Amendments to Service Tax Policies

The Royal Malaysian Customs Department has issued the following amendments to Service Tax Policies, in relation to the recent expansion in the scope of Service Tax. A summary of the salient amendments/ updates is also set out below.

1) Service Tax Policy No. 1/2025 (Amendment No. 3) – Financial Services dated 17 October 2025

- Exemption from payment of Service Tax on management services for fixed price funds under Amanah Saham Nasional Berhad (“ASNB”) [previously was Permodalan Nasional Berhad (“PNB”)] including:-

(a) Amanah Saham Bumiputera (“ASB”); or

(b) Amanah Saham Malaysia (“ASM”). - Exemption from payment of Service Tax on the acquisition of re-insurance services or re-takaful services by insurance companies or takaful companies [new].

Subject to meeting conditions, insurance or takaful companies who acquire re-insurance or re-takaful services for the purpose of providing medical insurance, medical takaful, life insurance, or family takaful services, are exempted from payment of Service Tax.

The above amendments are effective 17 October 2025.

2) Service Tax Policy No. 2/2025 (Amendment No. 2) – Rental or Leasing Services dated 17 October 2025

- Group relief – updated to cover companies within a group that receive rental or leasing services from any other company within the same group, whether inside or outside Malaysia.

The conditions for group relief have also been updated to be largely consistent with the conditions for group relief given to services under Group G of the First Schedule to the Service Tax Regulations 2018. - Business-to-business (“B2B”) exemption facility on rental or leasing services for the period from 1 July 2025 to 31 August 2025 is granted to rental or leasing service providers who newly reached the registration threshold in July 2025 and have applied for Service Tax registration on/ before 31 August 2025 [new].

Note that any claim for refund of the above Service Tax paid must be made on/ before 30 November 2025 and only after the Service Tax have been refunded to the clients.

The earlier Service Tax Policy No. 2/2025 and Service Tax Policy No. 2/2025 (Amendment No. 1) are revoked and replaced with the above Service Tax Policy No. 2/2025 (Amendment No. 2), effective 1 July 2025

3) Service Tax Policy No. 3/2025 (Amendment No. 1) – Construction Works Services dated 17 October 2025

- Non-reviewable contracts – one of the conditions to qualify has been amended to “The contract* is made in writing, signed before 1 July 2025, and duly stamped with stamp duty by the Inland Revenue Board of Malaysia (“LHDN”) before 31 December 2025.”

* including any variation order/ extension of time

- Service Tax exemption on the construction of residential buildings and public facilities related to residential buildings within a mixed development project [new].

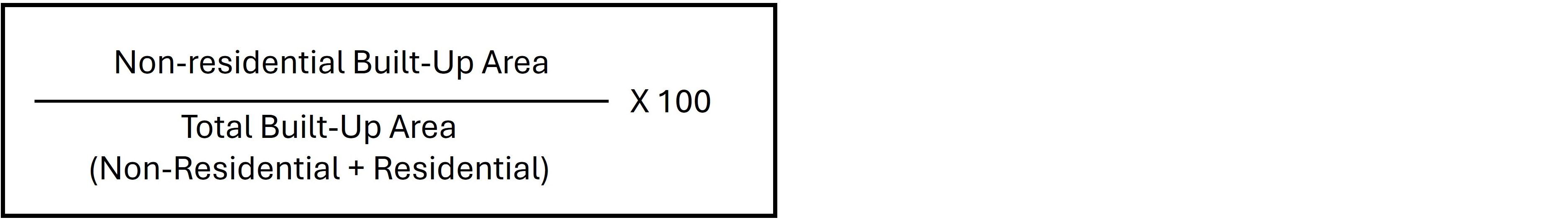

Subject to meeting conditions, the formula to determine the amount attributable to public facilities related to residential and non-residential buildings that are shared, is as follow:-

- B2B exemption facility on consultancy services under a design and build construction contract [new].

The main contractor is exempted from payment of Service Tax on the following consultancy services provided by consultants under items 1, 3, 4, 5, 6, 7, 9 and 13 of Group G of the First Schedule to the Service Tax Regulations 2018, subject to meeting conditions:-

(a) Legal services

(b) Accounting, auditing and bookkeeping

(c) Surveying services including valuation, appraisal and estate agency

(d) Engineering consultancy services

(e) Architectural services

(f) Consultancy, training or coaching services

(g) Management services

(h) Maintenance or repair services

- B2B exemption facility on construction work for the period from 1 July 2025 to 31 August 2025 is granted to construction work service providers who newly reached the registration threshold in July 2025 and have applied for Service Tax registration on or before 31 August 2025 [new].

Note that any claim for refund of the above Service Tax paid must be made on/ before 30 November 2025 and only after the Service Tax have been refunded to the clients.

The earlier Service Tax Policy No. 3/2025 is revoked and replaced with the above Service Tax Policy No. 3/2025 (Amendment No. 1), effective 1 July 2025.

4) Service Tax Policy No. 4/2025 (Amendment No. 2) – Education Services dated 17 October 2025 (Note that the English version of the Service Tax Policy appears to refer to it erroneously as “Amendment No. 1”)

- Children and dependents of foreign diplomats are exempted from paying Service Tax on educational services [new].

- Education fees or service charges that are fully sponsored by educational institutions, higher learning institutions, companies, foundations, or other organizations are exempted from Service Tax [new].

The earlier Service Tax Policy No. 4/2025 and Service Tax Policy No. 4/2025 (Amendment No. 1) are revoked and replaced with the above Service Tax Policy No. 4/2025 (Amendment No. 2), effective 1 July 2025.

Please click on the above header link for a copy of the Service Tax Policies for further information, including the respective conditions attached.

Petaling Jaya Office

Soh Lian Seng

Partner - Head of Tax and Tax Dispute Resolution

lsoh@kpmg.com.my

+ 603 7721 7019

Ng Sue Lynn

Partner - Head of Indirect Tax

suelynnng@kpmg.com.my

+ 603 7721 7271

Tai Lai Kok

Partner - Head of Corporate Tax

ltai1@kpmg.com.my

+ 603 7721 7020

Bob Kee

Partner - Head of Transfer Pricing

bkee@kpmg.com.my

+ 603 7721 7029

Long Yen Ping

Partner - Head of Global Mobility Services yenpinglong@kpmg.com.my

+ 603 7721 7018

Outstation Offices

Penang

Evelyn Lee

Partner

evewflee@kpmg.com.my

+603 7721 2399

Ipoh

Crystal Chuah Yoke Chin

Associate Director

ycchuah@kpmg.com.my

+603 7721 2714

Kuching & Miri

Regina Lau

Partner

reglau@kpmg.com.my

+603 7721 2188

Kota Kinabalu

Titus Tseu

Executive Director

titustseu@kpmg.com.my

+603 7721 2822

Johor

Ng Fie Lih

Partner

flng@kpmg.com.my

+603 7721 2514