal uncertainty.

Average annual net wage growth stood at a robust 14.5% in July far in excess of inflation. The brisk pace of wage increases over the last years has been largely driven by minim wage hikes. Given that almost a third of wages in the economy are at or close to the minimum wage level, large increases in the latter have a sizable effect on average net wage growth. Forthcoming legislation on a minimum wage adjustment formula will lead to a cooling off of the pace of wage growth in 2025.

Fiscal uncertainty remains a cause of concern for spending plans of companies and households alike. Growth in current government expenditure, notably public sector wages and the recalculation of pensions in the context of pension reform, coupled with lower than envisaged government revenues, already pushed up the government’s budget deficit to -4% of GDP at the end of July. On the current government spending path it is likely to almost double by the end of the year, growing higher compared to a year ago. One scenario under consideration by the authorities is to agree with the European Commission a downward adjustment path for the budget deficit in the medium term. Irrespective of the solution chosen, fiscal consolidation will take a few years to accomplish and be required to yield tangible effects in 2025.

Note: GDP is year on year change. Inflation is CPI, yearly average annual change. The unemployment rate is annual average. Own forecasts.