The Companies Act and the Partnership Act, of Uganda, require every company and a limited liability partnership registered in Uganda to keep a register of its beneficial owners.

A beneficial owner is defined as a natural person who has final ownership or control of a company or a partnership; or a natural person on whose behalf a transaction is conducted in a company or a partnership and includes a natural person who exercises ultimate control over a company or a partnership.

The beneficial owner register discloses the personal information of the beneficial owners, the nature of ownership or control they have in the company or the partnership, and the date they became or ceased to be beneficial owners, among others.

Upon the creation of the beneficial owners’ register, the law requires that a notice of the place where the register is kept together with a copy of the beneficial owners’ register be submitted to the URSB within 14 days, from the date of creation of the register.

The format of the notices and information required to be filed are elaborated in the Companies (Beneficial Owner) Regulations, 2023, and the Partnership (Beneficial Owner) Regulations, 2023.

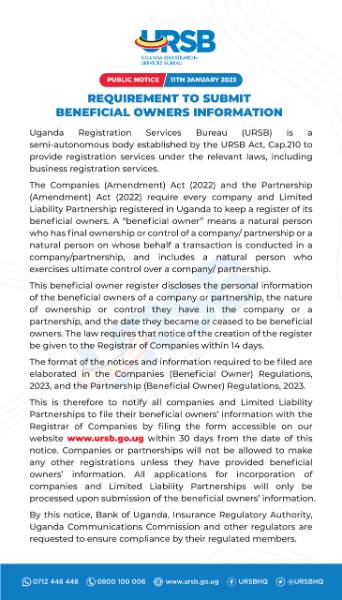

On 11 January 2023, the Uganda Registration Services Bureau (URSB) issued a public notice that urged all companies and partnerships to submit beneficial owners’ information with the Uganda Registration Services Bureau not later than 30 days from the date of the notice.

In the notice, URSB indicated that companies and limited liability partnerships will not be allowed to make any other registrations unless they have provided beneficial owners’ information.

Furthermore, the URSB specified that all applications for incorporation of companies and limited liability partnerships will only be processed upon submission of the beneficial owners’ information.

What this means to you.

- A company or a limited liability partnership is required to:

keep a register of the beneficial owners.

notify the URSB of the place where the register of the beneficial owners’ is kept.

submit beneficial owners’ information with the Registrar of Companies (URSB) by 11 February 2023 - A company or a limited liability partnership that fails to submit beneficial owners’ information with the URSB will not be allowed to make any other registrations unless they have provided that information.

- All applications for incorporation of a company and limited liability partnerships will only be processed upon submission of the beneficial owners’ information.

- Upon failure to comply with creating the register and filing a notice of the same with the URSB, the entity, and every officer in default shall be liable to a daily default fine of UGX 500,000 (approx. $135) each, for companies and UGX 1,000,000 (Approx. $270) each, for partnerships.

Submit a request for proposal

Find out how KPMG's Expertise can help you and your company

Request Opens in a new window

(NO. 2) Notice 2022 additional_30 December 2022.pdf/jcr:content/renditions/cq5dam.web.400.600.jpeg)