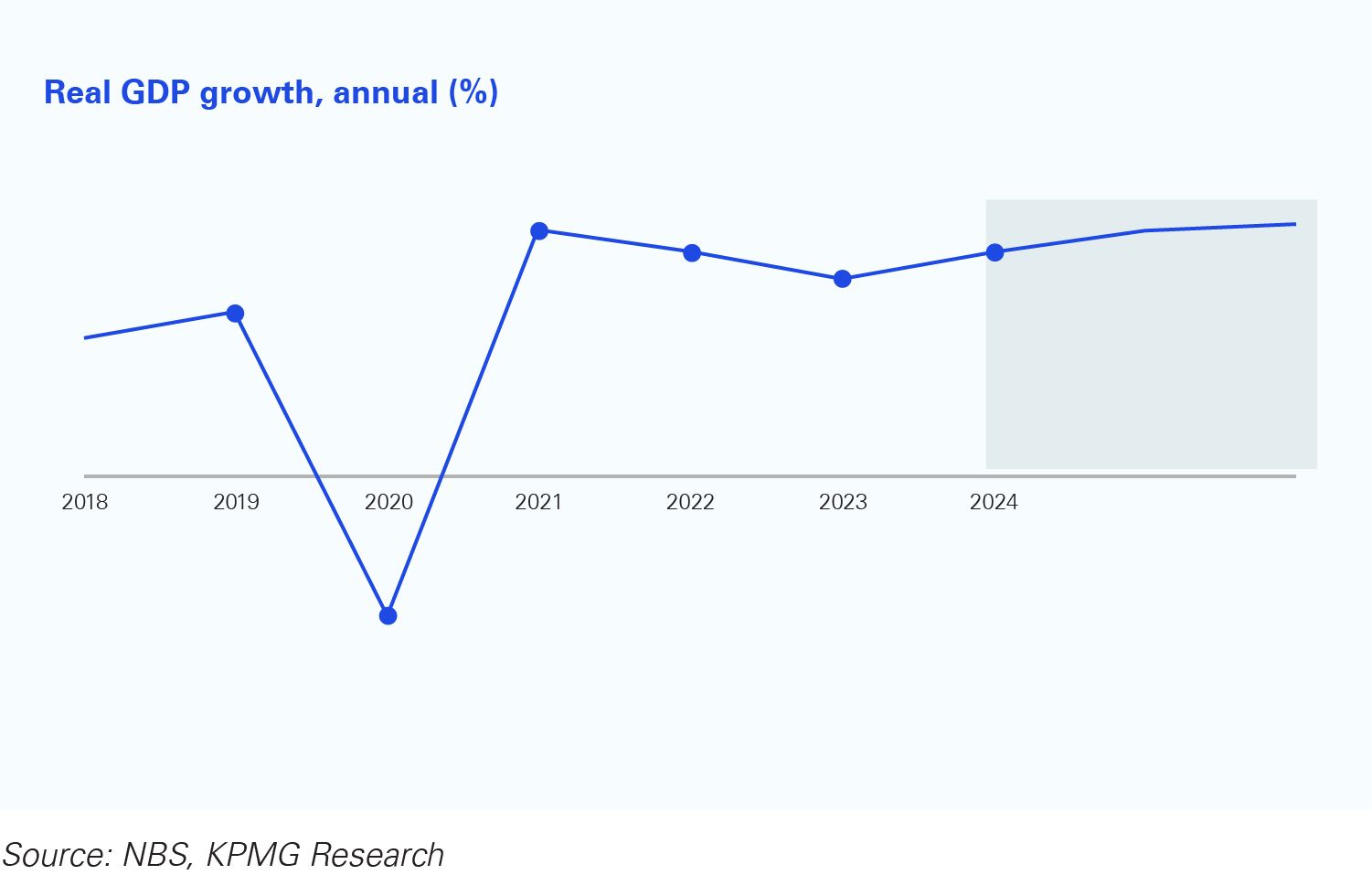

- Early indications suggest that growth could be stronger this year as the effect of macroeconomic headwinds which dragged on both demand and output last year appear to be gradually waning.

- Despite the recent stability in business conditions, sluggish household consumption and elevated interest rates are expected to constrain growth.

- Inflation is expected to cool towards the end of 2024 mainly due to base effects and the reinforcing disinflationary impact of tighter financial conditions. However, the likelihood that the Central Bank will transition to monetary easing this year remains low.

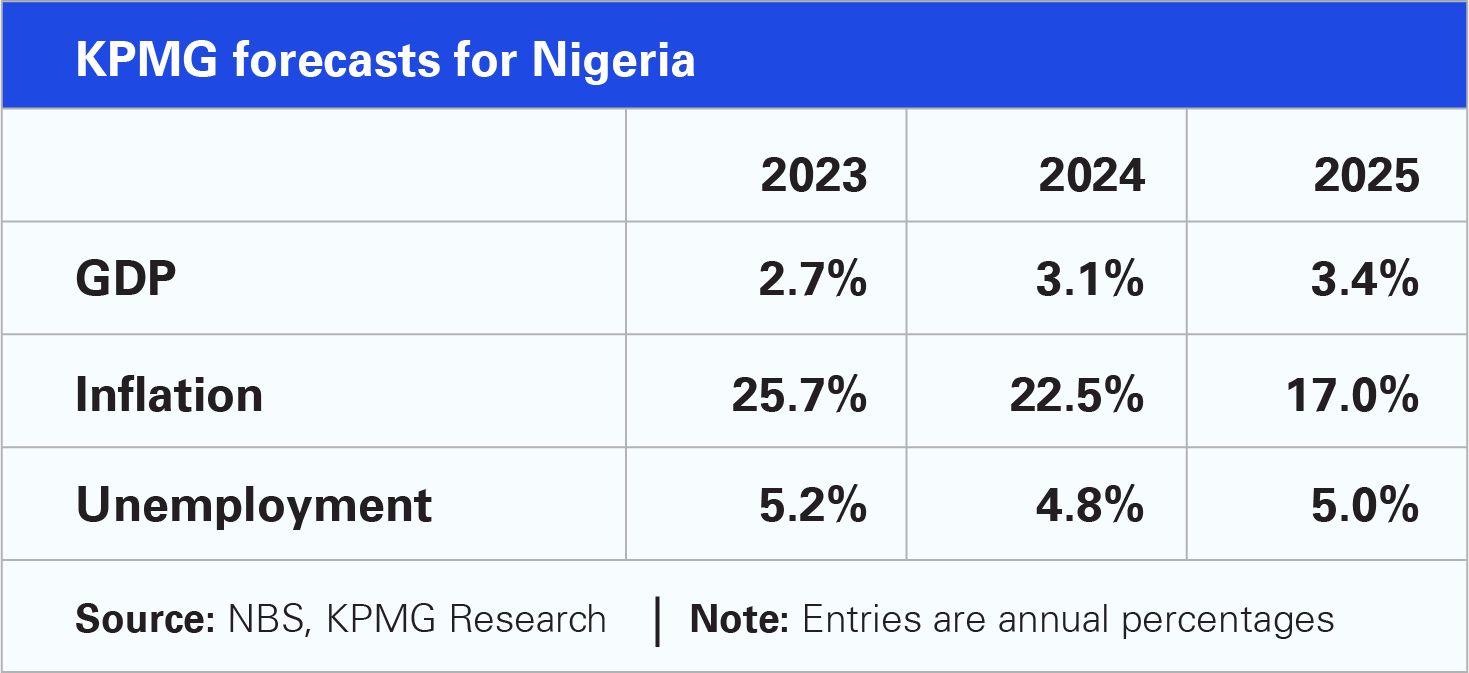

Data from the National Bureau of Statistics (NBS) shows that the economy expanded by 2.98% in Q1 2024. This surpassed the performance recorded in any quarter last year, except Q4 2023 which was buoyed by seasonal boom. The pick-up in economic activities may be an early indication that the effect of the energy and foreign exchange reforms, which slowed growth momentum in 2023, may be waning. This suggests that the economy could be on course for an improved performance this year. Stable business conditions seen in PMI readings averaging 51.9 since the start of the year and the recovery of the oil sector are expected to boost growth.

However, our view is that this economic expansion could be limited to around 3.1% in 2024. Household consumption will remain sluggish as rising costs continue to erode purchasing powers. At the same time, higher interest rates are considered the biggest risks to the outlook. Elevated borrowing costs may cause a scale-back in investment spending which may drag on both output and employment in the near term.

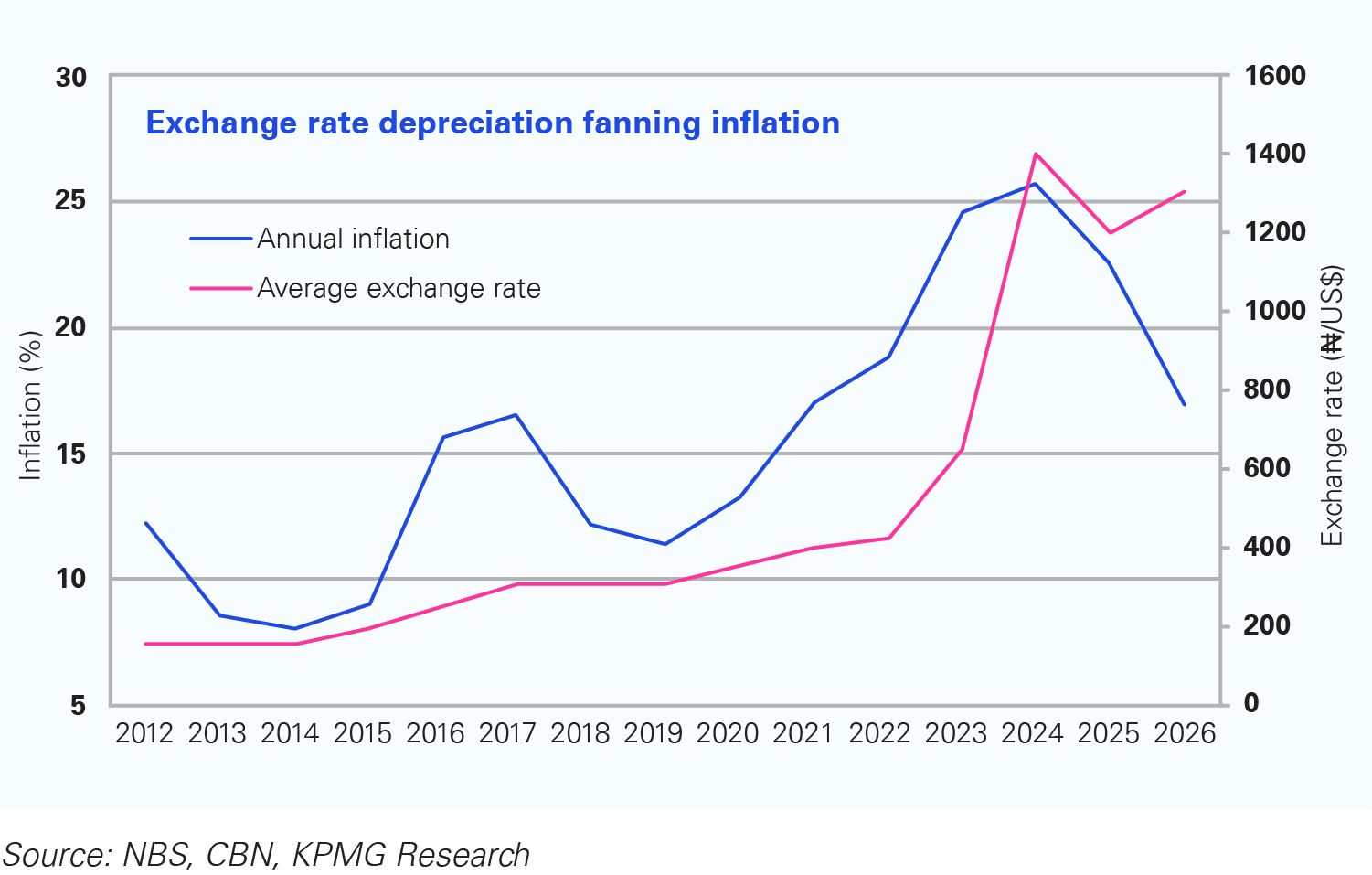

With respect to consumer prices, our expectation is that inflation will begin to lose steam in the second half of 2024. This outlook will be supported by both the onset of base effects and the current hawkish stance of the Central Bank of Nigeria (CBN) as inflation continues to accelerate, reaching a record-high of 34.19% in June 2024. Since its transition to an inflation-targeting framework this year, the CBN has raised the policy rate by a cumulative 800 basis points to 26.75% to rein in inflation.

While there is significant optimism around the tighter monetary stance of the CBN, data has shown a pattern of delay in the transmission of monetary impulse to the real economy. This additional understanding informs our projection that inflation may start to recede in the latter half of the year in response to rate hikes. But the chances that the apex bank will cut rates this year is low as authorities will need sufficient data to establish that inflation has been tamed.

There are risks to this positive outlook. Most of the pressure on inflation comes from exchange rate pass-through to domestic prices. Thus, any significant depreciation of the exchange rate may upend the outlook and stoke up inflation. Lastly, while we anticipate that the commencement of PMS supplies to the domestic market by the Dangote refinery sometime this year will boost output from the oil and gas sector, we do not expect this to be a game-changer for our inflation outlook.

Contributors

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia