1 min read

CBN Bank recapitalisation

Highlights

- We anticipate that the move by the CBN will enhance the stability and capacity of the banking industry as well as attract greater investments to the sector.

- The new capital requirement as defined by the CBN has triggered a call to action by ALL banks who are impacted to different degrees.

- Data suggests a significant capital shortfall of N4.2 trillion across all license categories, with available options for banks including capital raise (as much as between 35% - 90% of the new minimum capital); mergers and/or acquisitions; and the downgrade of license authorisations.

- We recommend a proactive monitoring of market dynamics to identify and address any systemic risks or disruptions that may arise during the recapitalisation phase to preserve the stability of the financial system.

Event

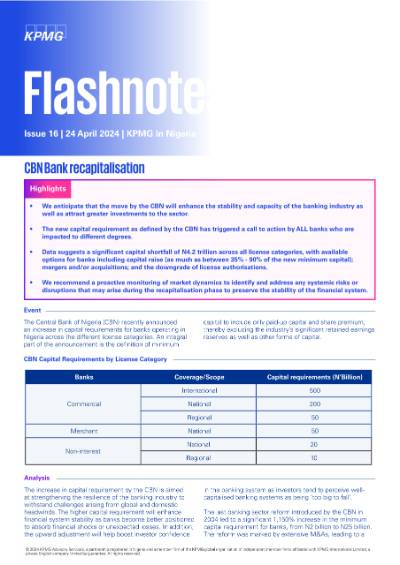

The Central Bank of Nigeria (CBN) recently announced an increase in capital requirements for banks operating in Nigeria across the different license categories. An integral part of the announcement is the definition of minimum capital to include only paid-up capital and share premium, thereby excluding the industry’s significant retained earnings reserves as well as other forms of capital.

Click here to read the full publication.