South Korea - Earned Income Deduction, Local Income Tax, Totalization of Gains

South Korea - Earned Income Deduction, Local Income Tax

This report covers the key features of South Korea's new tax law provisions that could impact Korean nationals abroad and foreign individuals in South Korea, including the new limit on the earned income deduction, a separate filing requirement for annual local income tax for individuals, and totalization of net capital gains and losses from transfers of foreign and domestic shares.

This report covers the key features of South Korea's new tax law provisions1 that could impact Korean nationals abroad and foreign individuals in South Korea, including the new limit on the earned income deduction, a separate filing requirement for annual local income tax for individuals, and totalization of net capital gains and losses from transfers of foreign and domestic shares.

WHY THIS MATTERS

Tax costs and budgets as well as compliance burdens for inbound and outbound South Korean expatriates will likely be affected by the limited earned income deduction and the new filing requirement for annual local income tax returns.

When a capital gains tax return is filed for a transfer of foreign and domestic shares, it shall be categorized as one type of asset and any capital gains and losses from these shares shall be totalized.

Limit Set on Earned Income Deduction for Wage and Salary Income

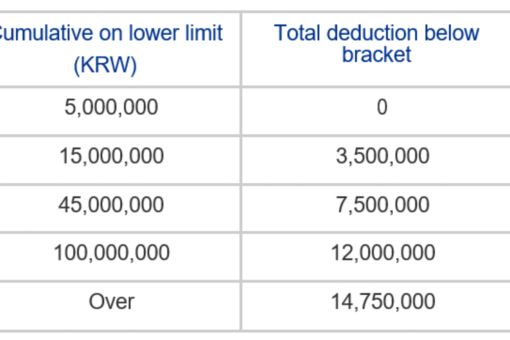

An earned income deduction is available for both residents and nonresidents in South Korea for their wage and salary income. The amount of the deduction depends on the amount of wages or salaries earned and computed as shown on the table below.

Source: KPMG Samjong Accounting Corp.

[KRW 1 = USD 0.000797 | KRW 1 = EUR 0.000744 | KRW 1 = AUD 0.00137 | KRW 1 = JPY 0.0883]

While there was no limit set on the amount of the earned income deduction, the amount exceeding KRW 20 million is not deductible as an earned income deduction with effect from 1 January 2020.

New Requirement for Annual Local Income Tax Return for Individuals

Prior to 1 January 2020, annual tax returns for individuals not only covered finalization of income tax but also local income tax for the tax year concerned. However, effective from 1 January 2020, individuals subject to filing annual Korean tax returns are required to file their annual local income tax returns with the competent district office in addition to their annual (national) tax returns as it will only report their final income tax liabilities.

This new separate filing requirement for local income tax was introduced in the 2014 amended Local Income Tax Law,2 which will be effective from 2016 tax filings according to the by-law. However, enforcement was postponed according to the revised by-law in the 2016 tax law revision and it shall apply from 2019 tax returns (filings due 1 June 2020) under the governing supplementary provision. In this regard, individual taxpayers should make sure that updated income tax forms are used for (national) income tax returns and also that annual local income tax returns are separately filed by the due date.

Totalization of Net Capital Gains and Losses from Transfer of Foreign Shares

Before amendment of the provisions on the calculation of net capital gains and losses arising from the transfer of shares, any net capital losses from the transfer of foreign shares were not allowed to be offset against capital gains from transfers of domestic shares and vice versa. As a result of such provisions, the capital gains tax burden could be increased on a transfer of foreign and domestic shares as the amount subject to tax was higher than the actual net capital gains realized from both foreign and domestic transactions.

In order to help mitigate such a higher tax burden on capital gains, the classification of foreign and domestic shares into different categories for capital gains tax purposes has been amended. Due to the amended provisions, net capital gains from the transfer of foreign and domestic shares are allowed to be totalized effective from transfers made on or after January 1, 2020.

FOOTNOTES

1 Korean Income Tax Law Amended by Act. No. 16834, 31 December 2019.

2 Local Income Tax Law Amended by Act. No. 12153, 1 January 2014.

The information contained in this newsletter was submitted by the KPMG International member firm in South Korea.

SUBSCRIBE

To subscribe to GMS Flash Alert, fill out the subscription form.

© 2024 KPMG Samjong Accounting Corp., a Korea Limited Liability Company and a member firm of the KPMG global organization of independent member firms affiliated with KPMG International Limited, a private English company limited by guarantee. All rights reserved.

For more detail about the structure of the KPMG global organization please visit https://kpmg.com/governance.

GMS Flash Alert is a Global Mobility Services publication of the KPMG LLP Washington National Tax practice. The KPMG name and logo are trademarks used under license by the independent member firms of the KPMG global organization. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm. The information contained herein is of a general nature and is not intended to address the circumstances of any particular individual or entity. Although we endeavor to provide accurate and timely information, there can be no guarantee that such information is accurate as of the date it is received or that it will continue to be accurate in the future. No one should act on such information without appropriate professional advice after a thorough examination of the particular situation.