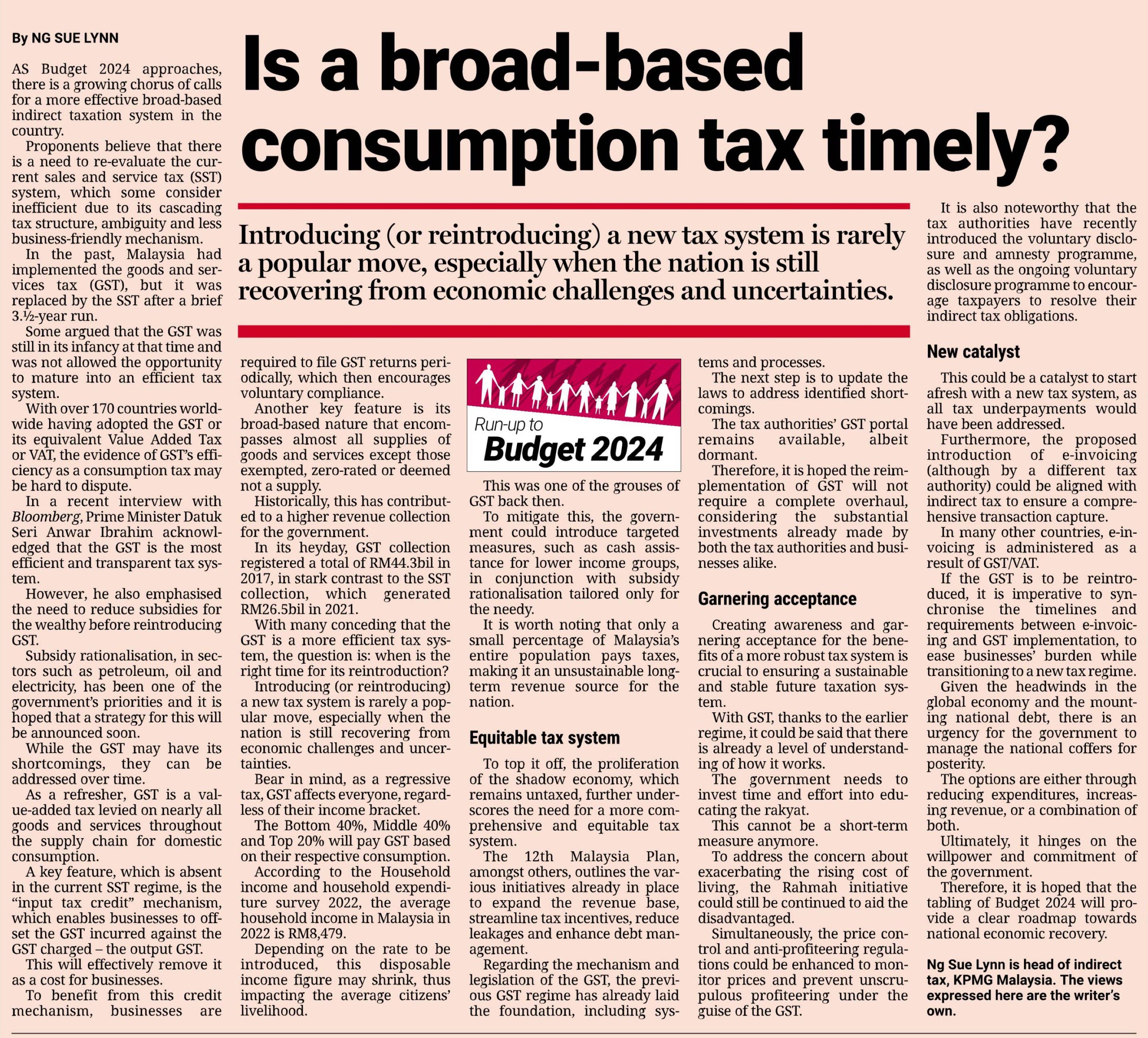

Is a broad-based consumption tax timely?

The Star, 3 October

In anticipation of the upcoming Budget 2024, Ng Sue Lynn, Head of Indirect Tax at KPMG in Malaysia, weighed in on the broad-based indirect taxation system in Malaysia, particularly the potential return of the goods and services tax (GST) and the need for an equitable tax system.

“If the GST is to be reintroduced, it is imperative to synchronize the timelines and requirements between e-invoicing and GST implementation, to ease businesses’ burden while transitioning to a new tax regime,” Ng added.

Read the full story via the attachment below:

Media queries?

For media-related queries, please email marcom@kpmg.com.my