European Debt Sales - Ireland

European Debt Sales - Ireland

An in-depth look into how the loan sale market performed in 2015 in Ireland.

“2016 looks to be a very active year in the Irish market. The pipeline remains strong with NAMA and RBS likely to be the most active vendors together with increasing numbers of secondary portfolio transactions.” – Alan Boyne, Partner, Head of Banking, Transaction Services, KPMG in Ireland

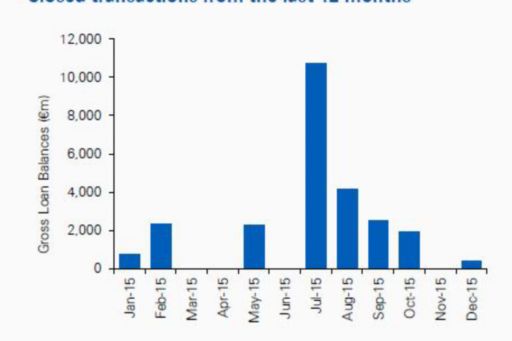

2015 was another bumper year for portfolio sales in Ireland, within excess of €25 billion of loan sales transacted, largely from RBS (UlsterBank) and the ongoing deleveraging by NAMA.

CarVal, Cerberus, Deutsche Bank, Goldman Sachs and Bank of Ireland were some of the most active investors in the Irish loan market, having bought most of the largest transactions brought to market in the past year.

The largest portfolio transacted was the €6.3 billion Project Arrow, which was sold by NAMA to Cerberus. Lloyds has completed its last portfolio sale, the €4.2 billion Project Poseidon, which sold to CarVal, Goldman Sachs, and Bank of Ireland.

Other developments

Heavy public and political pressure mounted in 2013/2014 which sought protection for borrowers whose loans were sold by banks. Following initial plans to regulate the owners of debt, the Consumer Protection (Regulation of Credit Servicing Firms) Act 2015 (“the Act”) reflected consultation with the industry and ultimately requires credit servicing firms to be regulated by the Central Bank of Ireland, which was widely welcomed as a practical change.

Looking forward & KPMG predictions

Having acquired over €50 billion of loans in recent years, investors expect to see further strong volumes of deleveraging occurring in the Irish market over thecourse of the next 12 months. NAMA is expected to continue to be a key vendor asit looks to complete its deleveraging plan, and new vendors may enter the market, such as Allied Irish Bank, which sold its first loan portfolio, a UK CRE NPL portfolio, in Q4 2015 to CarVal.

In addition to continued deleveraging, a key trend in 2016 will be secondary trades, whereby some of the investors who bought portfolios in recent years intend to sell some of the assets they have purchased or foreclosed on in order to unlock value. This will also give rise to significant refinancing opportunities for Irish banks.

Domestic buyer demand is expected to remain high for performing and also re-performing loans, as lenders seek to supplement their new origination levels, continuing the success of their acquisitions in 2015.

© 2025 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.