97 percent of Malaysia’s Top 100 companies include sustainability data in annual reports – global leader

PETALING JAYA, 7 November 2022 – KPMG’s biennial Survey of Sustainability Reporting 2022 provides analysis of the sustainability and Environment, Social and Governance (ESG) reports from 5,800 companies across 58 countries and jurisdictions including Malaysia.

The Asia Pacific region leads in sustainability reporting, with 89 percent of its companies undertaking sustainability reporting. At 99 percent, Malaysia is one of seven Asia Pacific countries, territories and jurisdictions that have sustainability reporting rates higher than 90 percent; others include Japan (100 percent), Singapore (100 percent), South Korea (99 percent), Thailand (97 percent), Taiwan (94 percent) and Pakistan (91 percent).

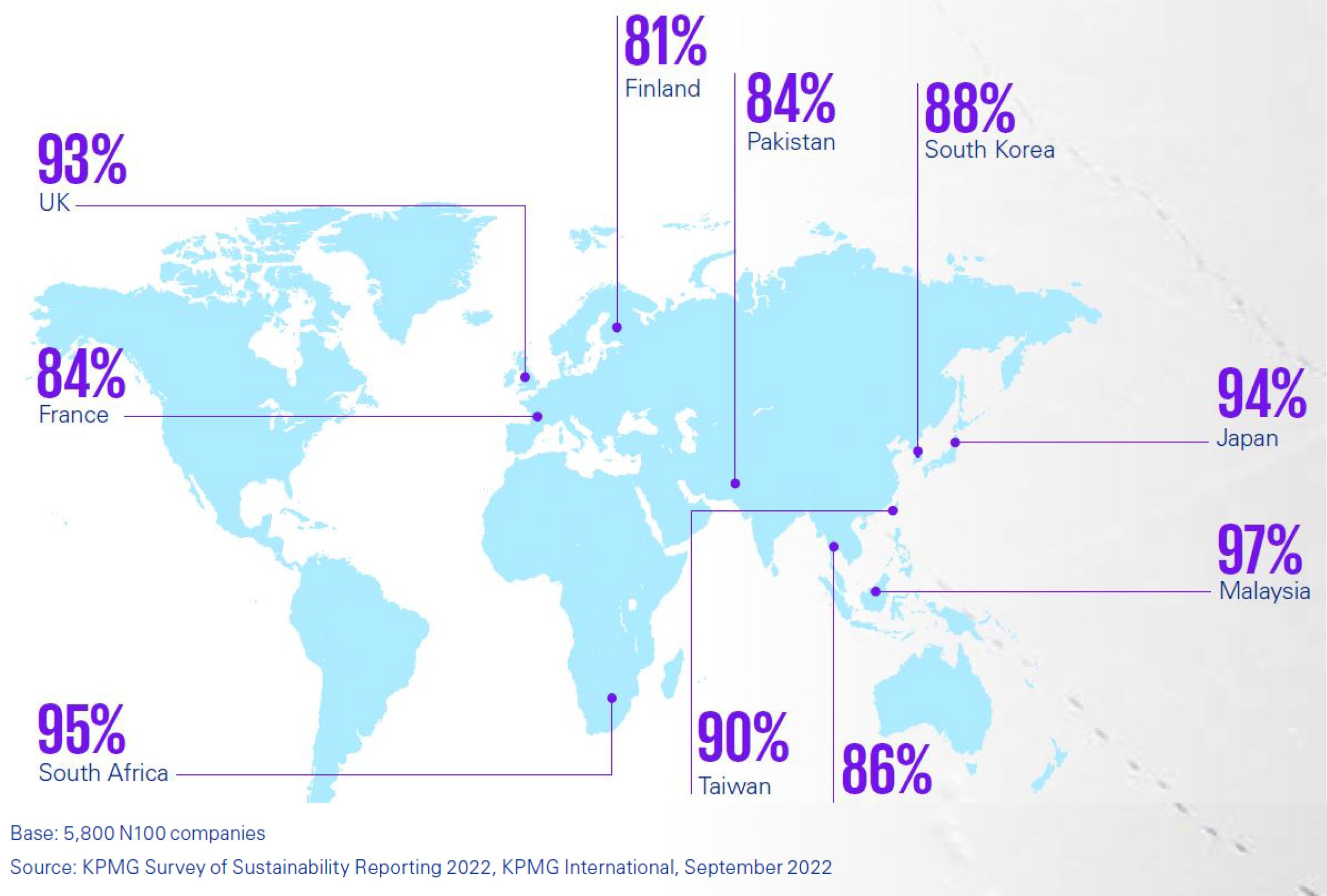

A deeper study of the top 100 companies in each country/jurisdiction analyzed (N100) found that Malaysia leads the top 10 countries by percentage of N100 companies that include sustainability information in annual financial reports.

Figure 1: Top 10 countries, territories and jurisdictions by percentage of N100 companies that includes sustainability information in annual financial reports (2022)

Ms Phang Oy Cheng, KPMG’s Head of Sustainability Advisory in Malaysia, said, “While sustainability reporting has been largely voluntary over the past two decades, this year’s study reveal that regulation will make a difference in enabling companies to achieve solid progress in their ESG ambitions and sustainability reporting.

She added, “For example, while there has been marked improvements in companies reporting carbon reduction targets, plans remain vague, and actions are too slow to show real results. What’s needed more than ever is globally consistent standards from governments and a collective effort from the world’s major companies to report on all aspects of ESG, recognizing the clear links between the environment and wider social equality issues.”

The Global Reporting Initiative (GRI) remains the most dominant standard used around the world. Singapore, Taiwan and Chile lead the uptake of this reporting standard. KPMG’s study also indicates a greater adoption of country stock exchange guidelines where GRI or Sustainability Accounting Standards Board (SASB) usage is lower. Leading adopters of stock exchange guidelines are South Africa (100%), Malaysia (95%) and India (89%).

Sustainability reporting through the ESG lens

This year’s report highlighted some further challenges the G250 (world’s 250 largest companies by revenue based on the 2021 Fortune 500 ranking) are facing when reporting on ESG. Among the thousands of reports analyzed, less than half of the G250 provided reporting on ‘social’ components (e.g., modern slavery; diversity, inclusion and equity; community engagement; and labor issues), despite an increasing awareness of the link between the climate crisis and social inequality.

At the same time, less than half of companies disclosed their governance risks (e.g., corruption bribery and anti-corruption, anti-competitive behavior or political contributions.) On average, only one third of N100 companies have a dedicated member of their leadership team responsible for sustainability and less than one-quarter of these companies link sustainability to compensation among business leadership.

ESG disclosures continue to be overwhelmingly narrative-driven, rather than publishing quantitative or financial data regarding impacts. This is clearly an area of improvement for companies in Malaysia and around the world. On a positive note, around three-quarters of reporting companies conducted materiality assessments and are disclosing material topics.

A call to action

New ESG requirements are driving a different perspective and set of conversations in Boardrooms, driving business leaders to stretch their thinking and ensure that from the top down they are making strategic decisions that take climate and broader ESG considerations more into account.

The KPMG report outlines the tangible ways businesses can invest in sustainability reporting:

— Understanding stakeholder expectations

— Incorporating materiality assessments into reporting

— Aligning reporting to mandatory or voluntary frameworks

— Investing in quality non-financial data management

— Understanding the impact of climate change and social issues on business

Phang concludes, “The pressure on businesses to report on non-financial metrics is only expected to grow as regulations evolve. We should start to see some progress over the coming year as organizations such as the International Sustainability Standards Board roll out new global standards for reporting. But companies shouldn’t wait to be told. By acting now, companies can make informed choices as a good corporate citizen to drive the positive change that their investors and customers demand.”

Download the KPMG Survey of Sustainability Reporting 2022 from www.kpmg.com.my/ESG

For media-related queries, please email marcom@kpmg.com.my