The Price Control and Anti-Profiteering (Mechanism to Determine Unreasonably High Profit) Regulations 2018 (“PCAP Regulations”) came into force on 6 June 2018, and it applies to all goods and services. It is noteworthy that the PCAP Regulations do not fix the selling price nor profit level of a business. Instead, the increments of mark-up percentage or margin percentage of the goods or services in the 3 preceding years are fundamental in determining whether the business is making unreasonably high profit (i.e., profiteering) in a particular year. Profiteering is an offence and on conviction, any corporate shall be liable to a fine not exceeding RM500,000 and, for a second or subsequent offence, to a fine not exceeding RM1,000,000 each.

To safeguard consumers from unscrupulous businesses who raise price indiscriminately, the Ministry of Domestic Trade and Consumer Affairs (“MDTCA”) enforcement officers actively carry out inspections at business premises of not only retailers, but also wholesalers and manufacturers (i.e., throughout the supply chain). Notices are issued to business operators to demand explanation over suspicion of profiteering and there have been numerous reported cases of business owners charged for profiteering offences. It is therefore crucial for businesses to understand the mechanism prescribed under the PCAP Regulations to ensure compliance.

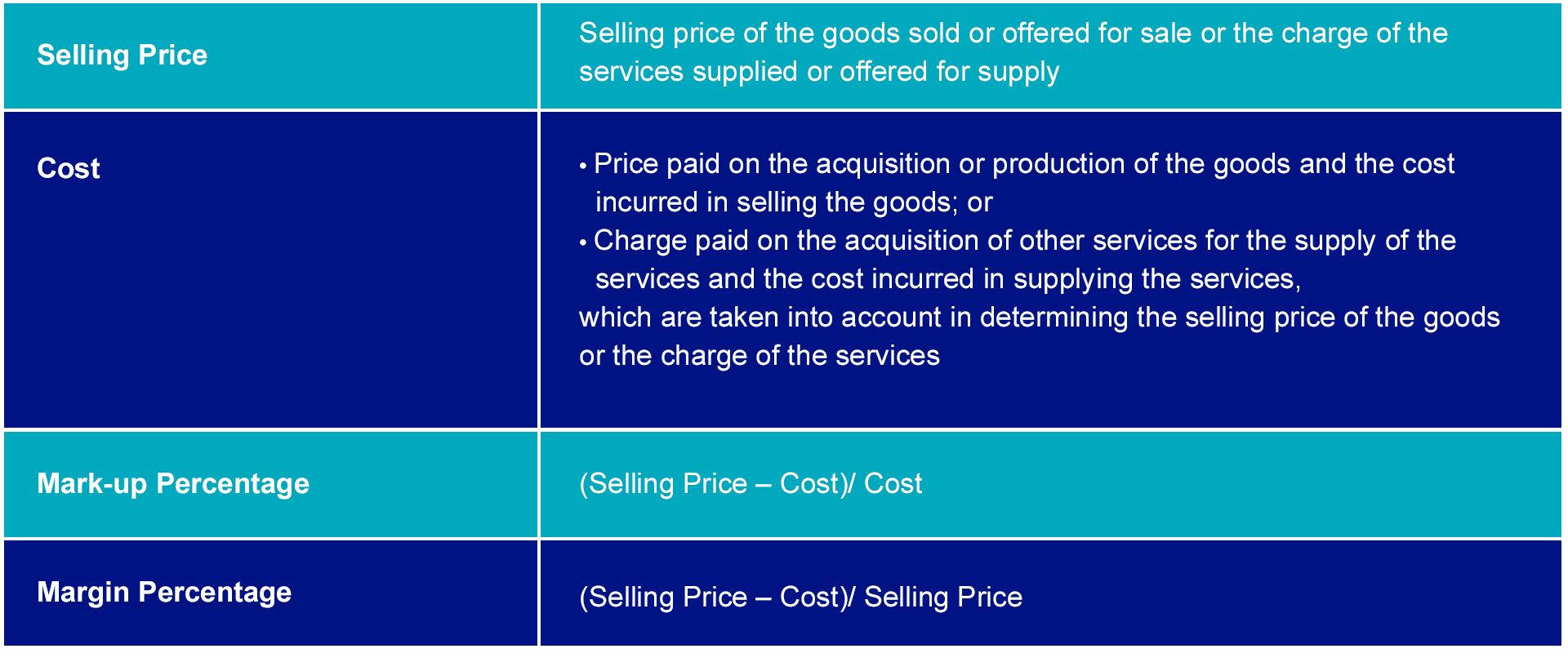

Having said that, compliance with the PCAP Regulations may not be straightforward. To ease businesses, KPMG’s Indirect Tax practice in Malaysia has developed and is pleased to share with you the "PCAP online calculator", a self-assessment tool that provides a preliminary assessment of whether a business is at risk of making unreasonably high profit for a particular goods or service offered for sale or supply. In using the calculator, you would need to input the selling price and cost accordingly to determine the mark-up percentage or margin percentage, as defined below: