Both sustainability reporting and carbon targets have been adopted by almost all of the G250 global group of companies and four-fifths of the N100 groups.

Organizations are making strides in sustainability, moving the needle in today’s business landscape. As sustainability increasingly becomes part of “business as usual,” it is crucial for reporting efforts to go beyond compliance, demonstrating a genuine commitment to driving long-lasting value creation for businesses.

While sustainability reporting has been mandatory for listed companies by Bursa Malaysia, its expansion to include Scope 3 emissions—those produced indirectly through an organization’s supply chain—under the National Sustainability Reporting Framework (NSRF) is a new development. Starting in 2027, Scope 3 reporting will be mandatory, and by 2025, companies must also comply with the International Financial Reporting Standards (IFRS) S1 and S2. This shift highlights the growing complexity of addressing environmental impact, not just at the organizational level, but also in support of the nation’s push for sustainable growth.

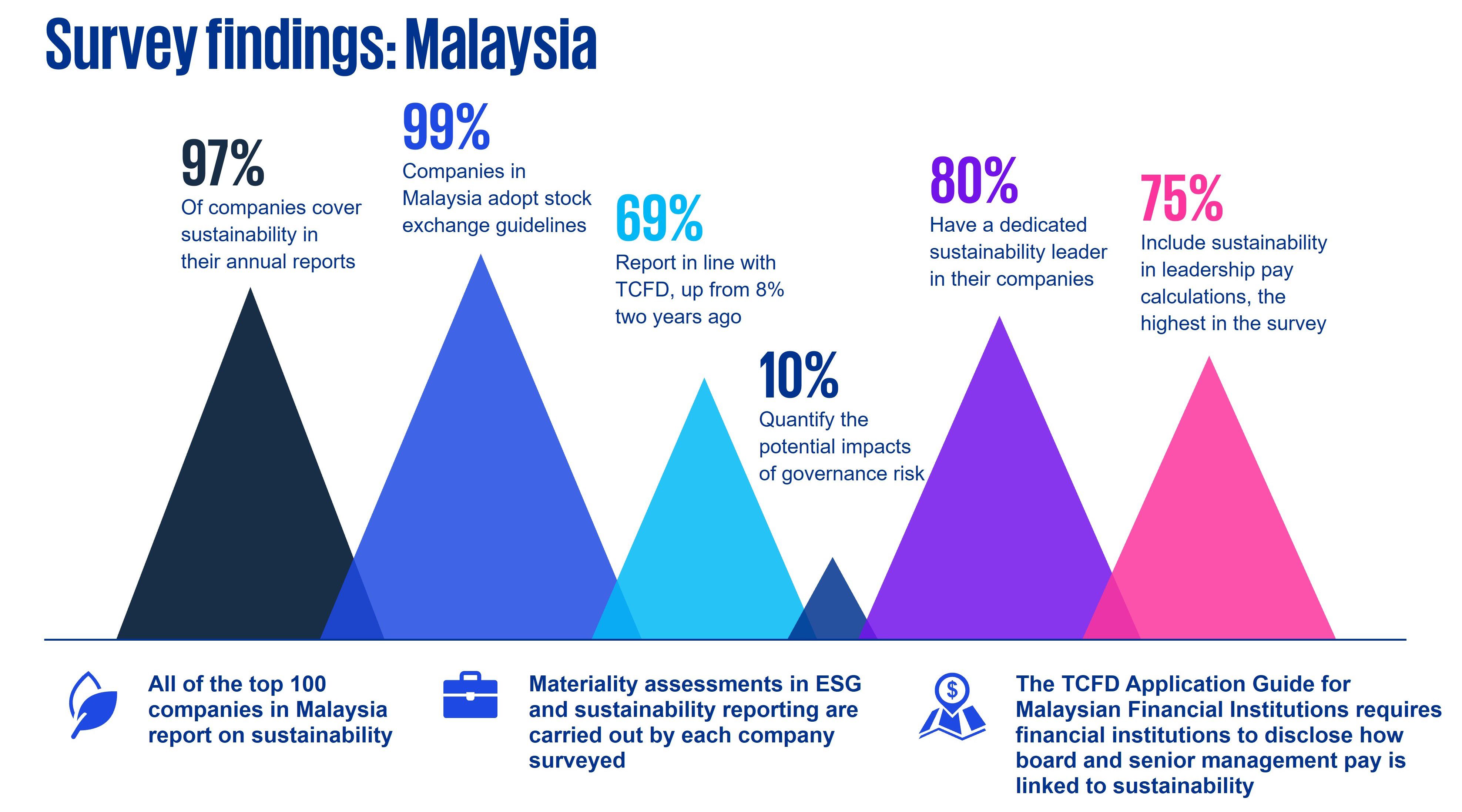

Our survey, conducted since 1993, explores key trends shaping the sustainability landscape. This year’s Survey of Sustainability Reporting 2024 gathers insights from 5,800 companies, including the top 100 companies across 58 countries, territories and jurisdictions, including Malaysia. The findings show that all of Malaysia’s top 100 companies now report on sustainability, signaling a shared commitment across leading businesses, especially amid rapid growth in reporting practices across the Asia-Pacific region.

As companies seek to differentiate themselves and remain future-focused, a commitment to sustainability is proving to be a valuable asset. By embracing sustainable practices, organizations are not only meeting regulatory expectations and investor demands but also building the foundation for long-term value and success.

Six major trends found in the survey

The Corporate Sustainability Reporting Directive (CSRD) applies to an initial group of companies for reports on financial years ending from 31 December 2024, with some having until 2029 to publish their first compliant reports. However some companies, mainly European-headquartered or with activities in Europe, are already preparing for CSRD such as by reporting material topics in accordance with the ESRS. Nearly half of European companies in the research already make disclosures using the EU Taxonomy.

Nearly four-fifths of both the G250 and N100 groups use materiality assessments. The larger G250 companies are more likely to use double materiality processes that assess both impacts on society and the environment and how this affects their financial performance. Double materiality is the most complete form of materiality assessment and is a cornerstone of compliance with the EU’s CSRD, so some of those adopting it are likely to be doing so to prepare for it becoming mandatory.

GRI remains the most popular standard, with three-quarters of G250 companies using it and nearly as high a proportion of the N100 groups. There have been bigger increases in use for both SASB and stock exchange guidelines over the last two years, although from lower bases. Their adoption varies significantly by country and region, with all surveyed companies in Saudi Arabia using its stock exchange guidelines and two-thirds of those in the Americas using SASB.

While voluntary guidelines and standards remain widely-used during this transitional period, this could change as mandatory reporting expands over the next few years.

Around half of both the G250 and N100 groups now report on biodiversity, up from around one-quarter four years ago, although growth has been slower in the last two years. Significant differences between regions on adoption rates found two years ago have narrowed since, with companies in the Middle East and Africa moving closer to the global average.

Nearly three-quarters of G250 companies report climate risks in line with the Task Force on Climate-related Financial Disclosures recommendations. As TCFD was a key input into both the ISSB Standards and ESRS, adopters are at an advantage when adopting these new standards.