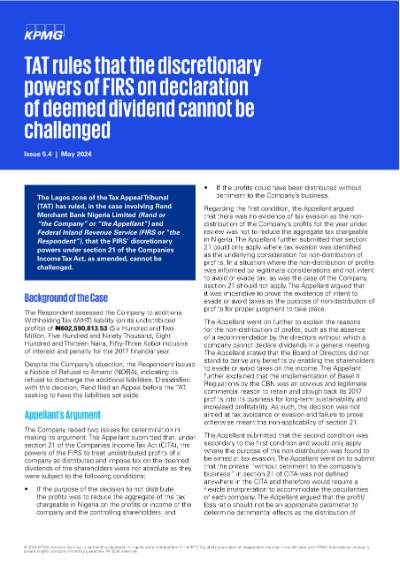

The Lagos zone of the Tax Appeal Tribunal (TAT) has ruled, in the case involving Rand Merchant Bank Nigeria Limited (Rand or “the Company” or “the Appellant”) and Federal Inland Revenue Service (FIRS or “the Respondent”), that the FIRS’ discretionary powers under section 21 of the Companies Income Tax Act, as amended, cannot be challenged.

Background of the Case

The Respondent assessed the Company to additional Withholding Tax (WHT) liability (on its undistributed profits) of ₦602,590,813.53 (Six Hundred and Two Million, Five Hundred and Ninety Thousand, Eight Hundred and Thirteen Naira, Fifty-Three Kobo) inclusive of interest and penalty for the 2017 financial year.

Despite the Company’s objection, the Respondent issued a Notice of Refusal to Amend (NORA), indicating its refusal to discharge the additional liabilities. Dissatisfied with this decision, Rand filed an Appeal before the TAT, seeking to have the liabilities set aside.

Click here to read full publication or download below.