European Debt Sales - Scandinavia

European Debt Sales - Scandinavia

An in-depth look into how the loan sale market performed in 2015 in Scandinavia.

“KPMG member firms in Scandinavia have experienced an increase in activity and expect growth in the number of portfolio transactions, primarily driven by new regulation, increased focus on capital efficiency, and the focus of banks on their core businesses.” – Daniel Frigell, Director, Corporate Finance, KPMG in Sweden

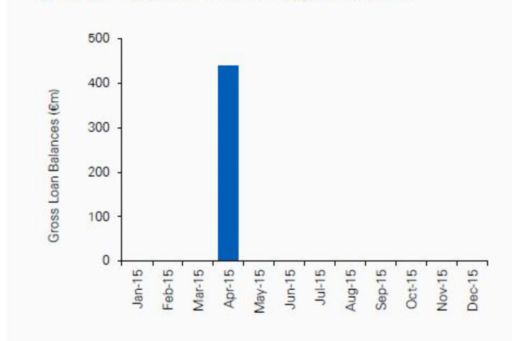

The two transactions shown were both from the Danish bad bank, Finansiel Stabilitet, as part of its ongoing winding down of bad loans that it had absorbed since the financial crisis hit Denmark.

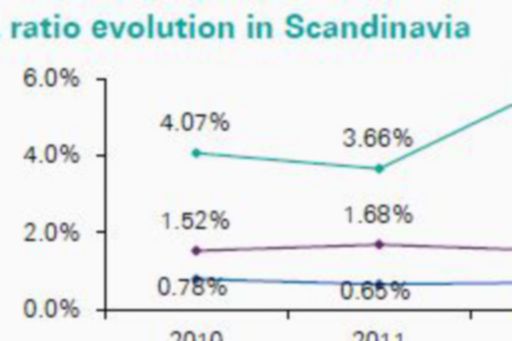

The loan sale market has primarily been in consumer credit NPLs, as strong capitalisation of banks during the financial crisis, particularly in Sweden, have led to few portfolio transactions.

Pricing has been high, driven by high demand for investments with stable cash flows in the low interest rate environment. The market is also maturing, with portfolios sold at an earlier stage of being a NPL subsequently driving up prices.

Other developments

Across the Scandinavian countries, securitisation is uncommon, and the few NPL transactions that have occurred in Scandinavia have largely been consumer credit portfolios. Denmark, however, is the exception, having brought a number of CRE portfolios to market post the creation of Finansiel Stabilitet.

New regulatory requirements (eg. Basel IV) are expected to drive growth in the loan sale market. The continued outsourcing of the collection process will also help drive divestment of portfolios.

Looking forward & KPMG predictions

In Denmark, the remaining stock of assets and loans to be sold from Finansiel Stabilitet is limted as its divestment and winding-down programme has been successfully ongoing. Even though non-bank debt investors are expected to look for opportunities in Denmark, the volume of secondary loan trading is expected to be low in the short to medium term mainly because of adequate capitalisation of Danish banks. However, selected exposures (eg. shipping or agriculture) could be in focus if a bank decides to sell.

The Swedish loan portfolio market is expected to pick up in the coming year, particularly with retail loan portfolios. Sweden has increasing debt ratios, driven by high levels of household debt due to increasing housing prices, which will likely lead to higher levels of NPLs that its banks will have to address with either an inhouse solution, or via disposals.

Norway has seen few loan portfolios come to market, but there is a possibility of retail loan portfolios coming to market. The government has taken measures to control household debt, but an increase in retail NPLs is likely, and banks may choose to explore options to find a solution to their growing problem.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.