The second edition of KPMG’s AIF Depositary Tech Survey provides in-depth insights into how technology is shaping the industry, with a focus on systems deployed by the mainly 30 largest Luxembourg depositaries—measured by Assets under Deposit (AuD)—across both regulated and unregulated vehicles.

With a sample size of 19 key depositaries, the survey delves into the current state of technological integration, identifying prevalent tools, platforms, and innovation that drives efficiency and adaptability.

By focusing on these technological aspects, the survey highlights both the challenges and opportunities faced by the AIF depositary sector in Luxembourg, allowing AIF depositaries to benchmark their performance against their competitors.

About our survey

Our participants

Diving into the data

Key takeaways

- Technology ecosystem

- Trends and insights

- New technology

Evolving from gradual adoption to cloud-driven growth

While 70% of banks and EU branches rely on on-premises solutions, momentum is shifting. Since 2020, 43% of new systems have been cloud-based, and that figure rises to two-thirds for those implemented since 2023. Banks tend to operate more systems on average than PSFs. The shift toward scalable, modern infrastructure is well underway.

Since 2022, we've seen 21 new implementations across a growing variety of tools 19 in total—highlighting the increasing diversity in solutions used. Notably, banks have led the way, representing 62% of these recent implementations.

In total, 43% of the systems that have been implemented since 2020 are cloud based. However, 70% of banks or branches of EU credit institutions still host their solutions on-premises.

Number of implementations over the years

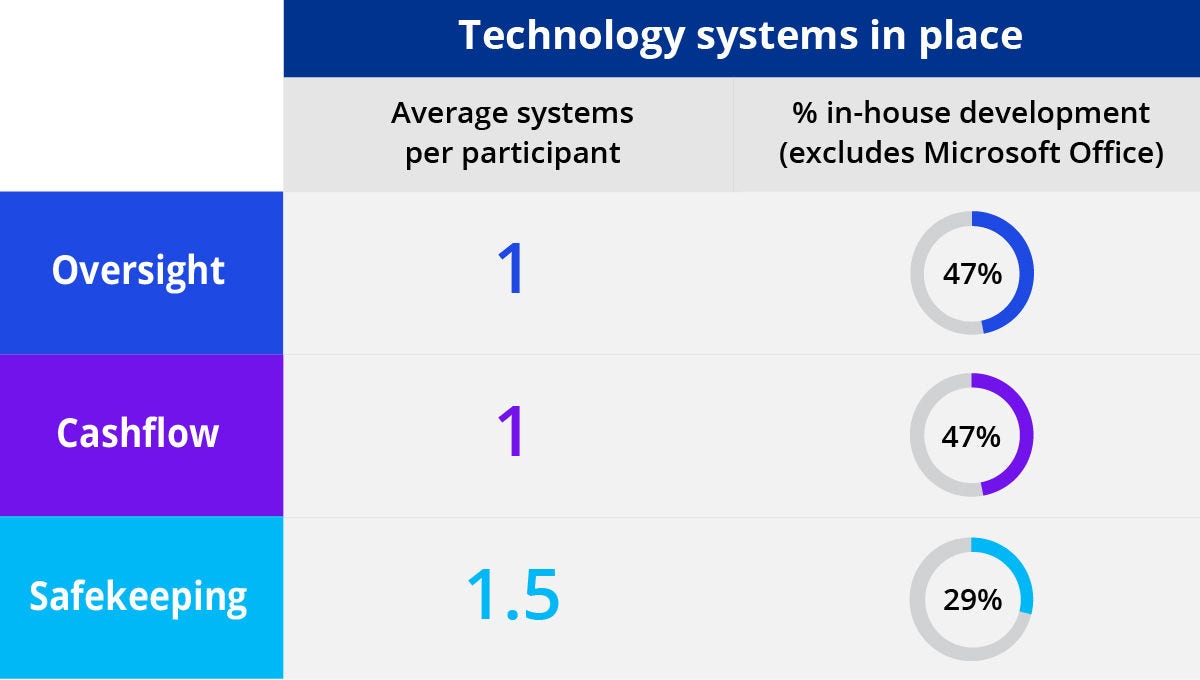

Average systems and in-house development

Participants deploy an average of 3.5 technology systems across key activities compared to 2022 where the average systems per participants was 2.8. This shift sets the stage for a closer look into the technological landscape of core depositary services, where system granularity and development strategies vary widely.

Compared to the first edition, there has been a decrease in the focus on in-house development. Currently, 47% of oversight systems and cashflow systems are built internally, while only 29% of safekeeping systems are developed in-house.

In the context of third-party vendor systems, we have observed an increased sophistication in the depositary technology landscape. However, this landscape remains fragmented across the three core depositary pillars. Examples include core banking systems like Avaloq and specialized systems or ERPs such as eFront, Governance.com, and Depowise. Additionally, core depositary systems are complemented by a range of agnostic tools that cover data management, document management, and workflow management.

Nevertheless, there is still a heavy reliance on excel spreadsheets

While technology adoption is advancing, Excel continues to play a central role—especially in oversight processes, which remain largely manual. Safekeeping, however, is emerging as a more digitally mature. Despite the prevalence of tech systems, dependency on excel remains high. This is especially true for oversight activities reflecting limited automation in this area — whereas safekeeping shows signs of digital progress.

% of Excel usage

Dedicated AIF IT budgets are increasing

In the 2022 edition of the survey, we observed that a continuous growth of IT budget would be expected for the 2022-2025 period. Indeed, participants’ budget rose from 47% to 56%, which shows an increasing share. Some players increased their budget by over 20% while others chose to stabilize.

Looking ahead to the next three years, we anticipate an acceleration in budget increases, with a larger proportion of firms expecting notable growth. Most organizations foresee their IT AIF Depo budget growing by more or less 10%.

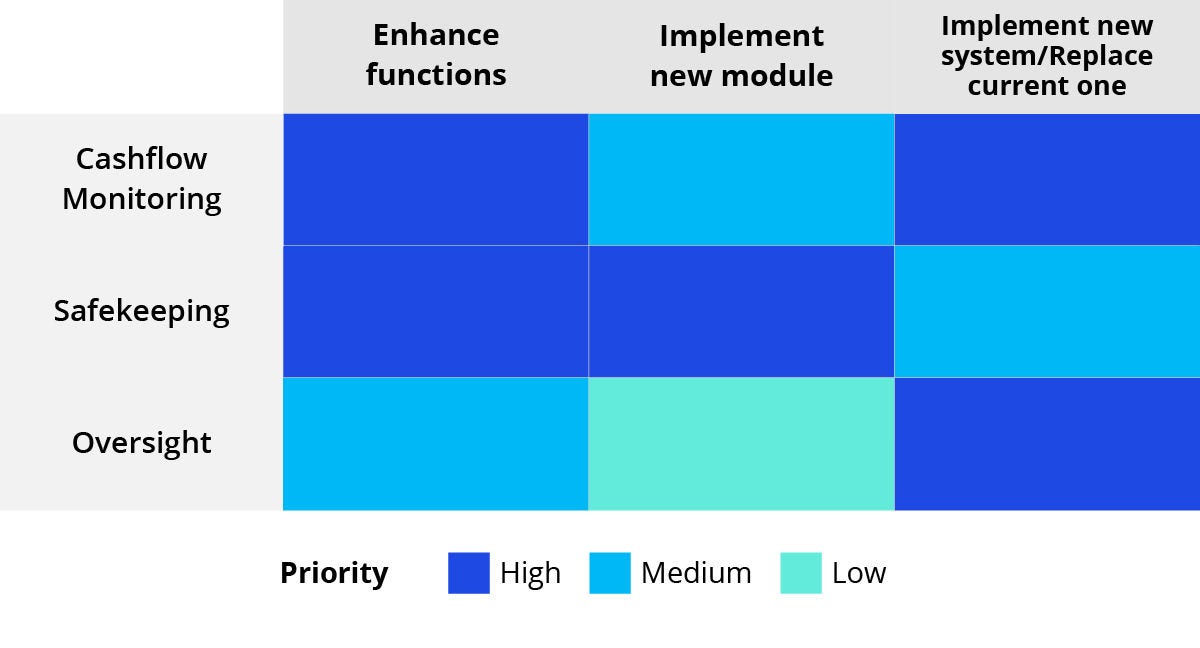

Developments of new features remain the core of the spending with priorities around enhancing current functions and or implementation/replacement of their current systems to address functional gaps and reduce costs.

DepoTech budget evolution

AI and new technologies are adding value

AI adoption has gained momentum since our 2022 survey, rising from 26% to 39%. Despite this progress, 61% of respondents have not yet experimented with AI—though all agree on its potential to deliver business value.

This year, we introduced a dedicated section on emerging technologies, with a particular focus on artificial intelligence, including generative AI, a rapidly evolving field that has only recently entered the market over the past two years.

Generative AI has seen rapid uptake, with 33% of market players already using it—mainly for cash monitoring and ownership verification. OCR is used by 47% of participants, primarily for data collection, extraction, and reading invoices or prospectuses. NLP is the least used, mostly applied to case categorization.

Area for future investments

Market players are planning significant upgrades to their tech stack, focusing on improving current functionalities to fill functional gaps and reduce costs.

Although functional system coverage is maturing, there remains a strong focus on cashflow monitoring and replacing oversight systems—even when a system is already in place.

Additional investments to be made are foreseen in the following areas where New Asset Classes encompasses quantitative funds, private equity, private debt, private assets and real estate.

Market shifts are pushing firms to focus on onboarding new asset classes and crypto-assets as core investment priorities

What sets us apart

Our findings highlight an evolution in the AIF ecosystem’s tech landscape for depositary services, showcased by the increasing number of system used compared to our past survey in 2022. On the other hand, many participants, if not all, still rely heavily on MS Office Excel which showcases the lack of tech adoption especially in oversight activities. However, the emergence of new, dedicated solutions – such as generative AI or OCR – are unlocking efficiency opportunities for the industry. While the full extent of further advancements remains to be seen, current trends suggest that these new technologies will drive greater opportunities and innovation in the sector.

At KPMG Luxembourg, our team of experts are consistently ahead of the curve, identifying emerging trends to help our clients make informed decisions. Our approach, expertise, and talent enable us to grasp both the big picture and the finer details, allowing us to deliver optimal solutions for our clients, now and into the future.