The last couple of years have been particularly vibrant for a relatively young and still expanding Baltic M&A market. After escaping the gridlocks of a global pandemic, 2021 marked itself as a record year in terms of deal volume (244 investments), while 2022 peaked with an all-time high total investment of €212 M in the region1. The 1st half of 2023 started sluggish, with deal activity slightly declining, in line with the deteriorating macroeconomic factors2. Nevertheless, we expect M&A activity for the second half of 2023 to pick up the pace, where business founders and operators will need to make a series of vital decisions to capture the highest possible deal value.

The acquisition process of a target company (Target) may be long and tedious. Even after selecting the winning bid, the process is still not finished. It is common for counterparties to negotiate the inclusion of specific price adjustment clauses after testing for profitability, net asset value, as well as net debt and normalized working capital (NWC) levels.

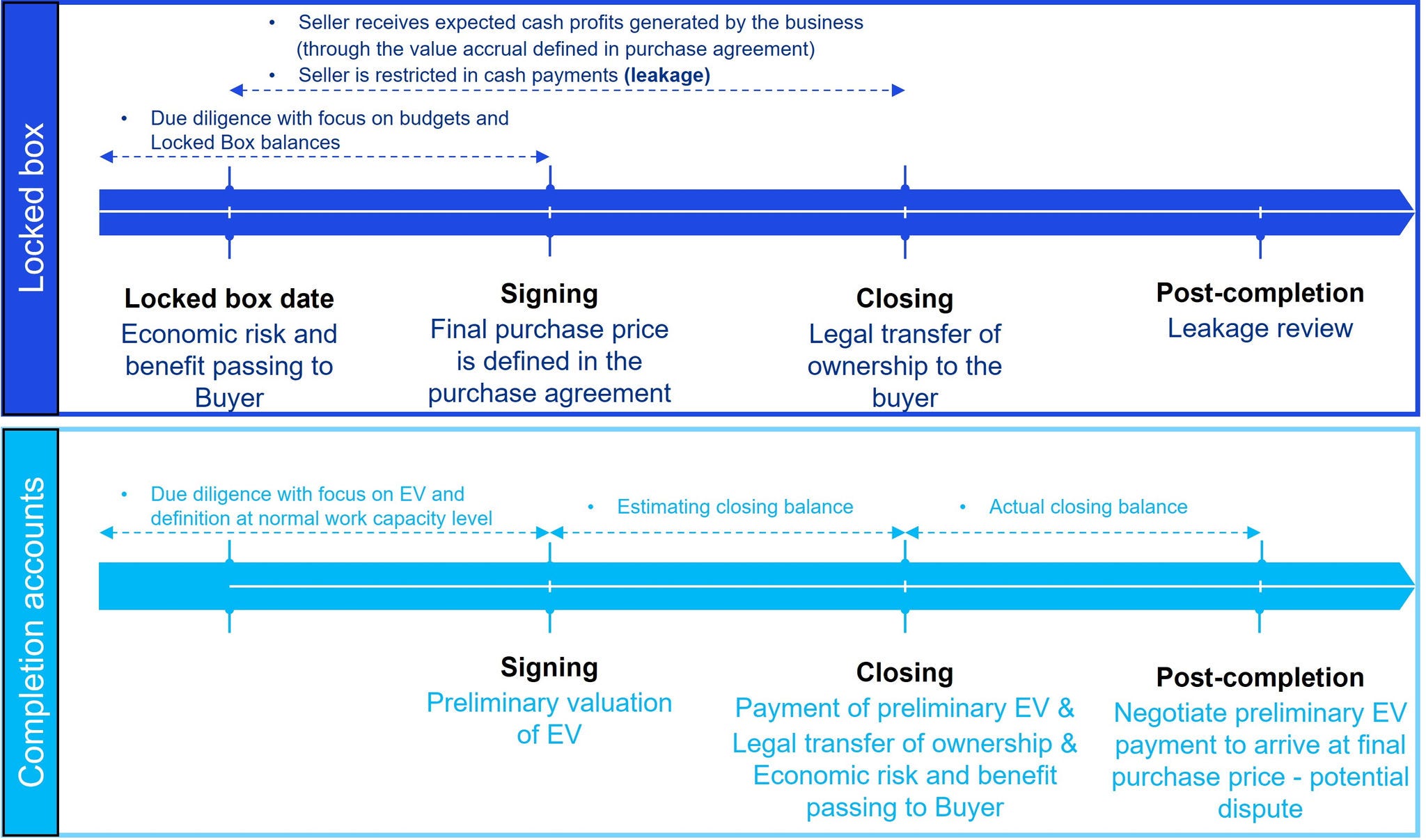

These adjustments are required to account for and reflect the Target’s financial position at deal Closing as well as safeguard the Buyer from any value loss before closing the transaction. To finalize the process a completion mechanism is employed to arrive at the final acquisition price. There are two widely accepted approaches in M&A transactions – locked box and completion accounts. Both approaches provide their advantages to a transaction as well as present different risks that should be thoroughly assessed. The purchase price may be subject to change depending on whether the deal is structured using the locked box or completion accounts.