European Debt Sales – United Kingdom

European Debt Sales – United Kingdom

An in-depth look into how the loan sale market performed in 2015 in United Kingdom.

“The UK residential mortgage market has garnered unprecedented momentum in the past 12 months, with a resurgence in post-crisis RMBS issuance. This all comes on the back of the successful sales of the Kensington and CHL mortgage platforms, and increasing activity from the challenger banks seeking to increase market share.” – Andrew Jenke, EMA region leader, Portfolio Solutions Group Partner, KPMG in the UK

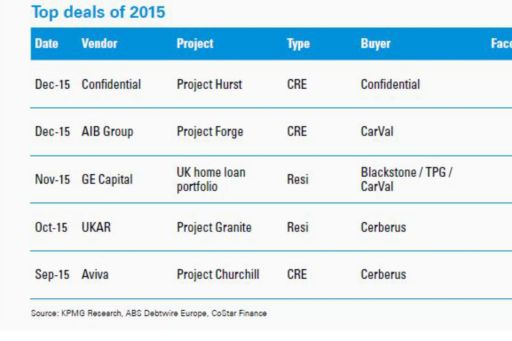

2015 was a record year for loan portfolio sales in the UK, with over £29 billion successfully traded. Most of the sales were signed in Q4 2015, including UKAR’s Project Granite, GE Capital’s home loan portfolio, and Aviva’s Project Churchill.

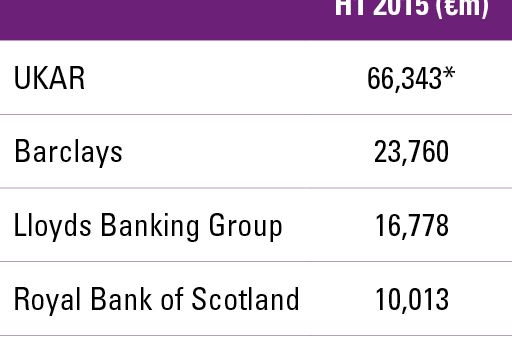

UKAR’s £13 billion Project Granite portfolio was the most notable trade of 2015; as a result Cerberus, that bought the portfolio, was the most active investorin UK loans for 2015, and UKAR became the top vendor by volume.

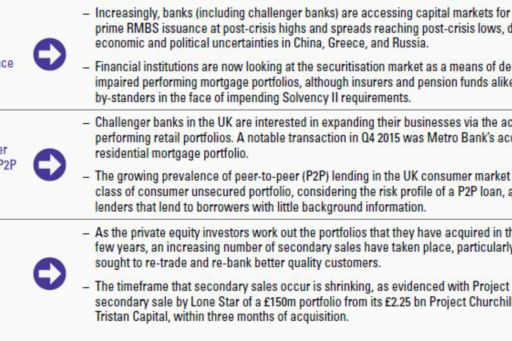

There has been an increasing number of granular SME/CRE and residential portfolios transacted in the UK, as many UK banks start to reassess the importance of supporting and retaining these customers.

Other developments

2015 saw a number of large loan portfolio transactions, with Aviva being a notable addition to the list of non-banksthat have exited non-core loan books. Large mortgage portfolios dominated the UK loan sale market in 2015. In spite of continued measures limiting access to riskier mortgages, mortgage lending in 2015 represented the highest netincrease since 2008, reflecting a buoyant UK economy supported by a continued low interest rate environment.

Looking forward & KPMG predictions

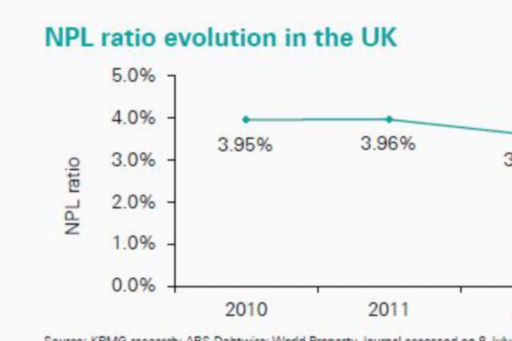

The market will evolve around more granular NPL transactions and a shift to origination, which can be expected given the UK’s considerable bank deleveraging to date and the pace of return to GDP growth. The UK also represents the most favourable legal and financing regime, meaning that many NPL purchasers are simultaneously following the evolution of the NPL market whilst also growing books of new business via origination.

UKAR is expected to continue its active deleveraging into 2016 post its successful sale of Project Granite. It is expected that it will bring another mega-deal to the market as its explores options to exit the legacy loans from the nationalised Bradford & Bingley and Northern Rock.

Though US private equity firms have dominated the investor landscape in the UK market, an increasing number of local and/or specialised buyers are expected to enter the scene as smaller and more granular NPL portfolios change hands. As seen in other mature markets, even in 2015 and 2016 new buyers have emerged to challenge existing players.

© 2025 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.