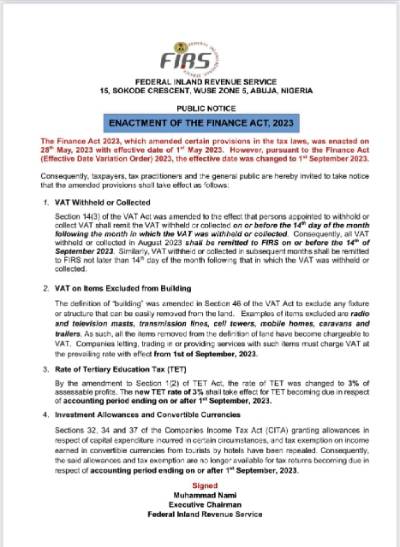

FIRS announces the effective date for the changes introduced by Finance Act, 2023

The Federal Inland Revenue Service (FIRS) has issued a Public Notice announcing the effective date for the amendments introduced by Finance Act, 2023 (“FA 2023”) in respect of some highlighted taxes and transactions. The Notice follows the Finance Act (Effective Date Variation) Order 2023, signed by His Excellency, President Bola Ahmed Tinubu, GCFR on 4 July 2023, which extended the effective date of the FA 2023 to 1 September 2023.

Based on the Notice, the changes and/ or compliance procedures for the highlighted taxes and transactions will become effective as follows:

1. The new filing due date of 14th day of the subsequent month for remitting the Value Added Tax (VAT) deducted at source by persons appointed by the FIRS will commence with transactions incurred in August 2023. Therefore, appointed persons are required to remit the VAT collected and/ or withheld at source from its August 2023 transactions to the FIRS on or before 14 September 2023. The new filing date will also be applicable to transactions in the subsequent months.

2. The amendment that excludes easily detachable structures like masts, transmission lines, towers, mobile homes, caravans, and trailers from the definition of “building” for VAT purposes will become effective from September 1, 2023. Therefore, companies that lease/ let, trade in or provide services with the above excluded items will include VAT on their invoices effective from 1 September 2023.

3. The new Tertiary Education Tax (TET) rate of 3% of assessable profits will become effective for TET due in respect of accounting periods ending on or after 1 September 2023.

4. Cessation of the grant of investment allowances in respect of capital expenditure incurred in certain circumstances and tax exemptions on convertible currency income earned by hotel from tourists will become effective for income tax returns due for accounting periods ending on or after 1 September 2023.

Commentary

We commend the FIRS for issuing the Public Notice to provide guidance to taxpayers on the implementation of the FA 2023. However, some of the clarifications provided in the Notice, are inconsistent with the provisions of the relevant laws. The National Tax Policy, 2017 explicitly provides that there should be no retroactive application of tax laws. Once the extant law provides the effective date for its application, it would be inconsistent for tax authorities to make that law effective as of an earlier date. This may create unnecessary conflicts and disputes.

In fact, making the provision of the law retroactive is contradictory to the decision of the Federal High Court (FHC) in Accugas Ltd. vs. FIRS, wherein the court established that, “the provisions of the Finance Act 2019 cannot be applied retroactively to periods, transactions, activities, and income earned prior to January 13th, 2020, when the Finance Act 2019 was enacted."

Therefore, the FIRS needs to urgently review its position on the following issues to ensure consistency with the provisions of FA 2023:

1. The requirement by the Notice for qualifying taxpayers to file the VAT returns withheld at source in August on or before 14th September 2023 is an overreach. The relevant VAT returns should be that of September, which should be due on or before 14th October 2023. Therefore, the new provision should apply to transactions incurred from September 2023 and beyond, and not August 2023, as stated in the Public Notice.

2. The Public Notice also noted that the “new TET 3% rate shall take effect for TET becoming due in respect of accounting period ending on or after 1st September 2023”. The implication of the FIRS’ position is that a company with accounting year end of 31 December 2023, for instance, will be required to pay the new TET rate of 3% when it files its income tax returns by June 2024.

The new rate can only be applied to periods, transactions, activities and income earned on or after the effective date of 1 September 2023. Consequently, the company with 31 December year end will need to apportion its assessable profits between pre and post 1 September for TET purposes. The old rate of 2.5% will apply to the pre-FA 2023 assessable profit, while the new rate of 3% will apply to the post-FA 2023 assessable profit.

3. Similarly, the FIRS’ position on the cessation of the investment allowance granted in respect of capital expenditure incurred in certain circumstances and tax exemptions on convertible currency income earned by hotel from tourists directly contradicts the provisions of the FA 2023. The FIRS’ position in the Public Notice indicates that the allowances are no longer available for tax returns becoming due in respect of accounting period ending on or after 1 September 2023, even if the expenditure was incurred on or before 31 August 2023.

It should be noted that FA 2023 provides that any qualifying expenditure incurred on plant and equipment (capital expenditure) on or before the effective date of the repeal will continue to enjoy the allowance until it is fully utilized. The implication is that affected companies can still claim investment allowance on qualifying expenditure incurred on or before 31 August 2023. Similarly, convertible currency income earned on or before 31 August 2023 will be exempt from income tax accordingly.

Based on the above, it is hoped that the FIRS will issue a revised Public Notice that addresses the issues noted above and update the TaxPro-Max platform to reflect the changes in accordance with the tax laws. This will help to provide clarity to affected taxpayers and mitigate unnecessary disputes regarding the implementation of the changes introduced by FA 2023. We can only achieve sustainable development through taxation if all stakeholders abide by the provisions of the law and adhere to tax policy direction as enunciated in the National Tax Policy.