FIRS Introduces Self-Registration Module on TaxPro-Max

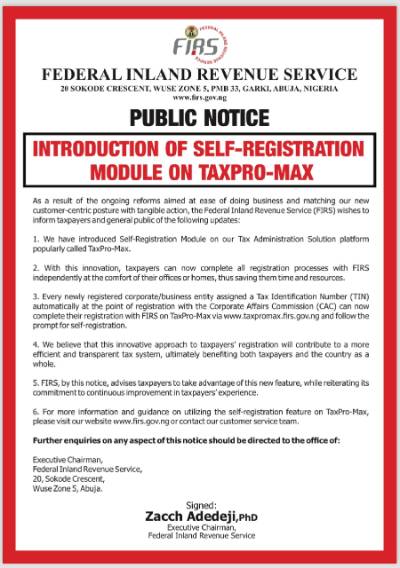

The Federal Inland Revenue Service (FIRS or “the Service”) has issued a public notice (hereafter referred to as “the Notice”) on the introduction of a self-registration module on its tax administration solution electronic platform i.e., TaxPro-Max (TPM). According to the FIRS, this action is part of its ongoing customer-centric reforms to encourage the ease of doing business for taxpayers in Nigeria.

Based on the self-registration module, taxpayers complete their registration process with the FIRS seamlessly without having to go physically to any tax office. Furthermore, newly registered business entities that are automatically assigned a Tax Identification Number (TIN) during registration with the Corporate Affairs Commission (CAC) can complete their tax registration on the TPM portal.

The FIRS indicated in the Notice that taxpayers requiring further information and guidance should visit the FIRS’ website or contact the office of the Executive Chairman of the FIRS.

Commentary

The introduction of the self-registration module demonstrates the FIRS’ continued effort to improve the tax compliance process in Nigeria. This initiative will help to modernize tax administration, improve compliance, and enhance the taxpayer’s experience. It will also lead to cost savings for taxpayers and the FIRS by reducing the need for paper-based processes and the cost/time associated with manual tax registration.

As the FIRS continues to streamline the tax administration process, this will result in efficiency and enhance transparency and accountability. Ultimately, the journey should be towards the digital transformation of tax administration to deliver an integrated and seamless experience for taxpayers.

Please click here to read the public notice.