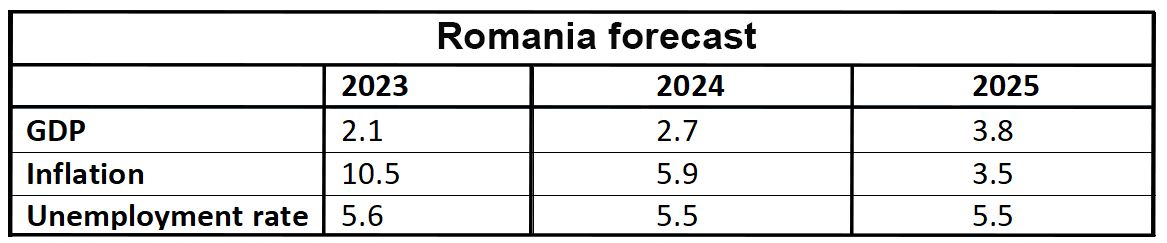

Economic growth is expected to pick up in 2024, primarily driven by stronger consumption.

- Robust wage growth is expected to continue to keep upside pressure on inflation in the short term.

- The path of fiscal deficit consolidation remains uncertain and it could impact business sentiment and private investment

The pace of economic growth is expected to quicken in 2024 to 2.7%, driven by both consumption and investments. But there are risks associated to this scenario. Further increases in wages and pensions this year, corroborated with the expected fall in inflation, should boost real purchasing power for a large number of consumers, thus pushing up consumption. The downside is that all these increases could deepen some of the structural macroeconomic problems, including difficulties in meeting this year’s budget deficit target, and worsen the country’s competitiveness.

Public sector consumption is expected to remain strong this year. Public sector investments, partly financed by funds coming via the European Union’s Recovery and Resilience Facility, are also envisaged to advance at a swift pace. However, residential construction could fare less well, since it could be hampered by high real interest rates. Overall, the contribution of gross fixed capital formation to economic growth is expected to be less than the year before.

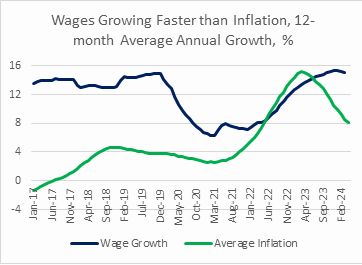

Annual nominal wage growth stands at more than 15%, far above the inflation rate and productivity growth. Minimum wage policy plays an important part in wage dynamics, as more than a third of employees in the economy are paid the minimum wage. If the political commitment to raise the minimum wage later this year is fulfilled, this will represent an increase in the annual rate of close to 25% pushing upward pressure on the whole wage structure in the economy.

Annual inflation has been trending downwards and, by the end of the year, it is expected to slow down to around 6%. Core inflation has been especially persistent with services inflation remaining relatively high.

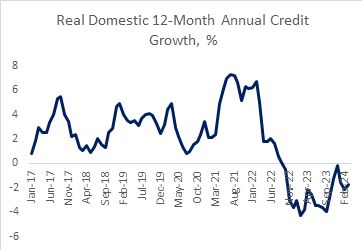

High inflation lowers the probability of the National Bank of Romania starting to cut interest rates in the very near future. The NBR’s benchmark interest rate remains at 7%, making domestic credit more expensive as inflation continues to fall. Real household credit demand growth has been in negative territory since the end of 2022 and could remain there as long as interest rates stay high.

Fiscal deficits are expected to remain elevated over the medium term. An acceleration of government spending, triggered by increases in public sector wages and pensions, would likely push this year’s budget deficit above -6% of GDP, above the government’s target of -5% of GDP. Fiscal costs of the new pension law are expected to increase pensions expenditure by a sizable amount this year, with the budgetary effects also being felt in subsequent years.

Higher domestic demand is expected to keep the current account deficit at around -7% of GDP this year. Foreign direct investment and EU funds will continue to partly finance this deficit. The fall in commodity prices helped to reduce the current account deficit by more than 2% of GDP last year. However, with imports growing faster than exports and the economy expected to gather more steam in the years ahead, current account deficits could remain at elevated levels in the medium term.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today