At KPMG Ignition Tokyo (KIT), which consists of a group of specialists not only in advanced technologies such as the cloud, AI, blockchain and IoT, but also in digital areas including data science, data visualization, cloud architecture and system security, we are always envisioning and fantasizing how we can integrate the expertise and the latest digital technologies which KPMG Japan has acquired over the years.

In this article, Masayuki Chatani and Tim Denley from KIT will again serve as the “Pilot” of Digital Management and discuss the outlook for tax businesses with David Lewis, Partner in the Transaction Advisory Group at KPMG Tax Corporation.

Digitalization Initiatives Promoted by KPMG Tax Corporation

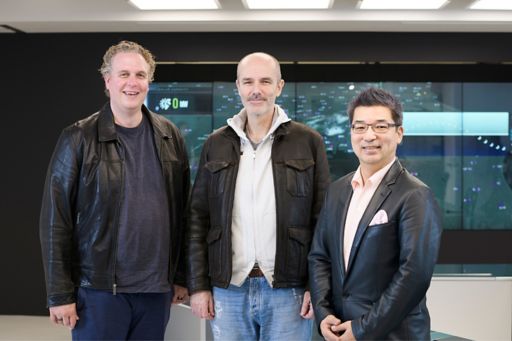

(Masayuki Chatani, Representative Director & CEO of KPMG Ignition Tokyo and CDO of KPMG Japan (right); David Lewis, Partner, Transaction Advisory Group of KPMG Tax Corporation (center); Tim Denley, Board Member & Partner of KPMG Ignition Tokyo (left)) *Professional affiliation and official position in the article are at the time of publication.

Denley: At KPMG, there are eight professional firms operating in three business areas—auditing, taxation and advisory. Taxation is thought to be the first among these business areas to experience changes.

Chatani: The taxation business is an important area at KPMG Japan. As it is inevitable that we will have to move from a transaction-based approach to value creation, KIT would like to work with you to bring about this change.

Denley: In this respect, what is important is to find “someone who is likely to change” within the organization that is already functioning. We discussed the outlook for the auditing business with Kentaro Maruta, Partner at KPMG AZSA, the outlook for the consulting business with Go Matsumoto, Partner at KPMG Consulting, and the changes in the advisory service with Tomoyuki Hotta, Partner at KPMG FAS, recently. Today, we invited David Lewis, Partner in the Transaction Advisory Group at KPMG Tax Corporation, because he was the only person we could think of who would be perfect to discuss the taxation business.

It is common for all businesses of KPMG to use our own financial data. The taxation business is distinctive in that it is linked with the area of compliance and therefore requires granular data. I hear that you are trying to use data that are the closest to actual transaction data.

Lewis: That’s right. As Tim just said, I also think that the taxation business is an industry that is the most likely to be disrupted.

While it has been pointed out that the digitalization of the tax business in Japan seems to be lagging behind other countries, there is more than a negative aspect to this. For instance, as improvements are made repeatedly while resolving individual issues in other countries, Japan will probably be able to pursue the path we need to follow with a comprehensive vision based on prior cases in other countries.

The biggest project I am now involved in is, to put it simply, the development of “a tool that can collect all kinds of data and carry out various analyses.” We are aiming to develop a tool that can be utilized not only for the taxation business but also for KPMG’s other businesses.

Through the development of this tool, I reinforced my belief that digitalization must be promoted by IT specialists and tax professionals working together. Though it is difficult to work on the project while performing our regular duties, we will steadily promote it so that it will not end halfway.

Tax Professionals Must Also Go Outside Their Field of Expertise

Denley: From the standpoint of technology management, I’m glad that we were able to proceed with the tool development step by step in sequence. I think that by understanding the difficulties while proceeding with the development, we can become an organization that can accept change.

Lewis: As far as accepting change, I sometimes feel that “those who are involved in the taxation business cannot think outside their field of expertise,” though this is not unique to Japan.

In the face of an environment where various changes are occurring as now, we may not be doing the business we are currently doing 10 years from now. I think that we must change ourselves so that we can withstand changes.

The reason why I am feeling this sense of crisis even more is that I heard from a colleague in the U.S. that “a leading digital company is trying to enter the tax return business.”

On the other hand, there are many people thinking “our work has been continuing for decades and as the taxation business has a history of 150 years, it will never change so quickly.” There may not be many people that are thinking the same way as me. However, “never even dreaming that things will change” is dangerous itself, I think. By the time people around you notice the change, it is too late.

Denley: The DNA of the typical disruptive innovator exists in some leading digital companies. The idea to enter the tax return business by utilizing their existing businesses and the latest technologies is natural and it can be handled as an extension of their business.

Lewis: The scale of the budget for developing technologies to realize this is also completely different. However, we have pride that our expertise in taxation business is overwhelmingly higher and our understanding of customer needs is by far deeper than theirs. Therefore, I think we are sufficiently competitive.

We must constantly evolve and change dramatically, which includes using technology. By doing so, I think we should be able to show sufficient competitiveness and win out against both new and old competitors.

For instance, the real intention of most of our clients is “not wanting to pay any tax if possible” and, to be honest, those that are not involved in taxation business “are not so interested” in detailed tax-related analyses.

To be a little more specific, generally speaking, the people that are given budgets that can be used within the company are the front-line departments that are expanding sales or supporting sales and they would rather have insights that contribute to management, such as business information or information that helps them analyze the company as a whole, rather than tax analysis data.

Taking this into account, KPMG Tax Corporation wants to provide solutions that can collect and analyze “an enormous amount of information that cannot be managed” regarding company management and various forms of data including paper documents and PDF files.

The larger the company becomes, the more information becomes scattered inside and outside the country. However, if we can digitalize this information, it will be possible to quickly prepare account ledgers and tax returns. I am envisaging that we can make use of KPMG’s knowledge in this area.

Denley: I see. I guess David’s team is undertaking the process of gathering personnel who can withstand future changes, start digitalizing information beginning with cases that are easy to handle, have them sense the advantages and attractiveness of changes and create the next change together.

And the “next change,” I think, is the discussion of platforms. Platformization is a key idea that supports the concept that what we are doing in our taxation business will contribute to other fields as well. I remember that Mr. Chatani joined KPMG just when we started to discuss this.

Chatani: That’s right. Tools that used to be created through vertical integration can now be created with horizontal distribution through the evolution of cloud computing and infrastructure, and this can greatly enhance the flexibility of data diversion and the freedom of appropriation of the technology assets created. There are many organizations that are unable to create things efficiently due to the remaining momentum from the past but if changes can be made with the strong will of management, efficiency will increase and the world they can see will change as well.

From Now on, We Will Be Making Challenges in Areas that Cannot Be Covered by Technology

Chatani: I think it is important to standardize data in order for us to change our operations so that they can be processed by computer. What is the situation in the field of taxation businesses?

Lewis: It may become possible for tax authorities to go directly to company’s books and automatically do tax returns and audits if digitalization progresses and be standardized.

In fact, there are some countries with that situation. Also, my view is that the national tax authorities will automatically prepare tax returns and perform tax calculations, and our business will replace the investigation of what the authorities have made from preparing tax returns.

Denley: I feel that tax-related operations have a defined “exit” and are gradually becoming digitalized. How far this will go will be the focus of attention going forward. I also intend to keep a close watch on the intervention of the government. As tax is the income of the government, there is a view that this will be the first thing they will start with when promoting digitalization. Cases are actually starting to appear in other countries as well.

Lewis: Yes, there is an approach where the government automatically calculates tax. However, there are areas that are difficult to determine with data alone and attached materials must be referred to in order to make a final judgement. This is why these referred data will become all the more important.

In such cases, it may be an overstatement, accounting data are not so valuable. We need to obtain and analyze original data to understand, for instance, “what is the unit price per tsubo of each building” and “what are the utility and maintenance costs of each building.”

In other words, we must not think in terms of accounting operations, but rather in terms of the original data. If we have these data, we will surely be able to grasp the necessary analyses and company status more accurately and in detail. Of course, accounting data will be handled as one of the standards.

Denley: Three to four years ago, I had a discussion with various people about how “GAAP and IFRS are, in essence, reports if they are taken directly from transaction data.” If the time comes when this becomes a reality, I think KPMG should take the lead.

Lewis: You’re right. If it becomes possible to carry out analysis in various forms, I think this will be quite revolutionary. From now on, we must not be bound by KPMG’s tax and auditing services but rather think of “what is best for our client companies and what will be of advantage to our customers.”

Of course, listed companies must prepare accounting reports and undertake auditing. However, I imagine that with a perfect audit trade, the blockchain would make it impossible to tamper with, traceability could be established for all evidence, and if one program could be written, all the processes up to auditing could be completed in one second. However, it may be necessary to judge whether “this is an asset or not” when carrying out accounting.

Chatani: Such a judgement can probably also be entrusted to AI by collecting training data.

Denley: I think KPMG is capable of making it possible. Anyone can collect data and I feel that society is also shifting to collecting data and considering them as a commodity. However, it goes without saying that what can be done with these data is what matters. This is why technology functions such as ours model the expertise that only we have. Then, human judgement may eventually become unnecessary.

Lewis: Even if that happens, I think new needs will be generated. Google was providing a search engine only as a means to collect data and as a result of thinking about how it can be utilized from various angles, they are now creating smartphones and cars. I think that this evolution involved their challenge to generate new ideas and technologies from what they were doing and actually implement them. The reason why we must take on the challenge of doing “something different,” is precisely for the sake of such development.

People on the Disruptive Side Will Win in the End

Denley: To say that “we will create a secure situation” looking ahead to the future may not seem realistic. However, we should prepare ourselves so that we can respond to changes and not be swayed by them. I think that such flexibility will be necessary.

Lewis: The ideas may still be rigid, but I think they will change going forward.

About two years ago, a young staff member reported to me that a certain person was saying that he would destroy the Big Four, meaning that “what David is concerned about is already becoming a reality.”

When I asked him why he was saying that he would destroy the Big Four, he replied, “the Big Four are only trying to seek efficiency and not trying to disrupt their own businesses. But it is those on the disruptive side that will win going forward.” It is true that everyone is still thinking only of enhancing business efficiency. This is why there is a chance to survive and win if they do something different now.

Denley: I guess it means that we must disrupt rather than being disrupted and be agile. What is important in being agile, I think, is to fail at an early stage, admit the failure and expand from there.

Lewis: It is also important not to try to do it on your own. It is necessary to constantly adjust your path and make changes by listening to those who know better.

There were many failures in the past but they are not wasted, as we are able to take the next step for further growth based on these failures. It is like being on a never-ending journey. This journey will continue for the rest of our life.

Denley: This can be applied precisely to our ongoing tool development. Although we are now making judgements based on whether or not these tools can exhaustively cover current business operations, I think the next step will be to evaluate “whether or not they can handle a change in business operations.”

Lewis: That’s right. After extracting data according to needs, we must refine our skills in the area of how to process these data. There is still so much to be done.

Denley: As everything will probably become digitalized, I don’t think it will be so difficult.

Lewis: It may not necessarily be so. There is a difference between “what we are looking at and where we are looking at.” There is the issue of whether we are collecting data that are truly necessary. Also, if all the information is digitalized but the data are not necessarily in the same place, we must pay attention, as we will only be able to reveal limited insights and perform limited work.

Chatani: There are cases, for instance, in real estate where detailed information such as the “shape,” “direction and layout” of the rooms may not be digitalized.

Lewis: You’re right. Any detailed information may be useful in considering “how to prepare information” but, in the first place, nothing will start without information. This is why it is important to first of all accumulate data.

Denley: I see. In the past when Big Data started to become popular, all kinds of data were captured but eventually it was often said that there were too many garbage data items that couldn’t be used. However, as processing capacity has improved a great deal now, we may be able to find value even in “garbage data.”

Chatani: If we can coherently offer professional knowledge, which KPMG has been offering through each of its firms, we may be able to comprehensively resolve the issues faced by our clients.

Lewis: I think we can resolve them if sufficient data are available.

This is not limited to taxation business but I am always thinking that “I want to be on the disrupting side” including when promoting future projects. I want to deliver whatever is best to protect not just myself but also my colleagues, their careers and the lives of their families. I can’t bear to pass on to the next generation something that is likely to sink.

We will not be able to survive with the awareness that “it is ok because it was ok in the past” or “because it has continued for 150 years.” We must develop something truly great so that “we will not be afraid of the emergence of other disrupters.” I hope to create something good by changing continuously and always aiming for something better.

Follow us on KPMG Ignition Tokyo LinkedIn for the latest news.

Connect with us

- Find office locations kpmg.findOfficeLocations

- kpmg.emailUs

- Social media @ KPMG kpmg.socialMedia