Tax Governance is in Inland Revenue’s spotlight. While relevant for all businesses and organisations that have tax obligations, Inland Revenue’s recent tax governance focus has been on significant enterprises – businesses with annual turnover greater than NZ$30 million. This group covers both local and foreign owned businesses with NZ operations (including NZ branches) and both public and privately-owned entities.

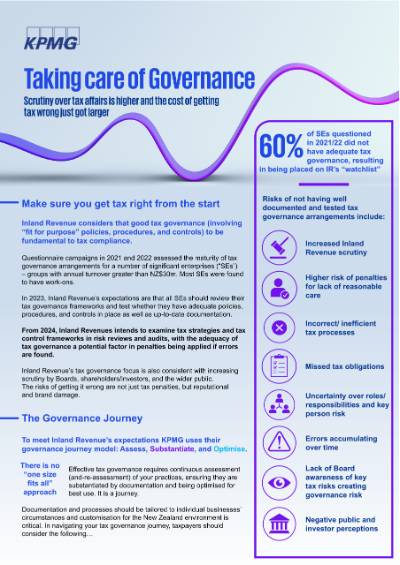

In 2021 and 2022, Inland Revenue ran tax governance questionnaire campaigns targeting approximately 300 significant enterprises, requiring them to provide responses on their tax governance arrangements and make improvements where appropriate. In 2023, its focus has shifted to educating the rest of the significant enterprise population base (approximately 900 businesses) of its ongoing expectations. However, all organisations should now be on notice.

Inland Revenue’s tax governance expectations

Inland Revenue has stated that it considers good tax governance (involving “fit for purpose” policies, procedures, and controls) to be fundamental to tax compliance.

Inland Revenue recommends that businesses set aside time to review their tax governance framework and test whether they have adequate policies, procedures, and controls in place as well as up-to-date documentation. Inland Revenue has indicated that it intends to examine tax strategies and tax control frameworks in risk reviews and audits covering significant enterprises from early 2024. Should adjustments arise in such future compliance activities, Inland Revenue may take into account the adequacy of tax governance in the course of giving consideration to penalties.

What does good tax governance look like?

The starting point should be developing a robust tax governance framework. This is a framework setting out the key tax risks your business faces and how they will be effectively managed. It should have the following components:

- Tax strategy – this should outline your business’s tax risk profile (i.e., the tax risk appetite set by the Board), the key tax risks to be managed, and at a high-level, how tax risks are identified and the approach to engaging with Inland Revenue.

- Tax control framework – this should set out the specific measures (“tax controls”) that are in place to manage tax risks, such as the review and sign-off processes for tax compliance obligations, key transactions, and engaging tax advisors, as well as the roles/responsibilities covering tax in the business.

- Tax reporting – this should set out the process for reporting to the Board (or Board equivalent) on tax matters, as ultimately tax governance will be a Director (or equivalent)-level responsibility.

Additionally, Inland Revenue expects that there will be:

- Documented policies and procedures for key tax types that should be followed by those preforming tax roles. For example, in relation to the calculation of GST, this may include: a process map or manual setting out how/where/what information is sourced, a description of key assumptions and positions underlying the calculations (including the basis for these assumptions/positions), and the “checks and balances” to ensure accuracy (such as prepare / review / approval roles).

- Regular independent testing of tax controls for their continuing effectiveness and accuracy. Such testing should include both whether a particular tax control applies (i.e., testing whether tax policies and processes are being followed) as well as whether it remains “fit for purpose” (e.g., testing how/whether the tax control is being updated to reflect changes in the business, roles and personnel, or the legislative landscape).

Practical tips

Inland Revenue has noted that there is no “one-size fits all approach” to tax governance documentation and processes. What this means practically is:

- The actual requirements will depend on the context of the business, including its size and complexity, with the expectation that more attention should be given by larger and/or more complex businesses to documenting their tax strategy and the tax control framework, testing and updating systems, and related reporting.

- There should be clarity about tax risk management objectives and the allocation of responsibilities, along with relevant documentation and reporting being tailored to reflect these features, rather than being “template” in nature.

- For businesses looking to leverage overseas tax governance documentation or policies, customisation to the New Zealand environment will be critical.

- For those in the not-for-profit or government sectors, attention should still be paid to the operation of tax types such as GST and employment-related taxes.

Where to start?

This can all seem a bit daunting. Here’s a possible three-step approach.

- Documenting and enhancing your tax governance frameworks. This is generally a good starting point. In our experience helping clients to comply, we find that interviews with those in the business that have tax responsibilities, including Board (or Board-equivalent) representatives, enables deep insights into how tax is operationalised and reported on, allowing for creation of tailored tax strategies and tax control frameworks, as well as identifying potential gaps and opportunities to implement “best practice”. Where there is an existing tax governance policy, regular review and/or adaptation to ensure it meets Inland Revenue’s expectations and the changing tax landscape should be at the top of your list.

- Developing “fit for purpose” tax policies and procedures for key tax types. This is a great next step and we typically recommend setting a plan so that you can manage workload and impact on the business and budgets. Whether income tax, GST, or employment-related taxes, having an external set of eyes, such as KPMG’s subject matter experts, working alongside your tax/finance functions to develop comprehensive tax process documentation, as well as specific tax policies (including in areas such as transfer pricing and global mobility), or review policies and procedures that may already be in place, can be both time and cost efficient in the short-term, and assist in identifying gaps/best practice improvements that will improve the performance of the tax function in the long-term.

- “Health checks” and detailed reviews into the operation of key tax types. Neither last nor least. An independent view from the tax process being tested is key. A winning combination may be an internal audit function (whether your internal team or an external advisor, bringing the controls testing experience for your business) and external tax advisors (providing the relevant tax subject matter expertise and a critical eye). From an end-to-end review of your tax compliance processes, to technical reviews of key tax policies, and validating the inputs into your processes, in our experience, there are a range of ways to provide comfort and assurance that your tax systems are fit-for-purpose and operating effectively.

If you would like to learn more about how KPMG can help, please contact Darshana Elwela and Dion Blummont.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia