The GInvTA, effective from 1 January 2018, was introduced to align the taxation of investment funds with EU principles and ensure equal treatment of domestic and foreign funds.

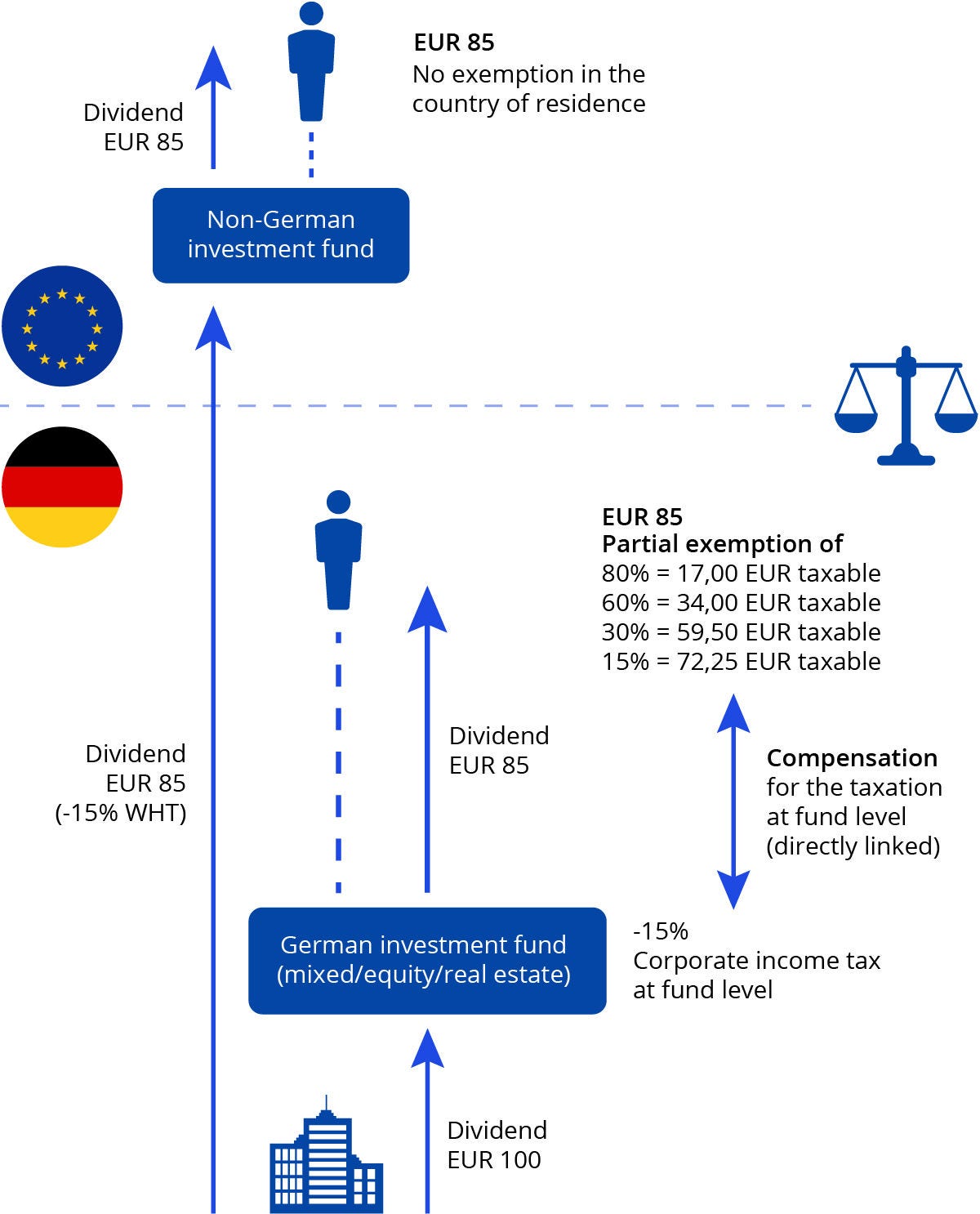

Under this reform, all investment funds whether German or foreign are treated as opaque entities and subject to 15% withholding tax (WHT) on German-source dividends at the fund level (or 26.375% without a valid German status certificate).

At the same time, Germany introduced partial tax exemptions for domestic investors (e.g. 30% for private investors in equity funds under §20 GInvTA). Accordingly, only 70% of income from equity funds whether arising from distributions or redemptions is subject to tax, while the remaining 30% is exempt to reflect corporate taxes already paid at the fund level. These investor-level reliefs were designed to offset the new fund-level taxation and are therefore directly linked to the 2018 reform.

However, foreign investors are excluded from these exemptions and remain taxable on 85% of the gross dividend, resulting in a higher effective tax burden compared to German investors. This distinction may amount to discriminatory treatment under EU law, potentially infringing the principles of the free movement of capital and the freedom of establishment enshrined in the Treaty on the Functioning of the European Union.