European Debt Sales - Austria

European Debt Sales - Austria

An in-depth look into how the loan sale market performed in 2015 in Austria.

“Austrian banks are increasingly evaluating hold versus sell strategies, but are mainly pursuing NPL transactions in South Eastern Europe. Although loan portfolio transactions are slowly picking up in Austria as well, the main activities are triggered by sales procedures of the bad banks.“ – Bernhard Klingler, Partner, Co-head of Advisory, KPMG in Austria

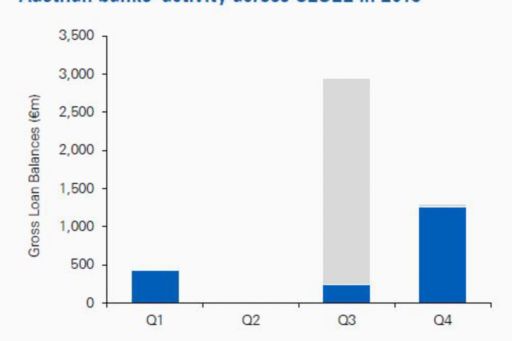

There have been no loan portfolios transactions in the past 12 months in Austria, though this certainly does not constitute a lack of NPLs on the balance sheets of banks. All of the major Austrian banking groups have significant volumes of NPLs, though most of it is in relation to their operations throughout CESEE.

Heta Asset Resolution, the bad bank formed by the Austrian government from the nationalized Hypo Group Alpe Adria in October 2014, currently holds €18 billion of NPLs, the majority of which relates to Austrian exposures.

Other developments

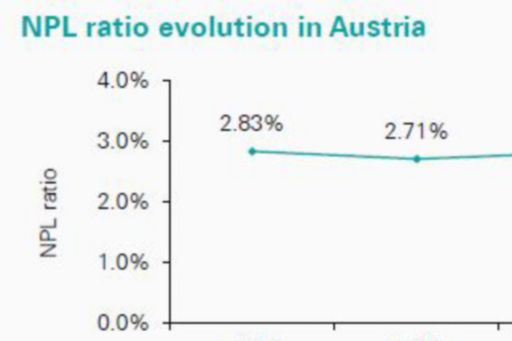

Austrian banks’ profitability is heavily reliant on their CESEE operations, which they had rapidly expanded into before the financial crisis. The subsequent market environment in CESEE has led to an increasing volume of NPLs held by Austrian banks, which led to an NPL ratio of 3.53 percent in 2015.

Measures that the Austrian government took to address the fallout from the financial crisis included terminating the licenses of its large banks, and turning them into bad banks mandated solely to dispose of impaired assets. A positive outcome of this government intervention has been a decrease in NPLs, with NPL volume falling to €32 billion in 2014, from €44 billion in 2013.

Looking forward & KPMG predictions

While the overall NPL ratio within Austria has been low due to strong underlying fundamentals (with the exception of Hypo Group Alpe Adria and Kommunalkredit, which were both nationalized), NPLs continue to be a problem for Austrian banksdue to their extensive CESEE operations. Due to deteriorating credit quality and challenging market conditions, Austrian banks will continue to look to sell off their banking operations (both the platform and loan portfolios) in peripheral CESEE countries.

Past successful loan sales have mostly been concentrated in consumer portfolios. There will continue to be challenges as Austrian banks look to offload their asset backed portfolios, particularly in SEE countries where the market is still nascentand current regulation surrounding the transfer of receivables remains unclear.

Heta Asset Resolution is expected to continue to deleverage its extensive volumeof NPLs in the coming year, after this past year has seen it selling off its Balkans operations, and splitting off its Italian arm. Heta may bring portfolios to market across its remaining Austrian and CESEE portfolios, though its strategy has not yet been released.

© 2024 Copyright owned by one or more of the KPMG International entities. KPMG International entities provide no services to clients. All rights reserved.

KPMG refers to the global organization or to one or more of the member firms of KPMG International Limited (“KPMG International”), each of which is a separate legal entity. KPMG International Limited is a private English company limited by guarantee and does not provide services to clients. For more detail about our structure please visit https://kpmg.com/governance.

Member firms of the KPMG network of independent firms are affiliated with KPMG International. KPMG International provides no client services. No member firm has any authority to obligate or bind KPMG International or any other member firm vis-à-vis third parties, nor does KPMG International have any such authority to obligate or bind any member firm.