European Debt Sales - Serbia

European Debt Sales - Serbia

An in-depth look into how the loan sale market performed in 2015 in Serbia.

“The market for NPLs in Serbia has come to life over the past 12 months with three small scale NPL portfolio transactions. It is expected that the recent Serbian AQR exercise undertaken by the National Bank of Serbia during the summer of 2015, under supervision of the IMF, will also accelerate NPL transactions.” – Dusan Tomic, Partner, Head of Financial Services, KPMG in Serbia & Montenegro

The number and size of the NPL transactions in the Serbian market have been insignificant to date, and only corporate loans are permitted to be sold by law to any investors registered in Serbia for the time being.

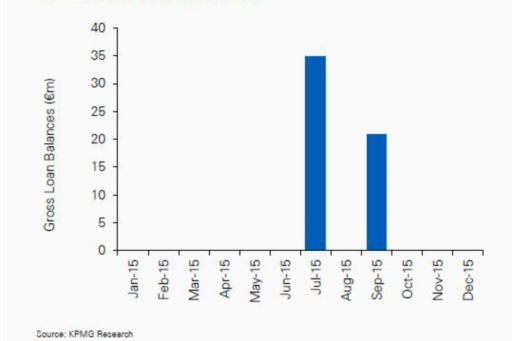

While the first portfolio sold in recent years was part of a regional NPL sale from Hypo Alpe-Adria-Bank, only two additional transactions took place during 2015, both of which contained mostly SME loans.

Serbian banks currently have had little incentive to sell their NPL portfolios, as many are well-capitalised and liquidity is not a problem in the Serbian banking sector.

Other developments

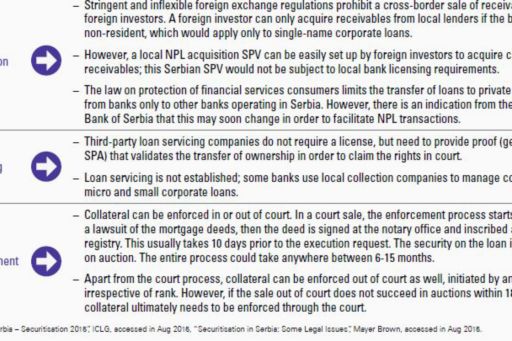

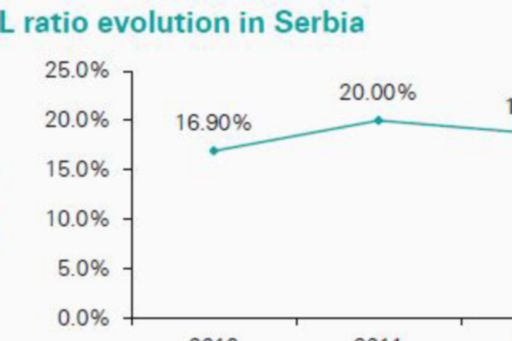

Gross NPLs in the Serbian banking system amounted to almost €3.6 billion at the end of Q1 2015, with a further increases expected going forward. With increased monitoring by the IMF, the government is working to ease the regulatory and administrative hurdles to resolve the high NPL volumes in Serbia’s banking system. This in particular relates to resolution of legal obstacles in the retail sector, as per current regulation, only other banks operating in the Republic of Serbia can purchase retail loans.

Looking forward & KPMG predictions

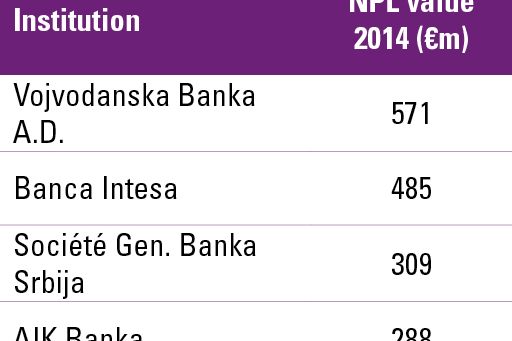

There are several reasons to believe that there is potential for more corporate NPL portfolios to be brought to market in Serbia: several banks are in resolution, corporate NPL volumes are concentrated within 20-30 connections that have exposure to most banks, and work-out can be a lengthy process. Coupled with this we see growing investor interest in acquiring portfolios based in Serbia in the coming year.

High NPL ratios and increasing regulatory pressure from the Serbian government, the IMF, and the EBRD add incentive for banks to resolve their NPL issues. We expect the results of the AQR to expose some shortfalls in prioritising which will bring book values closer to market value. This will assist in reducing the correctly observed “pricing gap” between buyers and sellers.

However, regulation will need to undergo changes in order to create a more dynamic loan sale market in Serbia, particularly in the retail segment, as well as creating an appropriate framework for AMAs.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.