European Debt Sales - Greece

European Debt Sales - Greece

An in-depth look into how the loan sale market performed in 2015 in Greece.

“The Greek debt market is expected to be fully transformed in 2016, considering the implications arising from the recapitalization of the banks currently in progress." – Christian Thomas, Partner, Head of Deal Advisory & Head of Forensic, KPMG in Greece

There have been no loan portfolio sales to date in Greece, though Greek banks are expected to bring NPL portfolios to market in the coming year in order to stabilise their balance sheets.

However, household loan portfolio sales to foreign investors are expected to face opposition in the current economic and political climate of Greece.

Greek banks are already deleveraging their NPL balance sheets throughout Eastern Europe as they seek to exit non-core operations outside of Greece.

Other developments

There has been great political and economic uncertainty surrounding Greece since the 2008 economic crisis hit Europe. Having been bailed out by the “troika” of the European Commission, European Central Bank, and theInternational. Monetary Fund on multiple occasions, and with widespread opposition to further imposed austerity measures by the Greek public, Greece faces an uncertain economic future, and its banking system will play a crucial role in any revival of the Greek economy.

Looking forward & KPMG predictions

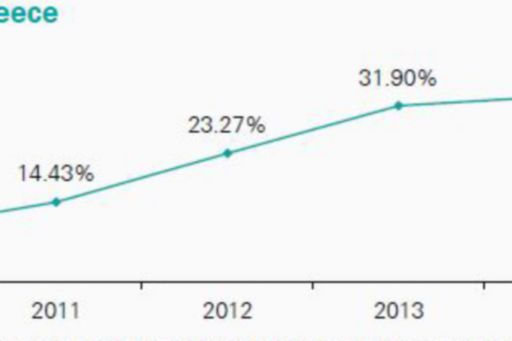

The core challenge at the heart of the liquidity crisis facing the Greek banking system is the estimated >€100 billion of NPLs on its balance sheets that prevent the banks from providing fresh financing to the real economy. The ECB estimates that this could rise further due to the impact of political uncertainty and ongoing capital controls faced by individuals and corporates. NPLs could rise to above 450 percent in the coming year.

All large Greek banks have established NPL Troubled Assets units, which may behived out into separate vehicles to reduce the burden on core balance sheets. Greek banks are expected to start bringing NPL portfolios to market, though the political risk premiums that international investors will apply to Greek portfolios will be challenging, particularly in the case of household loans.

One of the options being considered amongst several large Greek banks is of joint ventures with international players servicing retail/business loans. A key consideration from a Bank’s management viewpoint is to improve effectiveness while at the same time maintain economic interest in case of upside.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.