Myanmar Client Alert - 9 October 2018

Myanmar Client Alert - 9 October 2018

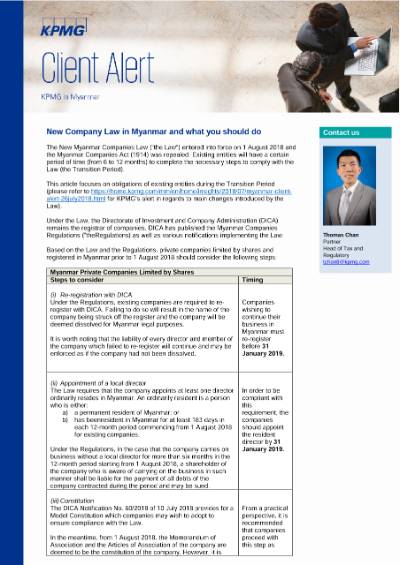

New Company Law in Myanmar and what you should do

The New Myanmar Companies Law (“the Law”) entered into force on 1 August 2018 and the Myanmar Companies Act (1914) was repealed. Existing entities will have a certain period of time (from 6 to 12 months) to complete the necessary steps to comply with the Law (the Transition Period).

This article focuses on obligations of existing entities during the Transition Period (please refer to https://home.kpmg/mm/en/home/insights/2018/07/myanmar-client-alert-26july2018.html for KPMG’s alert in regards to main changes introduced by the Law).

Under the Law, the Directorate of Investment and Company Administration (DICA) remains the registrar of companies. DICA has published the Myanmar Companies Regulations (“theRegulations) as well as various notifications implementing the Law.

Based on the Law and the Regulations, private companies limited by shares and registered in Myanmar prior to 1 August 2018 should consider the following steps:

Myanmar Private Companies Limited by Shares

| Steps to consider |

Timing |

(i) Re-registration with DICA Under the Regulations, existing companies are required to re-register with DICA. Failing to do so will result in the name of the company being struck off the register and the company will be deemed dissolved for Myanmar legal purposes. It is worth noting that the liability of every director and member of the company which failed to re-register will continue and may be enforced as if the company had not been dissolved. |

Companies wishing to continue their business in Myanmar must re-register before 31 January 2019. |

(ii) Appointment of a local director The Law requires that the company appoints at least one director ordinarily resides in Myanmar. An ordinarily resident is a person who is either: a) a permanent resident of Myanmar; or b) has beenresident in Myanmar for at least 183 days in each 12-month period commencing from 1 August 2018 for existing companies. Under the Regulations, in the case that the company carries on business without a local director for more than six months in the 12-month period starting from 1 August 2018, a shareholder of the company who is aware of carrying on the business in such manner shall be liable for the payment of all debts of the company contracted during the period and may be sued. |

In order to be compliant with this requirement, the companies should appoint the resident director by 31 January 2019. |

(iii) Constitution The DICA Notification No. 60/2018 of 10 July 2018 provides for a Model Constitution which companies may wish to adopt to ensure compliance with the Law. In the meantime, from 1 August 2018, the Memorandum of Association and the Articles of Association of the company are deemed to be the constitution of the company. However, it is worth noting that any provisions of the Memorandum of Association and the Articles of Association contradicting the Law have no effect except for a provision stipulating the corporate objectives of the company. The latter will remain in force until 31 July 2019 and will subsequently be deemed to be removed unless the company passes a special resolution to keep it and files a relevant notice to the DICA. Companies may wish to either adopt the Model Constitution or a tailor-made constitution to comply with the Law. |

From a practical perspective, it is recommended that companies proceed with this step as soon as possible. |

(iv) Simplification of the shareholding structure Since the Law stipulates that a sole shareholder suffices for establishing a company, companies with two shareholders, where a second shareholder was interposed to comply with the repealed Myanmar Companies Act, may take this opportunity for restructuring and removing the second shareholder. |

This may be done at any time after re-registration of the company |

(v) Annual filing of particulars Under the Law, every company must file within two months from its incorporation and thereafter file an annual return detailing corporate information (e.g. name of the company, address, number of members etc.) at least once every year. However, the above requirement is not applicable if the due date for filing the return falls during the re-registration period. |

The companies should review if filing of the annual return is necessary. |

| (vi) The Law requires holding companies to prepare consolidated financial statements on an annual basis. |

Please note that the re-registration requirements set out in (i) above are also applicable to branches registered in Myanmar. In addition, foreign companies with branches in Myanmar should consider appointing an authorized officer in Myanmar who should be ordinarily resident (similarly to section (ii) above regarding a local director of a company). Branches should also consider if annual filing is necessary.

It is important to note that with the introduction of the Law, DICA has also taken the opportunity to launch its online registry system on 1 August 2018. The system is running smoothly and most of the required filings may now be done online. Non-electronic filings may also be submitted to DICA but extra filing fees will be collected and delays are possible. Please note that filing fees range from approximately USD10 to USD200 (some higher fees are collected for filings in relation to public companies limited by shares and in relation to the change of legal form).

How can KPMG help?

KPMG can assist in assessing your investments into Myanmar or on reassessing new market opportunities. KPMG is experienced in advising clients looking at investing into Myanmar via acquisition of existing businesses or making greenfield investments into Myanmar.

Our team of dynamic professionals have the necessary experience in dealing with the intricacies of investing into Myanmar and will be able to offer practical advice and solutions. Please reach out to us to discuss and understand the impact to your investment in Myanmar.

About Client Alerts

KPMG Client Alerts highlight the latest tax and regulatory developments, impending change to law or regulations, current practices and potential problem areas that may impact your company. As certain issues discussed herein are time sensitive, it is advisable to make your plans accordingly.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia