Will IFRS 9 impact insurers?

Will IFRS 9 impact insurers?

The effective date of IFRS 9 Financial Instruments (IFRS 9) is around the corner – could South African insurers adopt IFRS 9 when the final insurance contracts standard is effective, or should they start an IFRS 9 conversion project soon?

How does IFRS 9 impact insurers?

Many preparers were concerned as the effective date of the final insurance contracts standard will only be after 1 January 2020, far later than the effective date of IFRS 9 which is for year-ends commencing on or after 1 January 2018.

The International Accounting Standards Board (IASB) addressed these concerns and published an exposure draft2 towards the end of last year, giving insurance companies, subject to certain criteria to be met, the options to defer the implementation of IFRS 9 (deferral approach) or to reduce the impact of IFRS 9 on current numbers (overlay approach).

These final amendments to IFRS 4 Insurance Contracts (IFRS 4)3 are currently expected to be published in eptember 2016.

Deferral approach

Entities that qualify for the deferral approach will only apply IFRS 9 for year-ends commencing on or after 1 January 2021.

A temporary exemption from applying IFRS 9 would be permitted for an entity, if the entity’s activities are predominantly related to insurance and comprise of:

- Issuing contracts in the scope of IFRS 4 that give rise to liabilities whose carrying amount is significant compared with the total carrying amount of the entity’s liabilities; and

- Issuing investment contracts that are measured at fair value through profit or loss (FVPL) under IAS 39 Financial Instruments: Recognition and Measurement (IAS 39).

Investment contracts are also included as they are often sold alongside similar products with significant insurance risk and are regulated as insurance contracts (i.e. they are related to insurance).

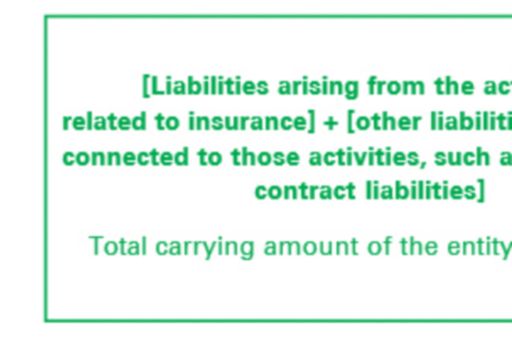

The predominance ratio for an entity should be calculated as follows:

An entity’s activities should be deemed to be predominately related to insurance only if the predominance ratio is:

- Greater than 90 percent; or

- Greater than 80 percent but less than or equal to 90 percent, and the entity can provide evidence that it does not have a significant activity that is unrelated to insurance.

An entity is required to calculate the predominance ratio, to determine if it qualifies, using the carrying amounts of the liabilities reported for the annual reporting period that ended between 1 April 2015 and 31 March 2016. For example, for a reporting period that ends on 31 December, the assessment will be done on the statement of financial position as at 31 December 2015. By doing this assessment before the effective date of IFRS 9, entities can determine early if they would qualify for the deferral approach. If they do not qualify, they can start their IFRS 9 conversion project in time.

Would South African insurers be able to apply the deferral approach?

In our view, some insurers may qualify based on the insurance and related liabilities included in the separate financial statements.

A group would not qualify if the consolidated financial statements include subsidiaries with predominant insurance activities as well as subsidiaries with significant activities that are unrelated to insurance, e.g. banking activities.Although the insurance subsidiary may qualify for the deferral in its separate financial statements, it may not be cost effective to apply as the group would not meet the required threshold and would be required to apply IFRS 9 from the effective date.

Would South African insurers apply the overlay approach?

The adoption of this approach requires IFRS 9 and IAS 39 to be applied to financial assets relating to contracts within the scope of IFRS 4. Generally, we do not believe insurers would be following this approach as it may not be cost effective and many insurers currently account for their financial assets as at fair value through profit or loss.

IFRS 9 conversion project

For insurers that do not elect or do not qualify to apply the deferral or overlay approach, IFRS 9 has to be applied for year-ends commencing on or after 1 January 2018.

Insurers should perform a comprehensive review of financial assets to ensure that they are appropriately classified and measured in accordance with IFRS 9.

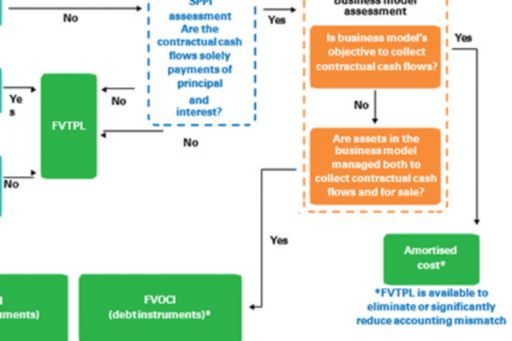

A business model assessment is required for financial assets that meet the SPPI criterion - i.e. where the contractual terms of the financial asset give rise, on specified dates, to cash flows that are Solely Payments ofPrincipal and Interest. Financial assets that do not meet the SPPI criterion are classified as at FVPL, irrespective of the business model in which they are held – except for investments in equity instruments, for which an entity may elect to present gains or losses in OCI (FVOCI).

The classification for equity instruments and debt instruments into the principal measurement categories can be summarised as follows:

Impact on insurers

If insurers cannot delay the adoption of IFRS 9, they should assess the impact of IFRS 9 as soon as possible. Apart from the accounting impact, systems and processes may need to be modified to apply IFRS 9 and to satisfy the new disclosure requirements required in the financial statements. The changes to systems and processes may necessitate changes to key internal controls over financial and regulatory reporting or impact the way in which work is performed by relevant personnel.

Featured articles

- 2016 South African Insurance Survey homepage

- Takaful - same but different

- The impact of blockchain on the insurance industry

- Would the application of the premium allocation approach result in business as usual?

- Privacy and wearable technologies - A POPI dilemma?

- The Changing Face of Financial Advice

© 2026 KPMG Services Proprietary Limited, a South African company and a member firm of the KPMG network of independent member firms affiliated with KPMG International, a Swiss cooperative. All rights reserved.