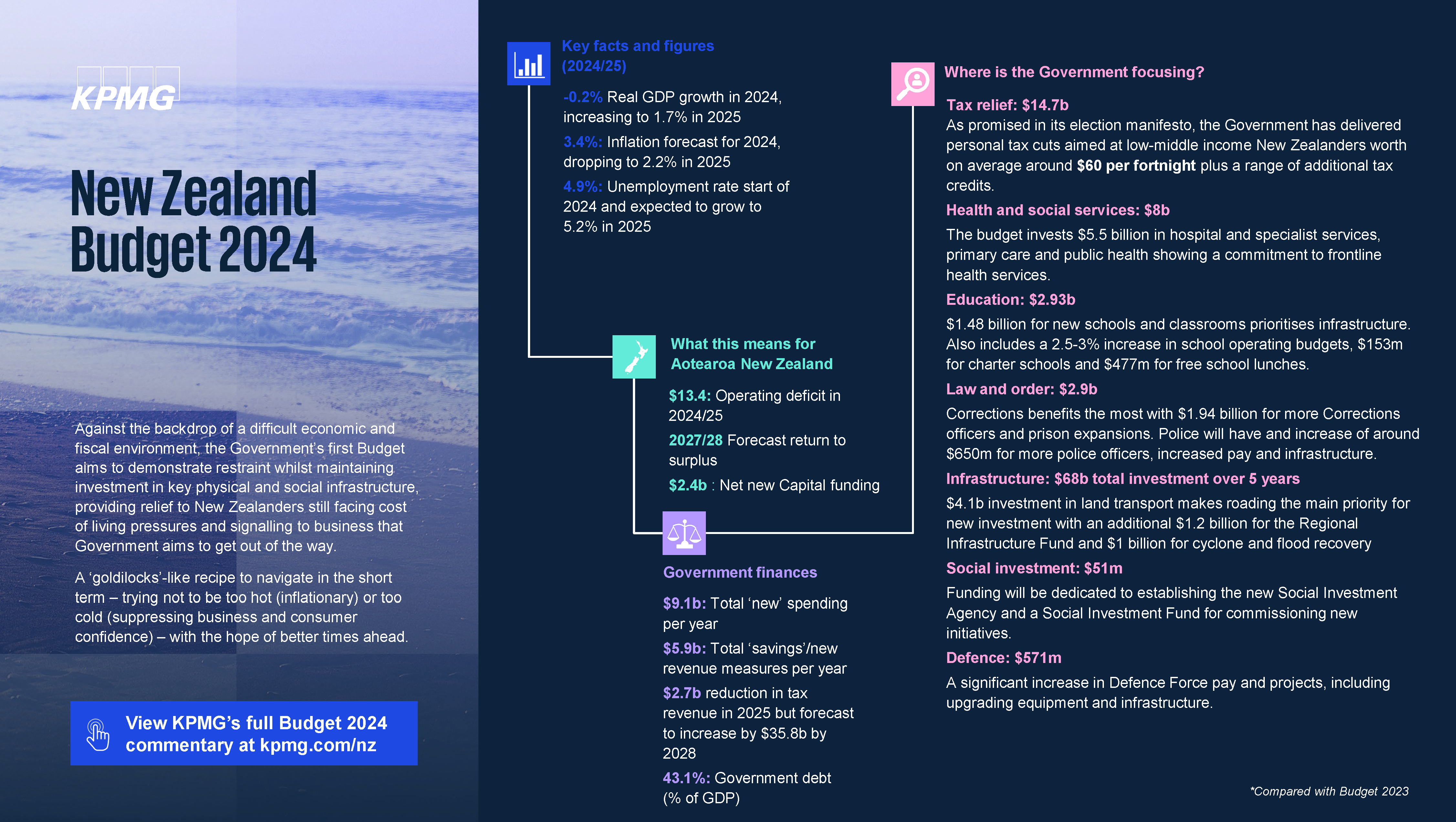

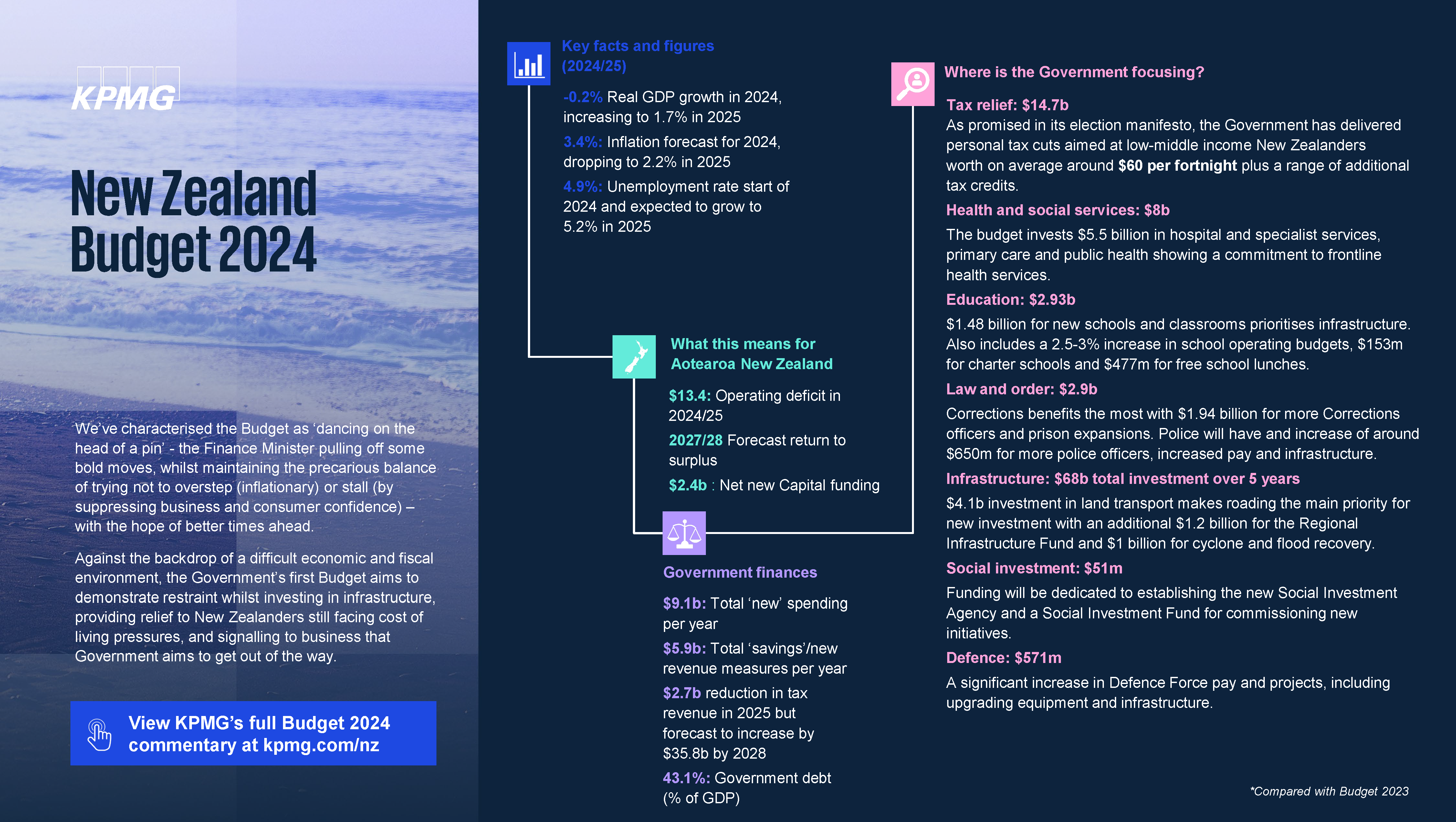

On Thursday 30 May 2024, Finance Minister Nicola Willis announced the 2024 Budget. We’ve characterised the Budget as ‘dancing on the head of a pin’ - the Finance Minister pulling off some bold moves, whilst maintaining the precarious balance of trying not to overstep (inflationary) or stall (by suppressing business and consumer confidence) – with the hope of better times ahead.

Against the backdrop of a difficult economic and fiscal environment, the Government’s first Budget aims to demonstrate restraint whilst investing in infrastructure, providing relief to New Zealanders still facing cost of living pressures, and signalling to business that Government aims to get out of the way.

The updated forecasts show lower GDP than forecast at the half yearly update and a return to economic growth in early 2025. It also shows inflation dropping back within the 1-3% band in late 2024, a quarter earlier than expected.

The slow economic growth means that the forecast tax revenue is $18.5bn lower than previously forecast. This, coupled with today’s spending decisions, results in a return to surplus in 2027/28, a year later than expected. The return to surplus relies on the Government reducing new spending even further in future years. The operating allowance for Budget 2024 is $3.2 billion (on average per annum over the 5-year period) and needs to reduce to $2.4 billion for Budgets 2025 to 2027. Regardless of the savings initiatives, net core Crown debt is still expected to keep increasing over the next five years.

This is a give and take Budget. Savings and increased revenue of $5.86bn have been identified across all agencies ($1bn more than previously announced), and two thirds of the new public spending is in health, education, police and the justice sector, as well as the tax relief and FamilyBoost package which is valued at $3.68bn a year. From digitising government to infrastructure, health, education, social investment and more, the 2024 Budget has implications for every corner of Aotearoa New Zealand’s households and businesses.

KPMG’s team of experts have provided analysis of key areas following the Budget announcement, outlining insights and implications for various sectors alongside considerations to make the most out of the Budget announcements to continue fuelling the prosperity of New Zealand.