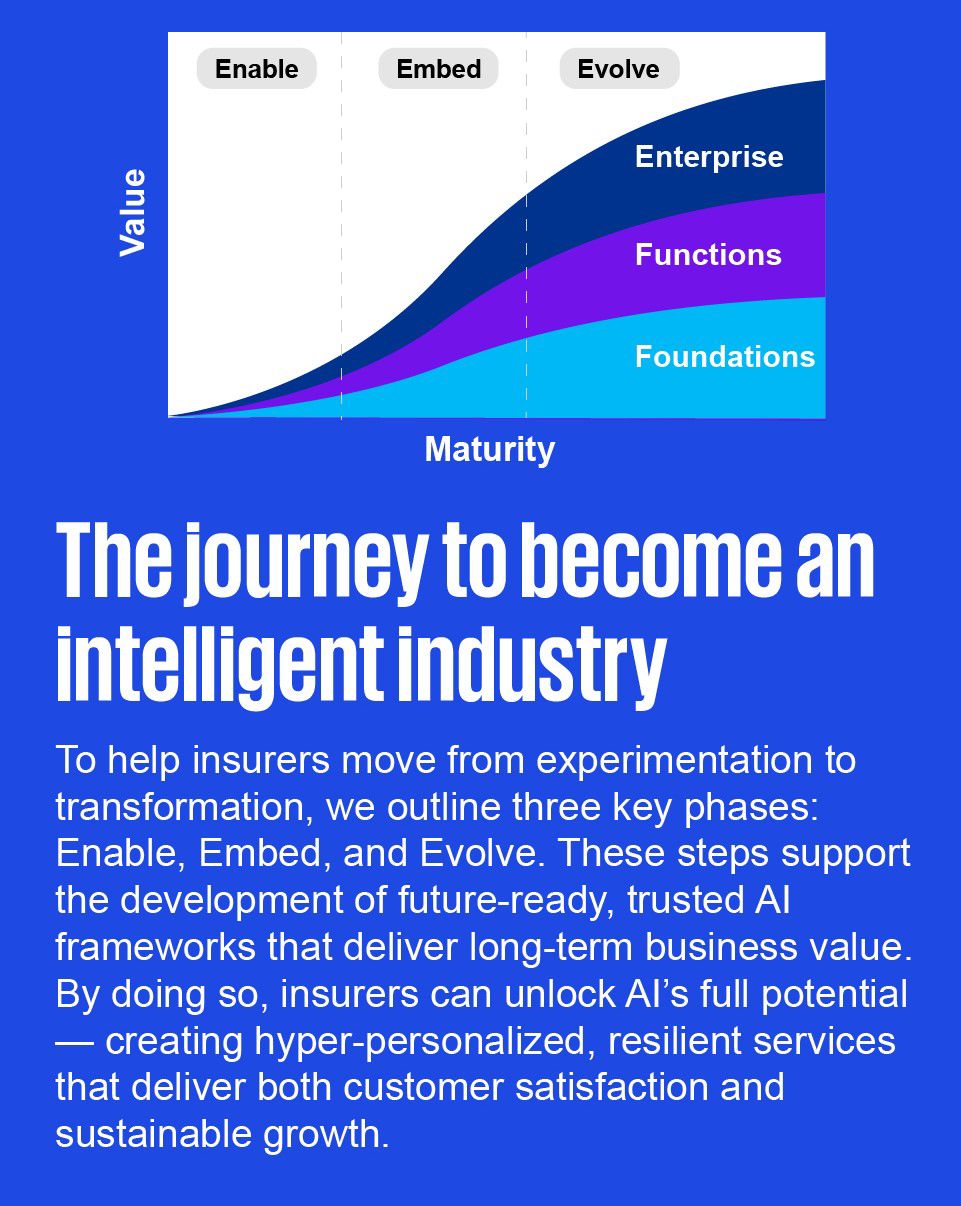

The Enable phase focuses on enabling people and building AI foundations. Organizations appoint a responsible executive, create an AI strategy, identify high-value use cases, boost AI literacy, align with regulations and establish ethical guardrails. AI pilots are launched across functions, while cloud platforms and pre-trained models are leveraged with minimal customization.

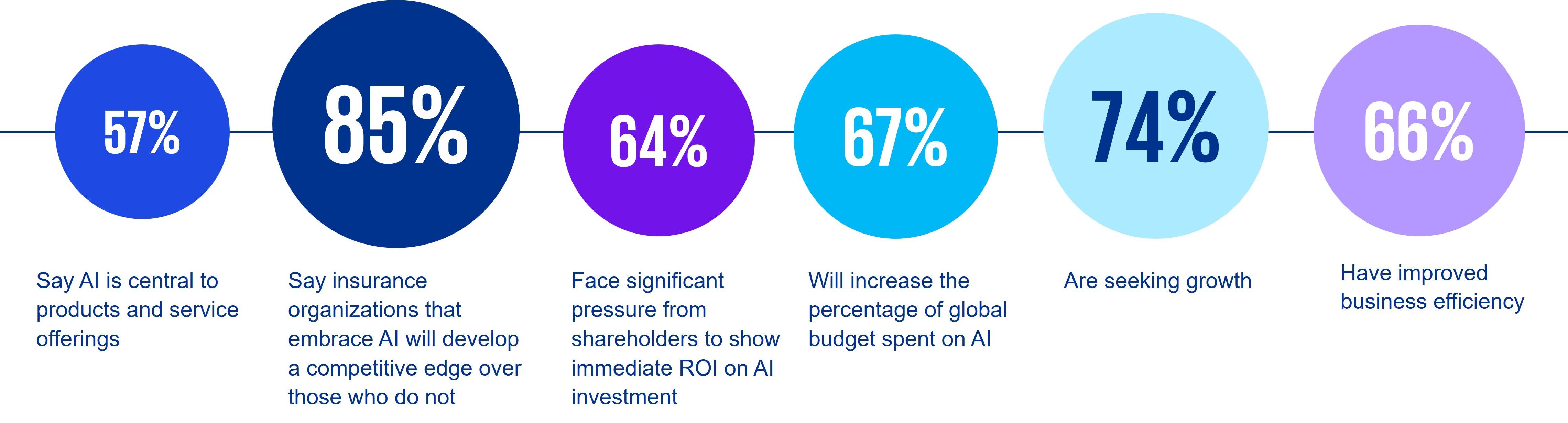

Artificial intelligence (AI) has long supported insurance — from automating claims and underwriting to detecting fraud and enhancing customer interactions. Now, generative and agentic AI are pushing the industry into a new phase: enabling hyper-personalization, smarter decision-making and innovation at scale. In Malaysia, this shift is accelerating digital transformation, with insurers investing in AI to stay competitive and meet rising consumer demands.

With adoption gaining pace, insurers face a critical juncture: how to harness AI responsibly while tackling talent gaps, data trust and regulatory shifts. Our Intelligent insurance – Malaysia report explores these opportunities and challenges, featuring global insights and real-world case studies from Malaysian insurers and insurtechs already navigating this space.

The Embed phase integrates AI into workflows, products, services, value streams, robotics, and wearables, delivering greater value. A senior leader drives enterprise-wide workforce redesign, re-skilling and change, embedding AI into operating models with a focus on ethics, trust and security. AI agents and diverse models are deployed, supported by cloud and legacy tech modernization, while enterprise-wide data enhances operations.

The Evolve phase evolves business models and ecosystems, using AI and frontier technologies like quantum computing and blockchain to solve large sector-wide challenges. AI orchestrates seamless value across enterprises and partners. Emphasizing ethics and trust with real-time security, this phase uplifts human potential with broad and deep workforce training, fostering a creative, innovative and value-driven future.