In the first of this series, we look at the need for directors to have information at their fingertips to help plan for the fallout of a looming recession.

With the year-end looming, inflation concerns, supply chain disruptions ensuing from global conflicts, and a weakening Ringgit wreaking havoc on financial performance, business leaders this year will once again be in the spotlight as they wrestle with cost control, investment strategies along with an increasing focus on company forecasting.

These serve as a timely reminder that the market is fast-changing – and that every so often these changes can and will have a significant impact on your business.

To navigate this ever-shifting landscape, boards need to have access to accurate, reliable, and relevant information at their disposal so as to make informed decisions whilst also being able to articulate their verdicts to the market with sound evidence. The need for timely and accurate information has never been more apparent – taking into account the rising scrutiny from regulators, the continuous disclosure regime and strict director liability laws.

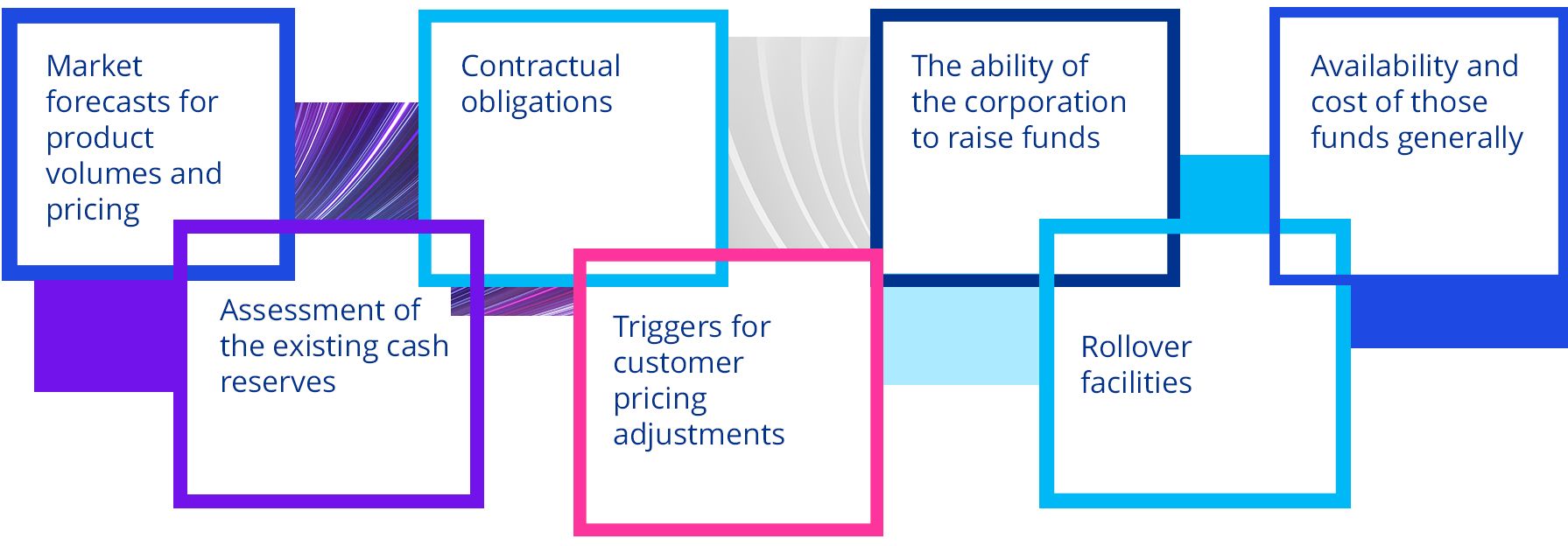

For starters, in forming a view that will lead to the making of informed decisions, a well-grounded and prudent director should obtain sufficient and relevant information from the management. Such pertinent information may be comprised of the following:

When there is ever any concern, or where internal insights are critical in the decision-making process, businesses may seek external experts to validate the information provided.

Whilst this level of diligence may not always protect company directors from unforeseen events, it can often mitigate the potential incurring damages, and may also help to gain support from the market or worse, the courts, if things do get that far.

Navigating unforeseen events and staying in control may seem insurmountable. But with the right information and insights, it is not impossible.

By Guy Edwards, Executive Director – Restructuring Services, KPMG Deal Advisory