In March, the State Council for the People’s Republic of China (“PRC”) issued a notice introducing a new itemised deduction for child-care costs for very young children.1 Also in March, the State Taxation Administration (STA) issued an announcement clarifying the implementation details regarding the additional itemised deductions effective retroactively from 1 January 2022.2

WHY THIS MATTERS

As with the other six itemised deductions, employees, including foreign nationals, can claim the new additional deduction through their employers or on their own annual IIT returns if certain conditions are met. Employers and individuals may want to consider the new deduction in their tax planning and need to be aware of the reporting requirements.

Overview

The State Council and the STA recently issued the notice and announcement to provide additional tax relief to taxpayers to care for infants and with the aim of boosting birth rates:

- On 19 March 2022, the State Council issued the Notice of the State Council on Introduction of Additional Individual Income Tax (IIT) Itemised Deduction of Care for Infants Under the Age of 3 - Guo Fa [2022] No. 8 (the "Notice"), which brings the number of the additional itemised deductions to a total of seven types.

- On 25 March 2022, the STA issued the Announcement of the STA to Revise and Promulgate the Administrative Measures for IIT Additional Itemised Deductions (Trial Implementation) - STA Announcement [2022] No. 7 ("Announcement No. 7"), to clarify the relevant implementation details, and the rules were effective retroactively from 1 January 2022.

- Announcement No. 7 also provided that Announcement of the STA on Administrative Measures for IIT Additional Itemised Deductions (Trial Implementation) - STA Announcement [2018] No. 60 (“Announcement 60”) will cease to be in force as of the same date.

Reporting Requirements

The relevant reporting requirements for the additional deduction of care for infants under the age of 3 are as follows:

Eligible Taxpayer |

Guardians of infants under the age of 3 (including biological parents, step-parents, adopted parents, and others who act as guardians) |

Eligible period for claiming the deduction |

From the month the infant is born until the month before the infant reaches the age of 3 |

Deduction standard |

RMB 1,000 per infant per month

The deduction ratio shall remain unchanged within a tax year |

Information necessary for required reporting |

|

Methods of claim |

The deduction may be claimed via:

|

Supporting documents retention requirements |

|

Effective date |

1 January 2022 (note: the newly introduced deduction type cannot be claimed on the 2021 annual reconciliation filing) |

Source: KPMG in the People’s Republic of China

KPMG NOTE

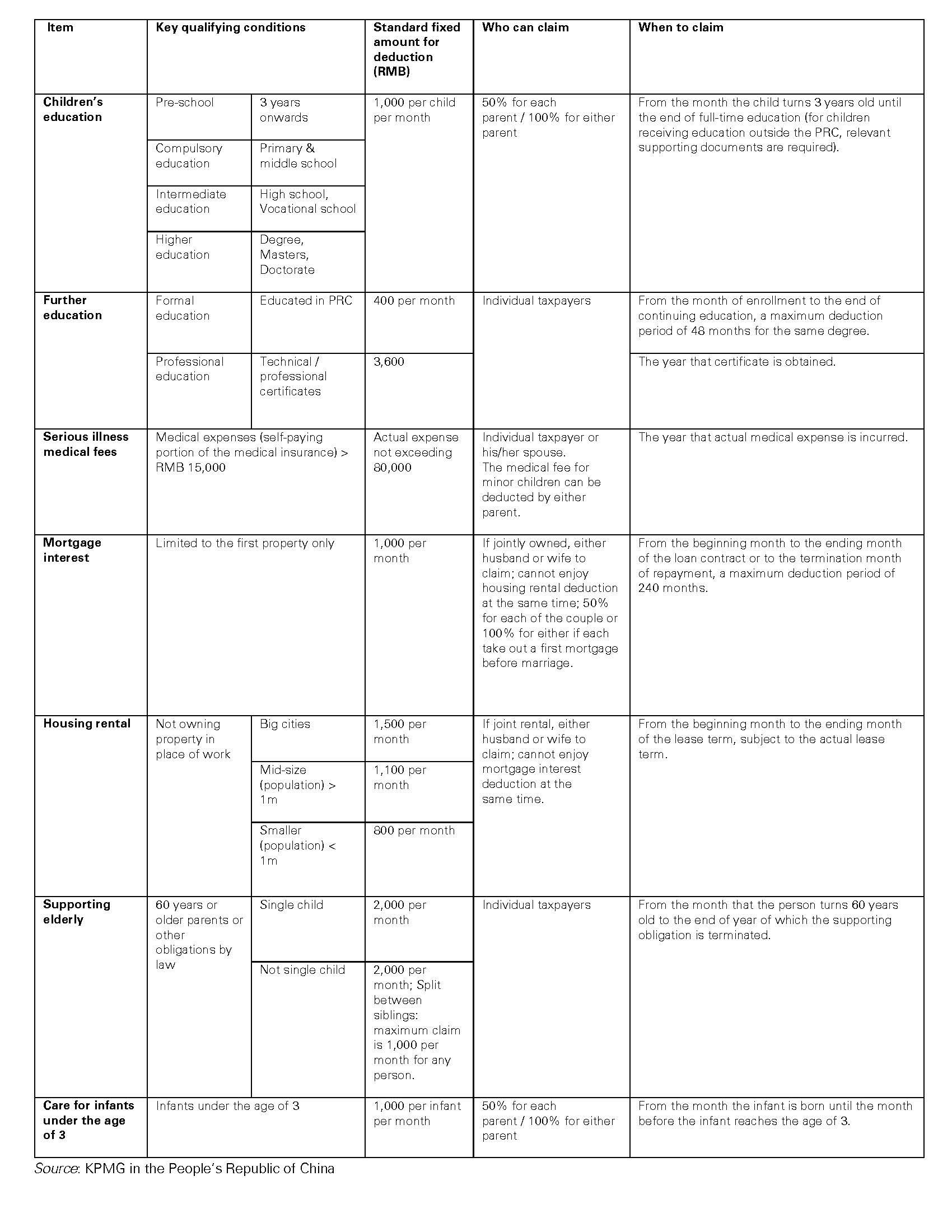

The new deduction introduced in Announcement No. 7 is in addition to the existing six additional itemised deductions (covering children's education, further education, serious illness medical fees, mortgage interest or housing rental, and supporting the elderly), which were discussed in GMS Flash Alert 2019-010 (23 January 2019). The updated deduction policy considers individual taxpayers’ cost of living throughout different stages of one’s life, and is aimed at relieving the overall tax burden of taxpayers. The reporting requirements for the new deduction take the policy transition into consideration and stay consistent with those for the six other deductions, to provide implementation convenience to taxpayers and withholding agents.

Considerations

Announcement No. 7 updated the filing system of the additional itemised deductions as of 28 March 2022. Taxpayers and employers should consider the following practical suggestions:

Taxpayer

|

|

Employer

|

|

Source: KPMG in the People’s Republic of China

Announcement No. 7 requires taxpayers to be responsible for the authenticity, accuracy and completeness of the information provided for the claim of additional itemised deductions. If false/erroneous claims are discovered in the administration process, withholding agents should remind their employees to correct the claims and notify the tax authority if the individual concerned refuses to make the corrections. Companies should review their information collection and administration procedures for employees’ additional itemised deductions claims and make necessary adjustments to their existing tax and HR policies and administration procedures, so as to be compliant with the relevant tax reporting requirements and enhance internal administration efficiency.

Additional Itemised Deductions Appendix Updated

Announcement No. 7 also updated the IIT additional itemised deductions appendix to add the new deduction.

KPMG NOTE

KPMG in the People’s Republic of China will continue to closely follow developments concerning relevant policies and practices relating to IIT itemised deductions, and share our insights with readers of GMS Flash Alert.

RMB 1 = USD 0.1525

RMB 1 = EUR 0.143

RMB 1 = GBP 0.121

RMB 1 = JPY 19.44

RMB 1 = AUD 0.213

(Source: www.xe.com)

FOOTNOTES

1 Notice of the State Council on Introduction of Additional Individual Income Tax (IIT) Itemised Deduction of Care for Infants Under the Age of 3 - Guo Fa [2022] No. 8.

2 Announcement of the STA to Revise and Promulgate the Administrative Measures for IIT Additional Itemised Deductions (Trial Implementation) - STA Announcement [2022] No. 7.

RELATED RESOURCE

This article is excerpted, with permission, from “New Individual Income Tax Law - Implementation Rules and supplementary guidance notes promulgated” in China Tax Alert (Issue 7, April 2022), a publication of the KPMG International member firm in the People’s Republic of China.

The information contained in this newsletter was submitted by the KPMG International member firm in the People’s Republic of China.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia

Stay up to date with what matters to you

Gain access to personalized content based on your interests by signing up today

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.

© 2026 KPMG Advisory (China) Limited, a wholly foreign owned enterprise in China and KPMG Huazhen, a Sino-foreign joint venture in China, are member firms of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved.

KPMG International Cooperative (“KPMG International”) is a Swiss entity. Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.