On Tuesday, 27 February 2024, President Bola Ahmed Tinubu, GCFR, launched the Expatriate Employment Levy (EEL). The EEL is a government-mandated contribution imposed on organizations which engage expatriate workers in Nigeria, subject to certain exemptions. Its objectives are to promote skills transfer and knowledge sharing, balance economic growth and social welfare, enhance collaboration between public and private sectors and address demographic shifts. The EEL will serve as a mandatory document like passport. Every eligible expatriate will be required to present the EEL card at the time of exit and entry into Nigeria. Several countries, especially in the middle east, have implemented expatriate levies or similar measures to grow their revenue base or control the influx of expatriates. So, Nigeria is not alone in this regard.

The levy will be computed at $15,000 for every expatriate on director level and $10,000 for those on other levels. Interestingly, the handbook, in paragraph 8.11, specifies that the EEL will be based ‘mostly on the offshore earnings of expatriates working in Nigeria’. This suggests an ad valorem rate, which is different from the fixed amounts specified in the handbook. The EEL, which is payable annually, should qualify for tax deduction as a validly incurred business expense.

The handbook, which contains the guidelines for implementation of the levy, ‘the Project’, was also launched by the President. According to the government, the Project will be operated on a Public Private Partnership (PPP) model between the Federal Government of Nigeria (FGN) represented by the Federal Ministry of Interior (FMI) as the guarantor while the Nigeria Immigration Service (NIS) will serve as the implementing agency. In this regard, the NIS will carry out periodic audit with a view to ascertaining the level of compliance with the EEL. However, the handbook does not specify how any disputes arising from the audit may be resolved. Please click here to access the handbook.

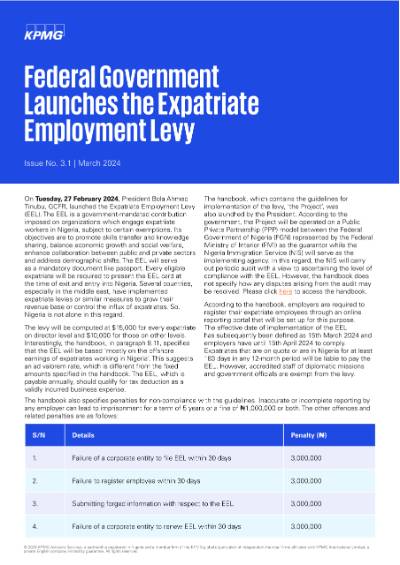

According to the handbook, employers are required to register their expatriate employees through an online reporting portal that will be set up for this purpose. The effective date of implementation of the EEL has subsequently been defined as 15th March 2024 and employers have until 15th April, 2024 to comply. Expatriates that are on quota or are in Nigeria for at least 183 days in any 12-month period will be liable to pay the EEL. However, accredited staff of diplomatic missions and government officials are exempt from the levy.

Please click here to access the full article.