COVID-19 has upended the economic and fiscal status quo. The Government is spending to protect the economy - that is understandable. This will, however, result in significant budget deficits and increases in net Crown debt. The choices about how we pay for that spend will need to be considered. The role of the tax system in repaying debt and repairing the Government’s finances will no doubt feature in the upcoming election campaign.

What do you think the tax response, if any, should be?

To help formulate your thinking, we have outlined some options for consideration with what we think are some pros and cons for each – download our PDF below.

For additional background information please also take a look at our dedicated Tax Working Group webpage.

Tell us what you think

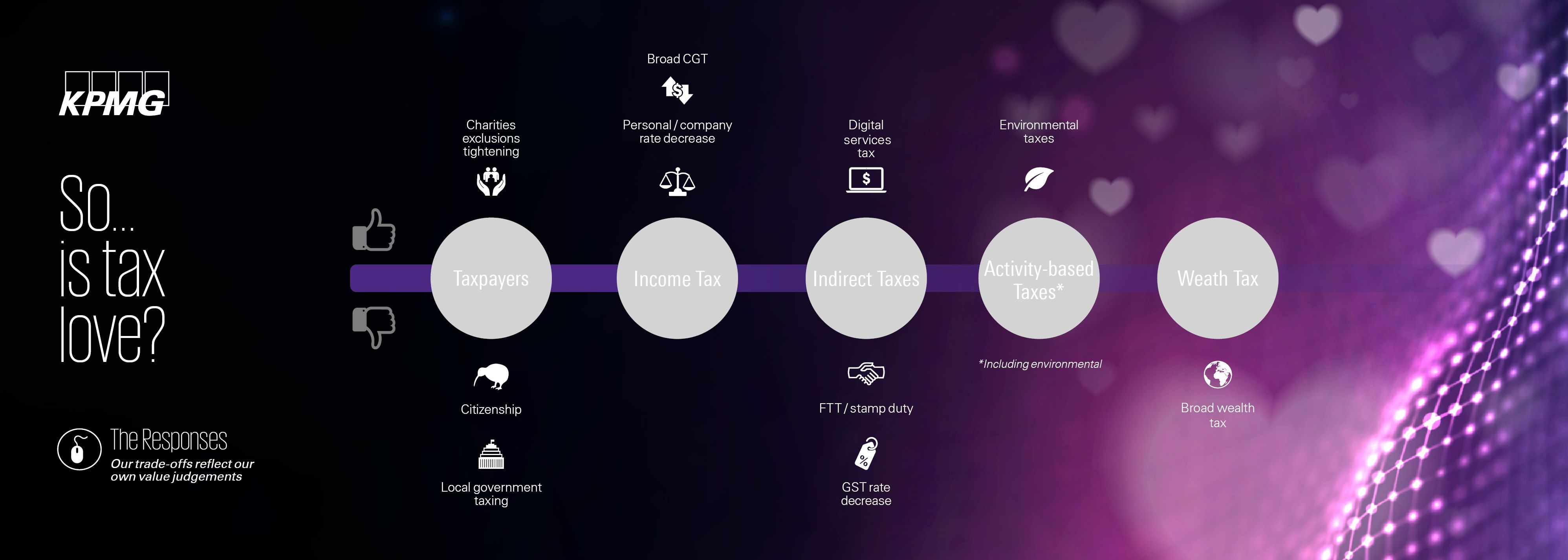

You can share your views and provide feedback on the options here, and it's great to see the level of interest already. Alternatively, please contact your regular KPMG advisor or one of the authors should you wish to discuss in more detail. We have summarised the results as of 7 July 2020 in the image below.

Webinar recording with Dr Deborah Russell

At the beginning of July we held a webinar with Dr Deborah Russell, the Labour MP for New Lynn and the Chair of Parliament’s Finance and Expenditure Committee. The theme was on the role of tax policy in a post-COVID-19 world, including if/how the tax system should be used to re-balance the economy and repair the Government’s fiscal position.

You can watch the recording of our webinar here.

Darshana Elwela

Partner - Tax

KPMG in New Zealand

Get in touch

Rachel Piper

Partner - Tax

KPMG in New Zealand

Darshana Elwela

Partner - Tax

KPMG in New Zealand

Nick Hope

Partner - Tax

KPMG in New Zealand