TP Talk: Getting it wrong can be costly

It is beyond doubt that Transfer Pricing (“TP”) has been one of the Inland Revenue Board of Malaysia (“HASiL”)’s main focal points, which can be evidenced with the ever-progressing enforcement of TP rules.

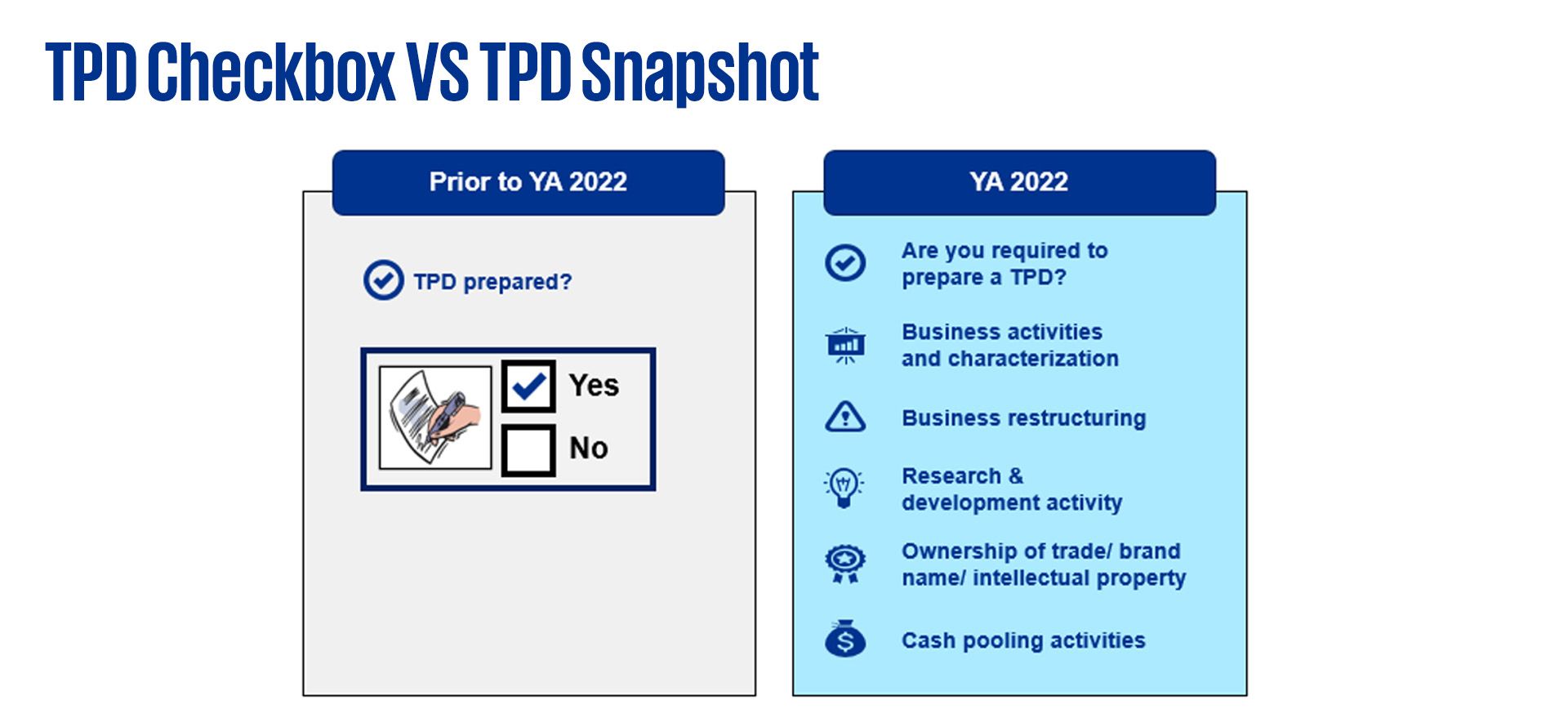

One of the notable requirements effective year of assessment (“YA”) 2022 is that the taxpayers are NOW mandated to disclose a snapshot of Transfer Pricing Documentation (“TPD”) in the Income Tax Return Form (i.e. Form C). A quick preview on the pre and post-changes on the TP disclosure are as follows:

It is apparent that TP transparency is the “new norm” for the taxpayers with the drastic change in Form C. With this, there is a strong indication that TP compliance and audit scrutiny may be an upheaval battle between taxpayers and HASiL.

Anchored with the aim of knowledge sharing, our esteemed TP specialist will perform a deep-dive on the new TP lingo. Through this session, your readiness will be enhanced for a seamless submission of Form C.

Who should attend:

- Chief Financial Officer or equivalent

- Finance Managers

- Tax Managers / Advisors

- Accountants and accounts executives

- Accounts / Finance / Tax personnel

Speaker: Nivashini Rayapay, Director, Global Transfer Pricing Services

21 February 2023 (Tuesday)

10.30am to 11.30am

Platform:

Webex Events

Fee:

Complimentary

For event queries, please email to kpmgconferencesseminars@kpmg.com.my

TERMS & CONDITIONS

Registration closes on 20 February 2023 at 12pm.

All delegates must register with their own respective email address in order to access / attend the webinar. Entry into the webinar is unique to the registered delegate’s email address and is non-transferable. If you are registering on someone else’s behalf, please ensure to insert the delegate’s email instead of your own.

NOTE

KPMG’s webinar series are conducted online; hence, you will need to have stable internet access in order to participate. While you may view the webinar using a mobile device, it is recommended to participate using a laptop / PC for optimal experience.