European Debt Sales - France

European Debt Sales - France

An in-depth look into how the loan sale market performed in 2015 in France.

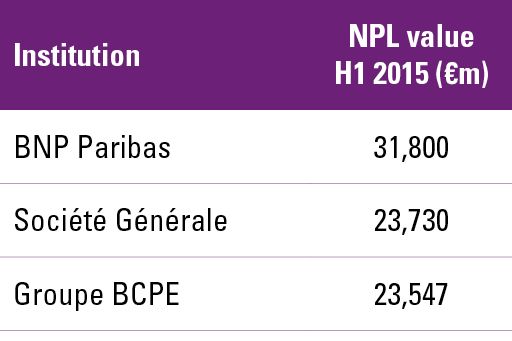

“In 2015, France saw a repeat of previous years with modest activity in its loan sale marketplace. This despite there being in excess of €120 billion of NPLs inits banking sector, the second highest volume in Europe." – Cyril Schlesser, Director, Corporate Finance, KPMG in France

There have been no public loan sale transactions in France in the last 12 months. However, French banks have continued to deleverage NPL portfolios in many other European countries, including Spain, Italy, and Romania.

2016 sees KPMG launch of Project Spring, the first loan portfolio brought to market in France. Initial feedback from investors indicates strong demand for French real estate backed loan assets, particularly against the backdrop of ever increasing completion in many other of France’s western European peers.

Other developments

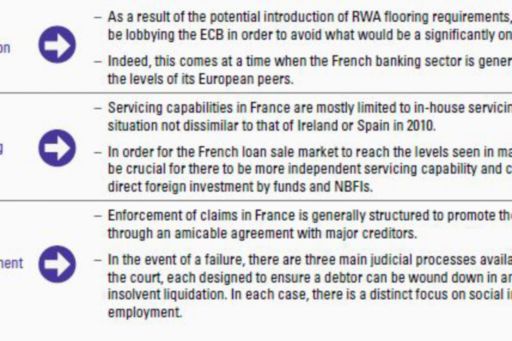

Three of France’s leading banks have some of the lowest common equity Tier 1 capital ratios – at or around 10 percent – in Europe. Rumours regarding the potential introduction of minimum asset risk-weighting requirements under ‘Basel IV’, are considered likely to be felt most harshly in France, given the relatively more aggressive approach its banks taketowards risk-weighting.

Looking forward & KPMG predictions

Loans to SMEs will drive the growth of activity in the French NPL marketplace. In Europe, France is second only to Italy in terms of NPL volumes and increasing precedent deals will encourage banks to explore the sale of loans as a means of effective de-risking.

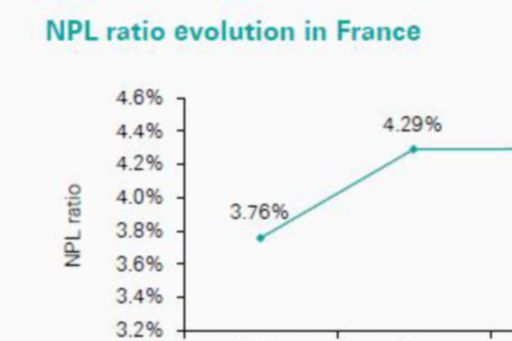

The share of loans overdue in France is expected to continue to be constant at approximately 4 percent (the level which it has been at since 2009), this while NPL ratios have been declining to below 3 percent for most other Western European countries such as Germany and the UK. This expectation is mirrored in the GDP growth rates, which have been consistently positive in most other Western European countries, but have been lowest in France since 2010.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.