In an interview with US TV channel CNBC in August 2021, Deutsche Bank CEO Paul Maley said that "It's necessary for any bank that wants to compete in the future, to make sure they have an ability to interact and interoperate with DeFi systems as they emerge. "

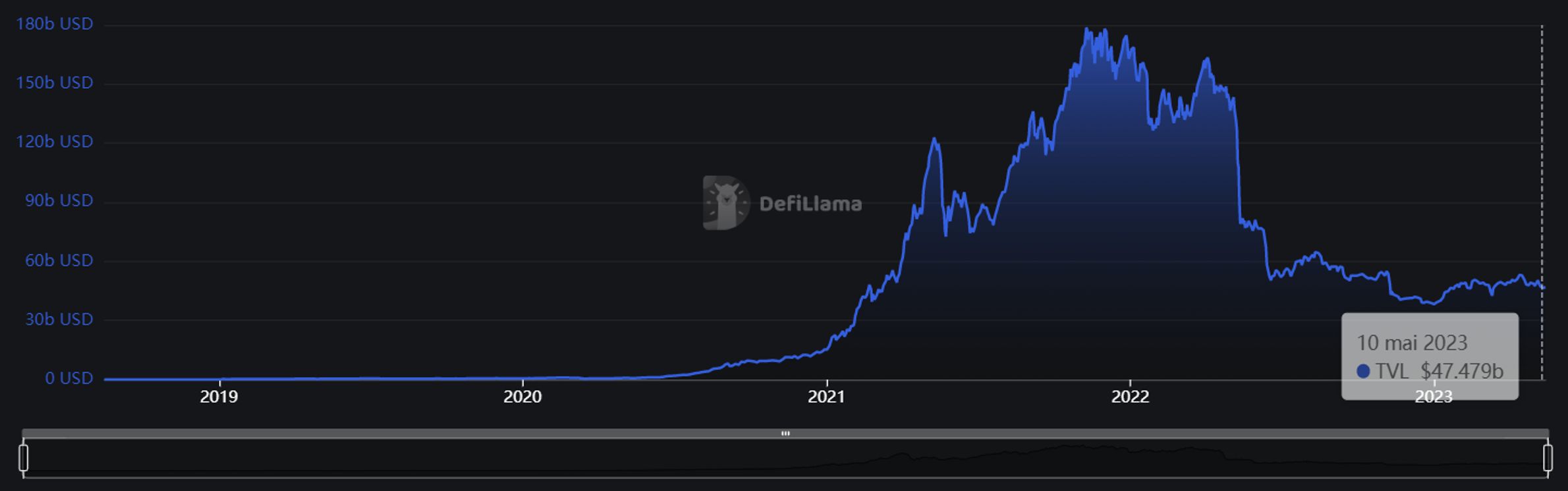

As of May 10, 2023, decentralized finance represents $47.479b of liquidity stored across various blockchains, mainly Ethereum. These liquidities are provided by DeFi players, who receive returns for their contributions.

Source : DefiLlama

Decentralized finance, or "DeFi", refers to decentralized financial infrastructures operating on an open, peer-to-peer, international blockchain.

The aim of DeFi is to make financial services traditionally provided by banks and financial institutions more accessible, without the need for trusted third parties. Trust in third parties (banks, insurance companies) is replaced by trust in the reliability and security of a decentralized, unforgeable and immutable computer protocol.

While many platforms (wrongly) claim to belong to the "DeFi" ecosystem, not all of them have the same characteristics (Examples : Binance DEX et Idex).

This article will focus on how decentralized finance works and what's at stake.

Sommaire

- Introduction

- DeFi History: DAOs and decentralized applications (Dapps)

- The benefits of decentralized finance

- The rise of decentralized finance

- Key features of decentralized finance

- Example of three major protocols in the DeFi ecosystem

- Criticism and risks

- Challenges and opportunities for our businesses

![Is decentralized finance the future of finance? [ Newsletter Advisory - July 2023 ] - KPMG Monaco](https://assets.kpmg.com/is/image/kpmg/pink-blue-neon-laser-texture-over-blue-background-banner:cq5dam.web.1400.350)