Deferment of Tax Instalment Payments for Small and Medium Enterprises and Special Revision of Income Tax Estimation

Further to the announcement in the 2022 Budget on 29 October 2021, the Malaysian Inland Revenue Board has issued the following:

(a) Frequently Asked Questions (“FAQs”) in respect of the deferment of tax instalment payments for 6 months from 1 January 2022 to 30 June 2022 for small and medium enterprises;

(b) FAQs in respect of the special revision of income tax estimation in the 11th month basis period for all businesses before 31 October 2022; and

(c) The application form for the special revision of income tax estimation in the 11th month basis period.

Exemption from the Restriction of Tax Deduction on Payments Made to Labuan Companies

Section 39(1)(r) of the Income Tax Act 1967 (“the ITA”) was first introduced in Finance Act 2018 to restrict the deductibility of payments made by a resident person to any Labuan company (as defined), effective from 1 January 2019.

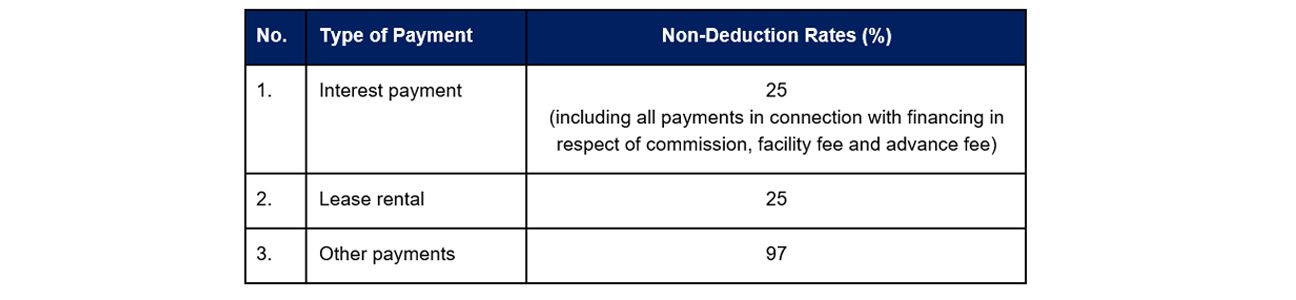

The Income Tax (Deductions Not Allowed for Payment Made to Labuan Company by Resident) Rules 2018 and the Income Tax (Deductions Not Allowed for Payment Made to Labuan Company by Resident) Rules 2018 (Amendment) 2020, were subsequently gazetted to prescribe the amount not allowed as a tax deduction for the following payments:-

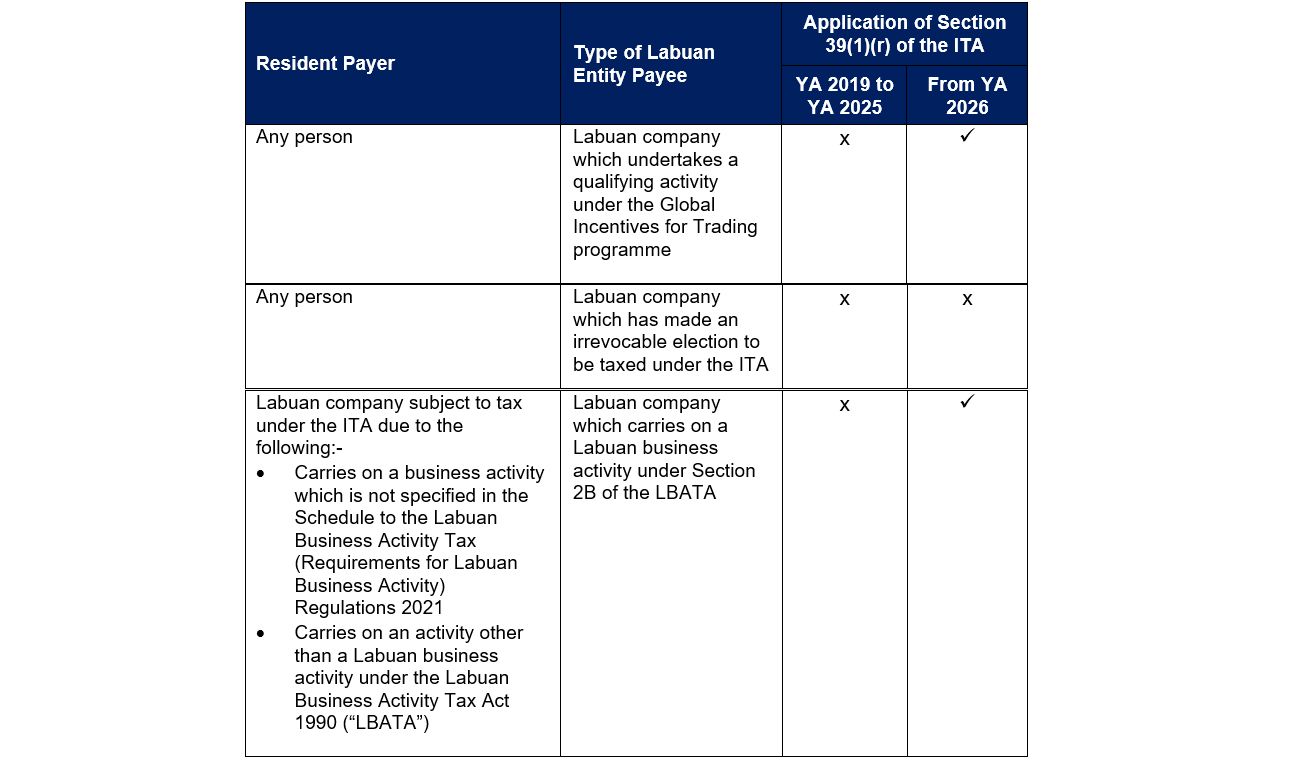

On 23 November 2021, the Income Tax (Exemption) (No .11) Order 2021 (“Exemption Order”) has been gazetted to provide exemptions from the above Non-Deduction Rules as follows:-

As the Exemption Order is deemed to have come into operation on 1 January 2019, a Company may revise its submitted Tax Returns for the affected YAs in order to apply the Exemption Order, where applicable. The revision must be made by 31 December 2026.

The relevant FAQs, application form and the Exemption Order can be accessed via the above links.

Should you have any questions or require further clarification, please do not hesitate to email or contact any of our Executive Directors, Directors, Associate Directors or Managers whom you are accustomed to dealing with or who are responsible for the tax affairs of your organization.

Tai Lai Kok Executive Director Head of Tax |

Petaling Jaya Office

Tai Lai Kok |

Long Yen Ping |

Bob Kee |

Ng Sue Lynn |

Soh Lian Seng |

|

Outstation Offices

Penang Office |

Kuching & Miri Office |

Evelyn Lee |

Regina Lau |

Kota Kinabalu Office |

Johor Bahru Office |

Titus Tseu |

Ng Fie Lih |

Ipoh Office |

|

Crystal Chuah Yoke Chin |

|