Initially reintroduced to increase the level of tax compliance and the nation’s tax base, Malaysia’s Special Voluntary Disclosure Program (SVDP) 2.0 provides the golden opportunity for taxpayers to start afresh on a clean slate.

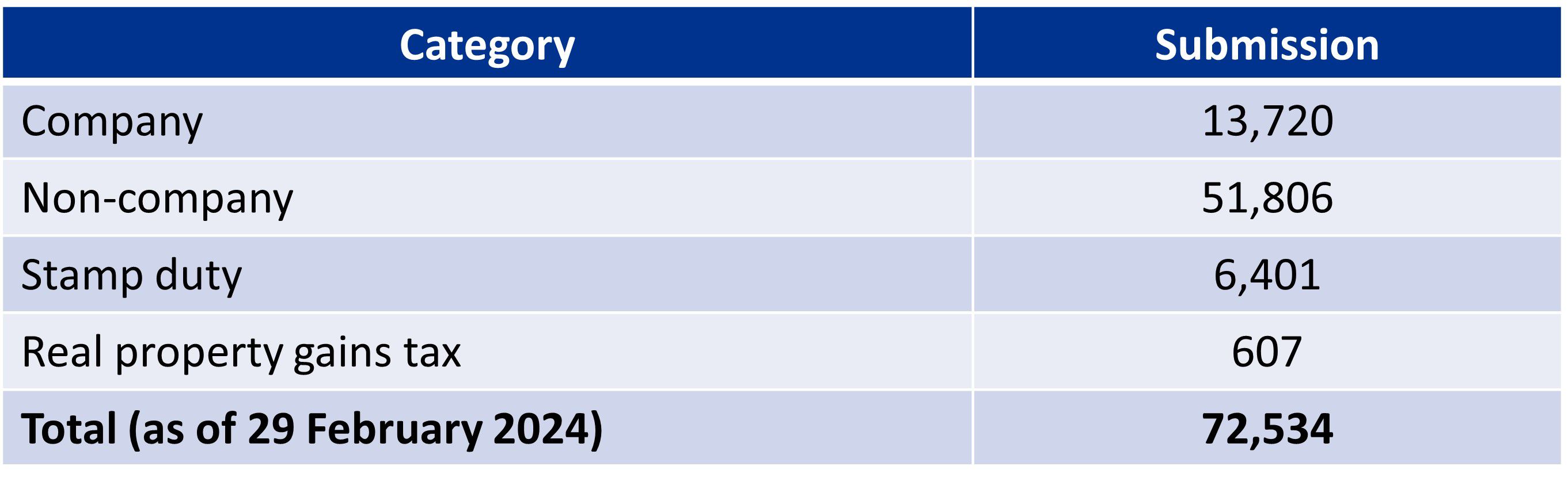

SVDP 2.0, which runs until 31 May 2024, has already garnered considerable traction with 72,534 submissions and RM652.4 million collected from both new and existing taxpayers as of 29 February 2024. However, amidst the uptake, questions surrounding SVDP 2.0 still arise. On a quest to get these questions answered, KPMG in Malaysia recently organized a webinar headlining Pn. Norfaidah Binti Daud (Director of the Tax Compliance Department, IRB) and En. Mohd Sarimi Bin Che Sarif (Section Director of the Department of International Taxation, IRB). The session was joined by myself, Chang Mei Seen (Partner, Transfer Pricing) and moderated by James How (Associate Director, Tax Dispute Resolution).

(from left to right: Encik Mohd Sarimi Bin Che Sarif, Section Director of the Department of International Taxation, IRB, Ms Chang Mei Seen, Partner in Transfer Pricing at KPMG in Malaysia, Puan Norfaidah Binti Daud, Director of the Tax Compliance Department, IRB, Soh Lian Seng, Partner – Head of Tax, KPMG in Malaysia)

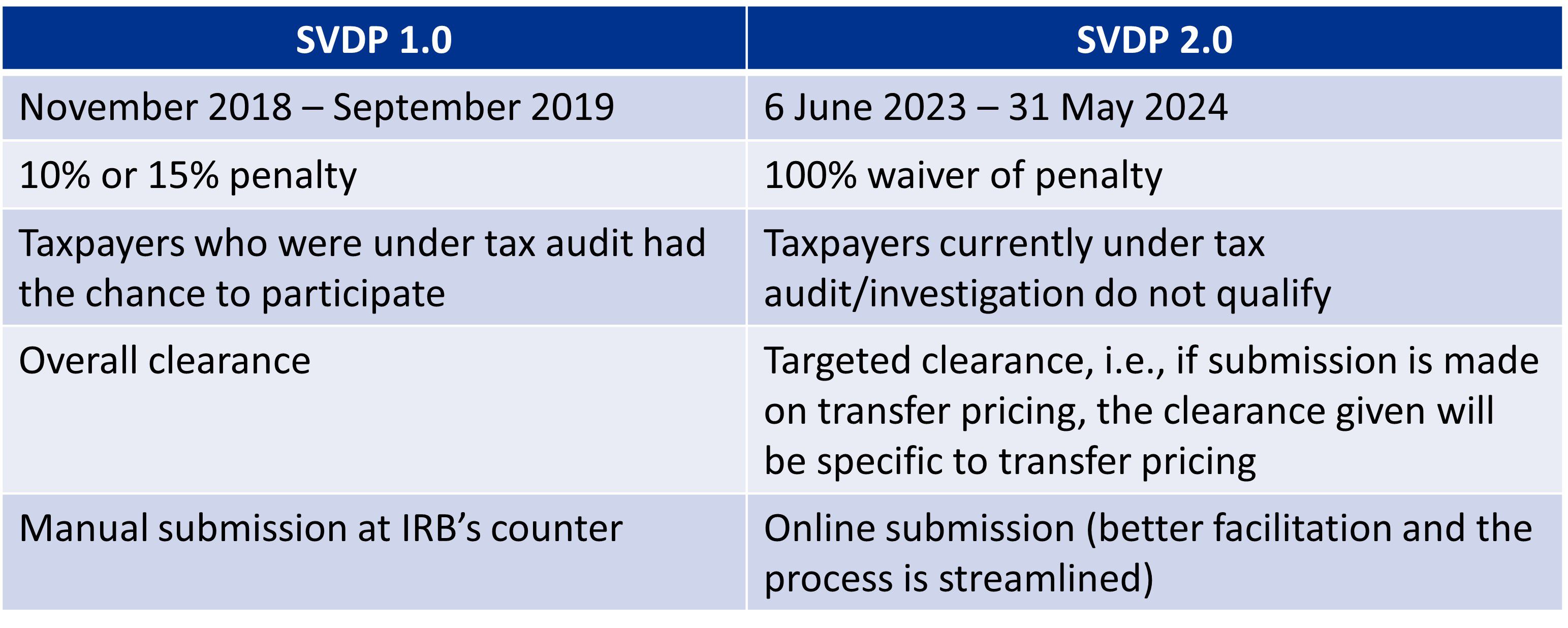

Key to SVDP 2.0’s appeal is its zero percent penalty provision, coupled with the assurance from the IRB that, for the Year of Assessment (YA) in which voluntary disclosures are made through SVDP 2.0, no further audit or investigation exercises will be conducted, and they will be accepted on a good faith basis. This, alongside ongoing initiatives such as tax identification number, e-invoicing and tax corporate governance framework, has contributed to the country’s significant strides toward facilitating effective tax reporting and encouraging greater tax compliance. To give you better clarity about SVDP 2.0, you will find below a comparative table between SVDP 1.0 and 2.0, alongside a breakdown of voluntary submissions.

Table 1: Main differences between the two SVDPs

Table 2: Breakdown of voluntary disclosure submissions, as of 29 February 2024

During the panel, we have highlighted several common areas of scrutiny by the IRB during a tax audit and prevailing tax disputes which should warrant further review by taxpayers. Our discussion on these common areas can be broadly summarized and classified as follows:

Income: Issues pertaining to recognition of income, advance income, accruals, and tax law changes, as well as undeclared income concerns, such as gains from asset disposal and rental income. Documentation beyond accounting records, such as license agreements and legal opinions, was highlighted for proving income intention. Additionally, emphasis was placed on whether companies have the necessary SOPs to properly recognize lump sum income over time, considering differing accounting and tax rules.

Expenses: The distinction between advertising and entertainment expenses, particularly hospitality-related costs like food and beverages, can be nuanced. Similarly, sponsorship expenses may involve entertainment elements, necessitating careful evaluation. These considerations underscore the importance of strong tax governance within the company, including the need for proper SOPs and documentation to clarify intentions, beneficiaries, and compliance with tax regulations.

Incentives: Scrutiny surrounding claims of incentives after expiry or without meeting conditions was also addressed, as well as reinvestment allowance claims, disputes arise due to interpretation gaps on terms like "factory" and "manufacturing," insufficient documentation for qualifying projects (i.e. Project Paper), and claims on non-qualifying assets. This emphasizes the need for companies to review their claim of incentives such as Reinvestment Allowance (RA) claims.

Transfer Pricing: Companies face common risk areas in transfer pricing, such as intragroup financing, intragroup services, royalties’ payments, and limited risk entities. It must be prepared to defend the arm's length nature and economic substance of its transactions.

Crucially, good tax governance is a subset of good corporate governance. This involves assessing the organizational process, reviewing its tax risks and mitigating those tax risks, which organizations are encouraged to look into. It is vital to remember that aside from the proper documentation and good governance practices, the end of SVDP 2.0 does not signal an endgame for transfer pricing.

As cooperative taxpayers, businesses can still participate in voluntary disclosure under the existing audit framework. With SVDP 2.0 approaching its conclusion on 31 May 2024, taxpayers are encouraged to seize this opportune moment to assess the potential areas they would like to report and avail themselves of the zero percent penalty rate. With the impending implementation of e-invoicing, now is the ideal time for taxpayers to reassess their tax reporting strategies and ensure compliance with regulatory requirements.