Over the past 30 years, Ireland has established itself as a global asset management leader through a combination of formidable investor protection, enviable tax efficiency, regulatory excellence and a strong talent base.

This success has taken place against a backdrop of huge change; the last few years have been especially dynamic, with major shocks such as Brexit, Covid-19, and war in Ukraine creating significant market disruption. In this context and with a new macroeconomic era of elevated interest rates in place, this is an opportune time for the sector to take stock of where we are, spot emerging trends, and establish strategy for the medium term.

The last ten years – a story of growth

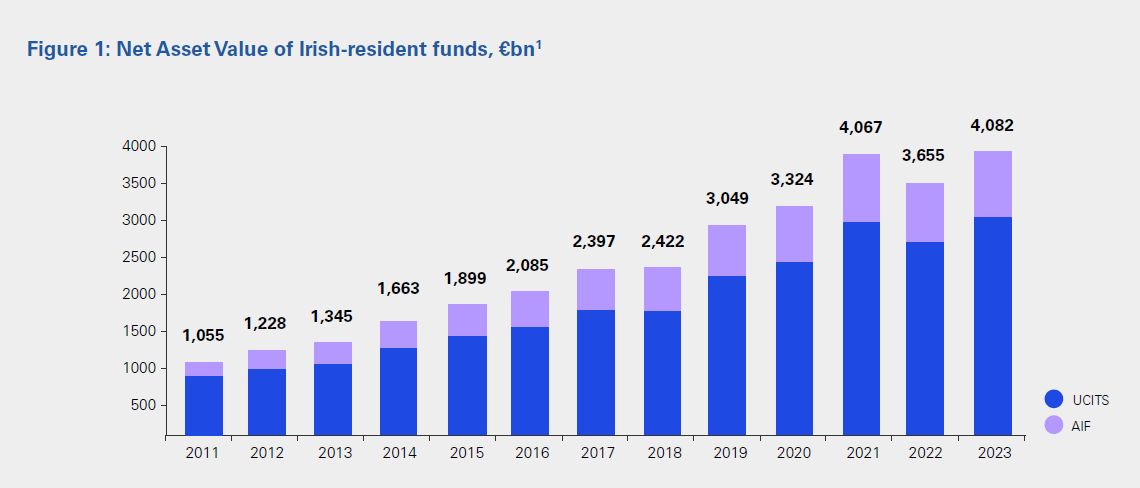

The story of Ireland’s asset management industry in the last decade has been one of strong growth, the net asset values (NAVs) of Irish domiciled funds rising from €1,055bn in 2011 to a record €4,082bn in 2023. This remarkable trajectory has been driven by external macro drivers such as the long period of low interest rates following the global financial crisis as well as Ireland’s success in a number of key areas such as hedge fund administration and ETFs.

1 irishfunds.ie/facts-figures/industry-statistics

The next five years – the trends that matter

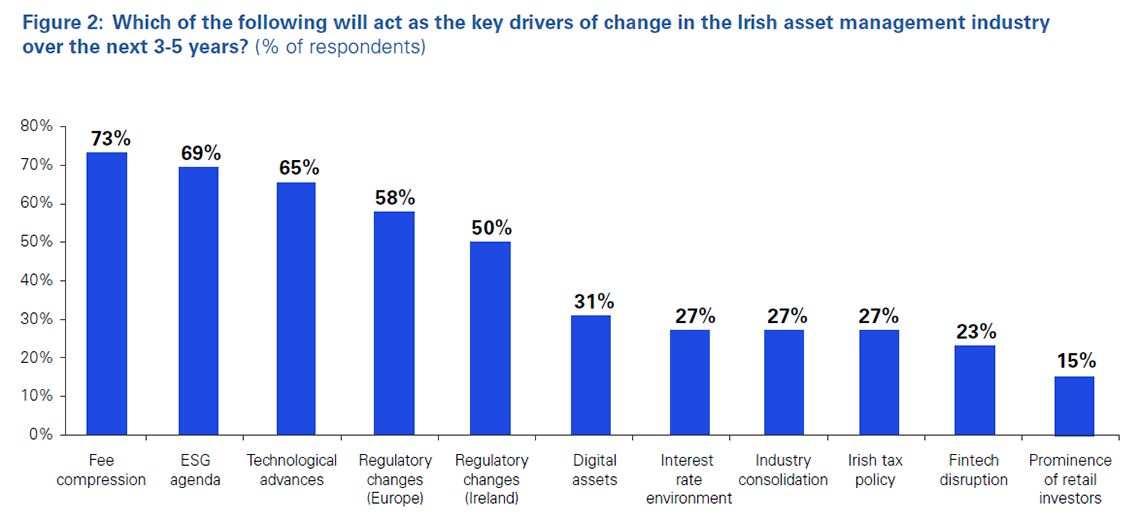

As always, the industry is evolving rapidly in response to an array of technological, commercial, and regulatory trends. To drill into these pressures and forecast the industry’s response, KPMG has performed extensive research via surveys and conversations with leading sector players. The following themes emerge clearly:

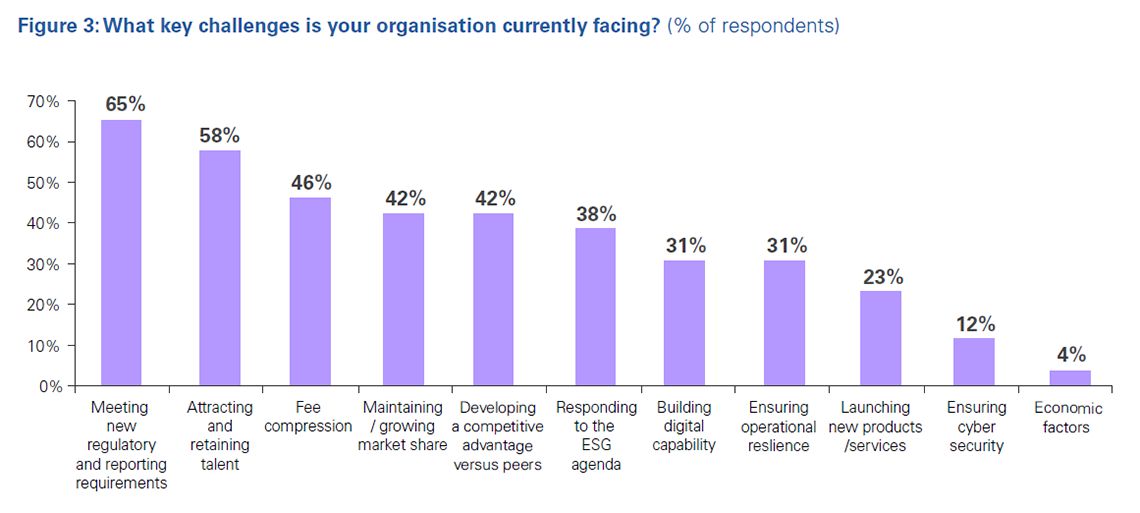

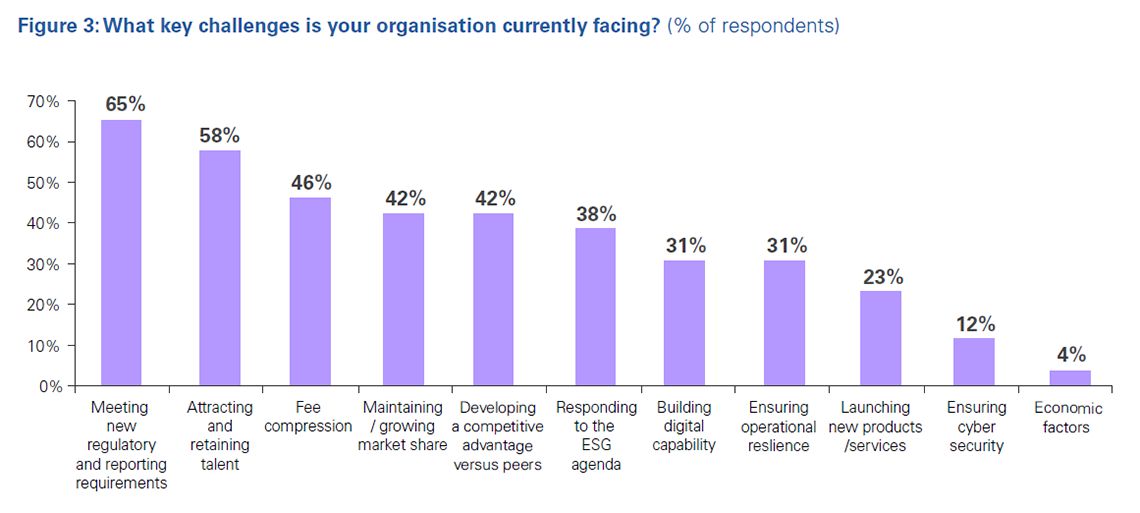

Substance: in the post-Brexit shakeup, the rise of third party mancos continues unabated as costs and regulatory pressure make it less viable to run self-managed funds, particularly for smaller managers. The substance requirements of these third party mancos continues to increase as regulators aim to avoid “letterbox entities” of a small number of local employees.

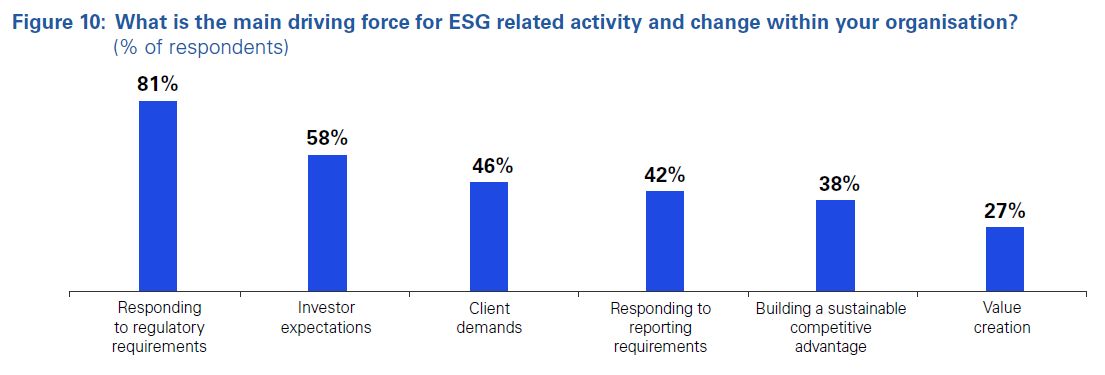

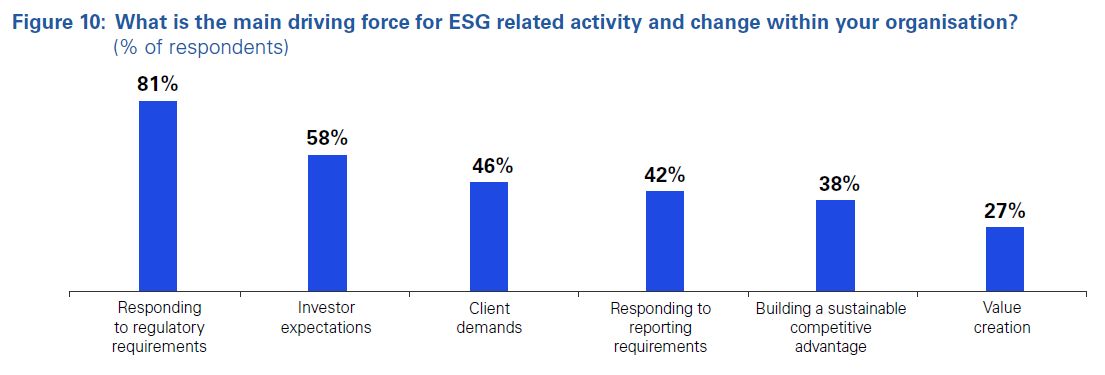

ESG: investor and regulator demands for ESG action are growing, imposing a significant burden on asset managers and third party servicers to respond via capital allocation, innovation, reorganisation, training, data gathering, personnel hiring, and reporting.

Costs: a huge majority of players across the asset management value chain are deeply concerned about cost pressures, particularly in the context of cross-sector fee compression and rapid interest rate rises.

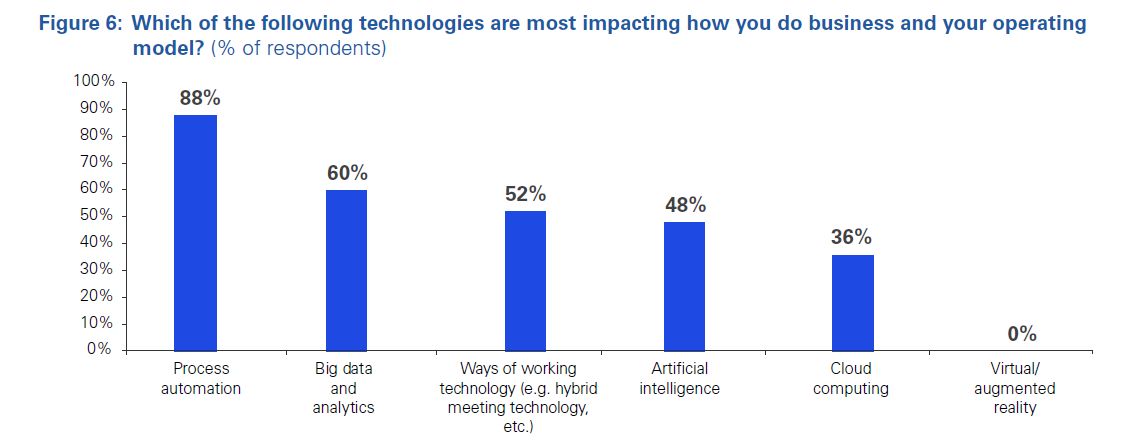

Technology: recent hype around AI is forcing widespread reflection on its likely industry impacts. At the same time, the sector is relying on automation to cut costs and still has a significant task to update a sprawling legacy tech stack to meet investor, client, and regulator expectations.

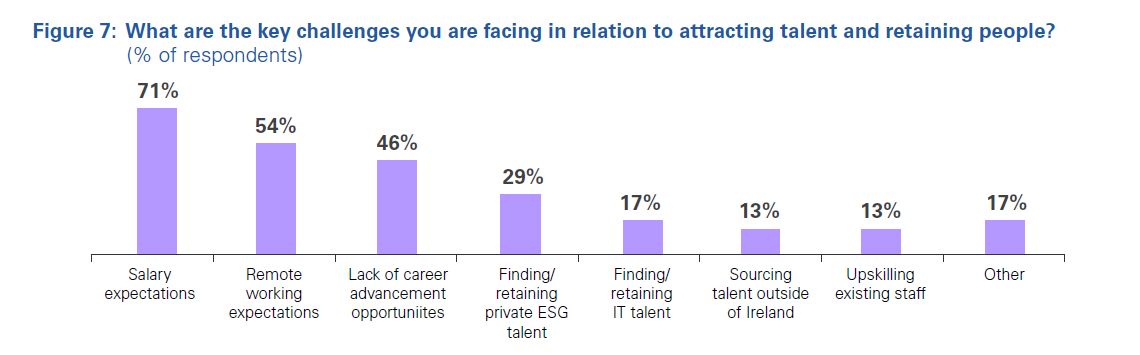

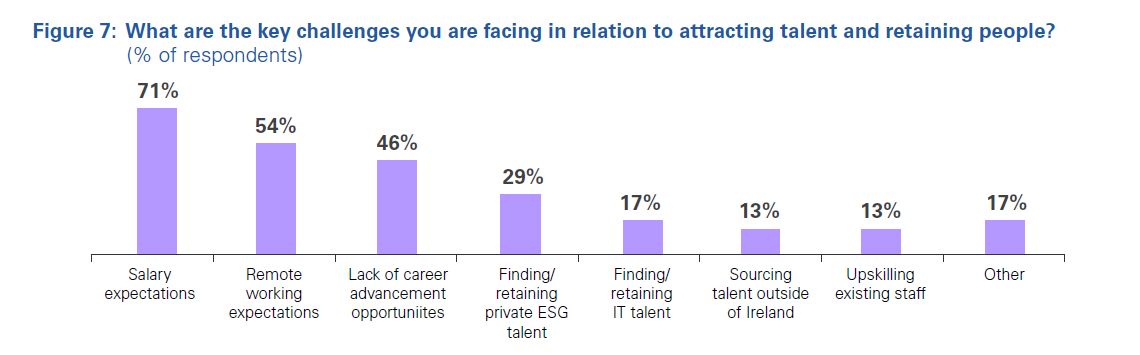

Talent: despite Ireland’s strong position as a talent hub and the welcome tailwind provided by Brexit, a clear majority in the industry see attracting and retaining talent as a challenge.

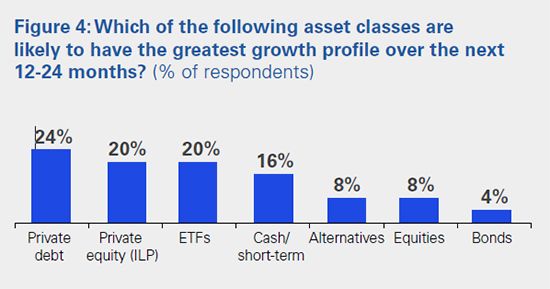

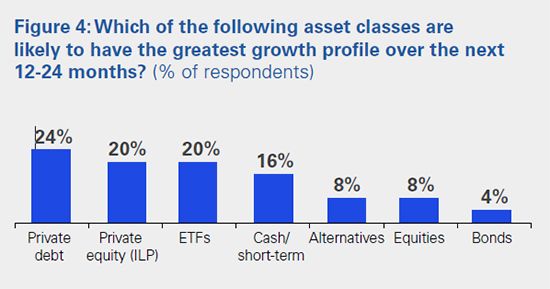

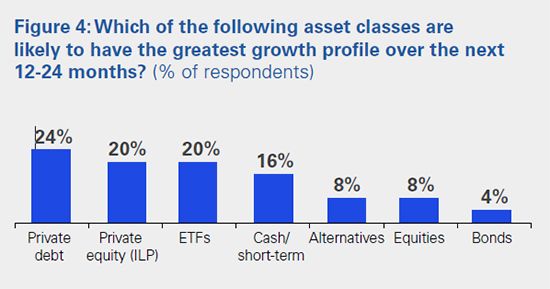

Product mix: the rise of alternatives is expected to continue as asset managers seek to diversify their portfolios and develop strategies that for the most part cannot be replicated by passive vehicles. This will also lead to an expected opening up of access to these investments to retail investors.

The next five years: Ireland’s response

The picture that emerges from our research is of a sector that is well aware of the challenges it faces and prepared to confront them, in many cases with a clear strategy. Specifically, we found that:

Endemic concern with rising costs is driving a range of responses, the most prevalent of which is process automation. However, there is also a need to consider product mix, customer experience and revenue models in the battle to avoid erosion of profit pools.

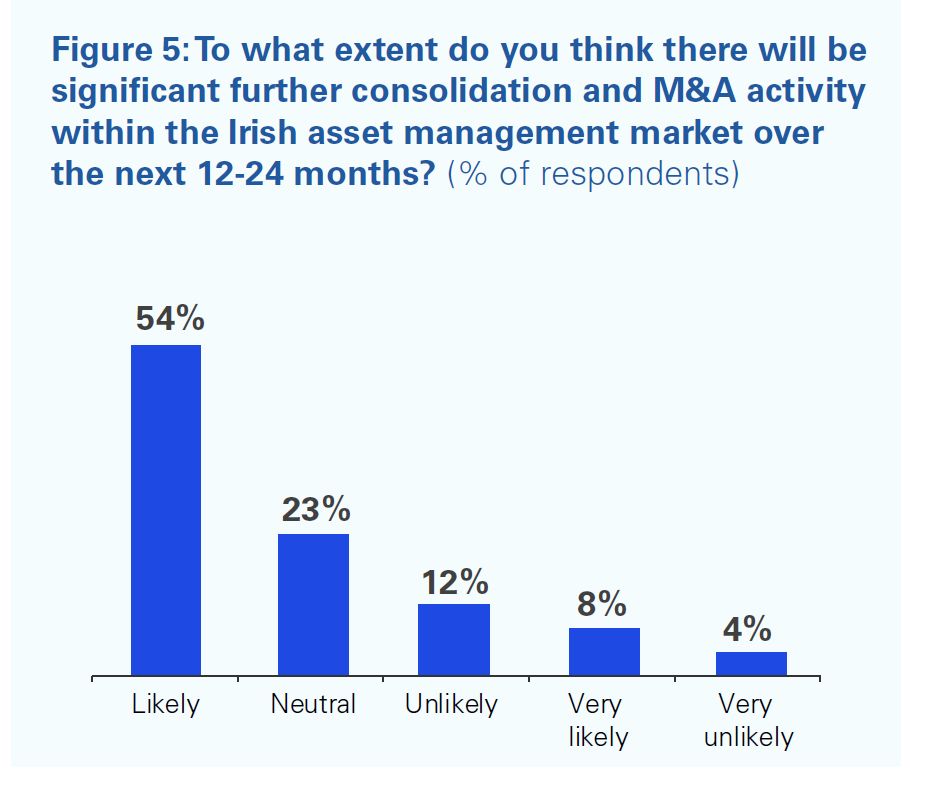

Scaling and consolidation emerge as other themes for players seeking to shore up profitability against an inflationary backdrop and fee compression, reflected in widespread expectation of further consolidation in the coming two years.

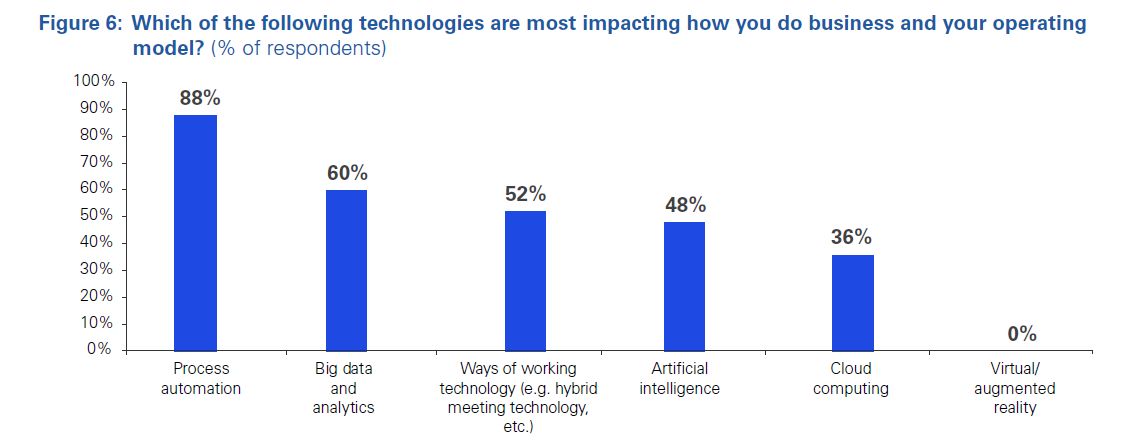

Managers have a clear focus on technology as both a challenge and an opportunity. Whilst process automation is by some measure the biggest preoccupation, data analytics, ways of working technologies, and AI are all commonly cited as salient issues having a big impact on existing operations.

On talent, many managers believe the post-Brexit settlement will continue to fuel Ireland’s attractiveness as a European operations base relative to the UK, helping soften recruitment pressures. Moreover, Ireland’s convergence of asset management with its strong IT sector is welcomed as a key development for the talent funnel. Nonetheless, meeting salary expectations is widely seen as a significant challenge.

A slightly mixed picture emerges on ESG, which is commonly recognised as a trend the industry as a whole needs to respond to maintain growth, but is only seen as an important success factor for winning new business by about a fifth of survey respondents. These figures reflect concerns that ESG is primarily seen as a regulatory imperative but not as a core driver of value creation. In the face of relentless media and regulator interest, many firms are looking to embed ESG into business models and operations, but are fearful of greenwashing accusations with the later leading to a significant reduction in flows into sustainable funds.2

2 Global Sustainable Fund Flows: Q3 2023 in Review, Morningstar

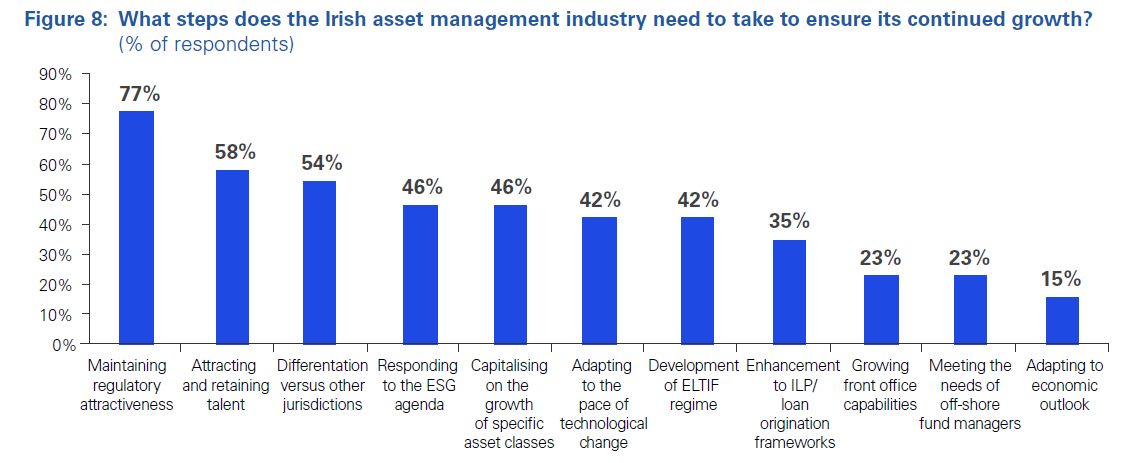

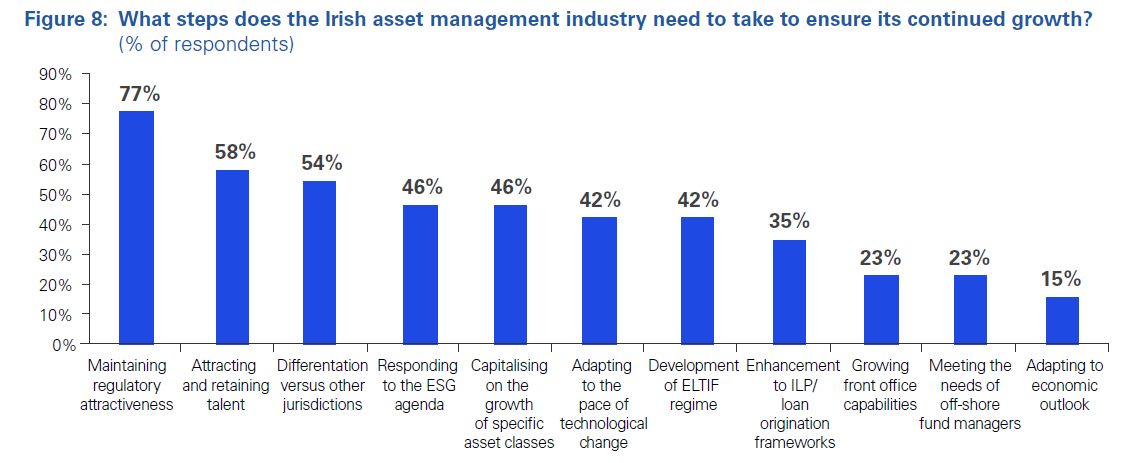

At the national level, it is clear that the sector considers maintaining regulatory attractiveness to be by far its most important step to maintaining its growth trajectory.

This goal was supported by some three quarters of surveyed respondents, with attracting and retaining talent, responding to the ESG agenda, and jurisdictional differentiation, the next most popular steps, all some way behind.

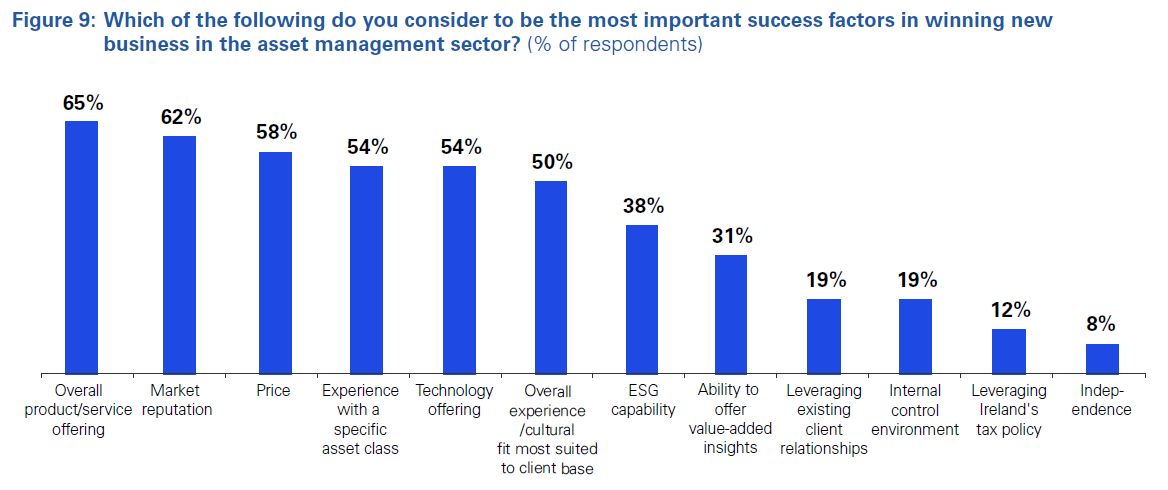

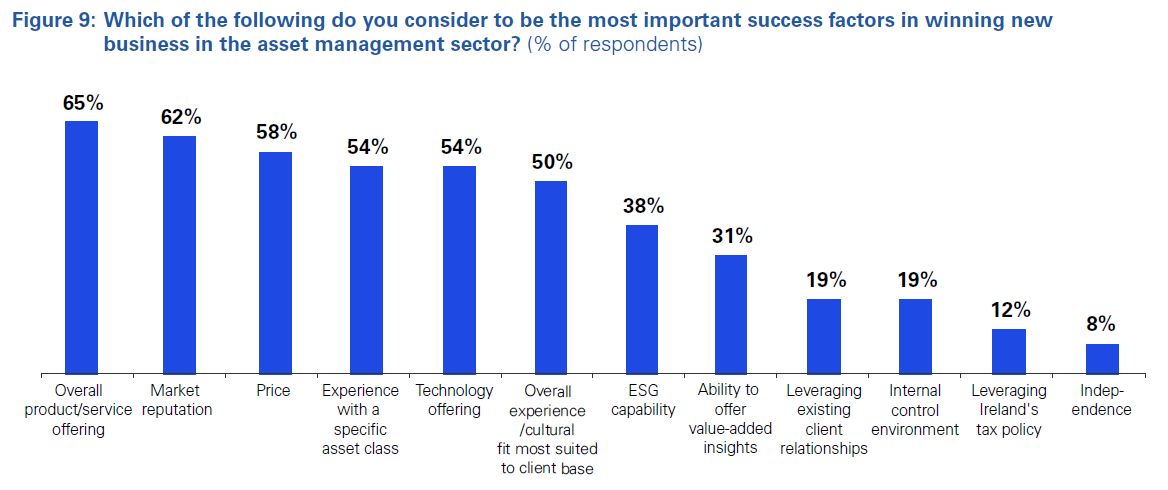

At the business level, there is less unanimity of opinion: most firms see price, overall product offering, market reputation, technology offering and asset class experience as their key concerns for winning new business.

Conclusion

Ireland’s asset management sector has emerged strongly from the pandemic but has no shortage of critical trends to contend with in the coming years, as inflation, fee compression, ESG and technological progress continue to make themselves felt. For Ireland to continue its impressive growth trajectory, it will need to respond to these pressures astutely. We conclude with some key considerations by stakeholder type:

Asset managers and funds service providers

- Process simplification will be increasingly important in the face of rising investor, client and regulator expectations, with automation providing one obvious solution.

- Managers should be poised to move into the digital assets domain once it has become more established in other regions.

- Profits will be sustained by continued expansion into other parts of the value chain. Managers should be willing to pursue such opportunities, including RAIFs, ETFs, managed accounts, private capital.

- High interest rates should create more opportunities for active managers in debt and equities – opening up a space in between passive investing and the private market.

- Upwards pressure on salary expectations will need to be actively managed, possibly through role juniorisation, postponement of senior hires, and automation.

- Technology investments need to be carefully assessed and prioritised, but cannot be delayed by firms looking for solutions across a range of areas including client relationships, process efficiency, and insight provision.

- Specific technical skills shortages may hamper some firms’ ambitions to expand up the value chain, but can be addressed through direct workforce upskilling, active partnership with higher education institutions, and European hires.

- Responding to the ESG agenda without due strategic rigour and depth can be risky as consumers grow more literate in this area and more alert to overinflated claims and greenwashing.

Government

- Maintaining Ireland’s regulatory attractiveness and flexibility is a critical prerequisite for continued growth.

- As the industry in Ireland seeks to move up the value chain, a more advanced financial skill base at graduate level will be necessary to fuel the industry’s more sophisticated jobs, which may require a more activist approach to skills and education specific to the sector.

- Skills shortages exist in some key areas such as ESG, technology and compliance, and there is a role for government in monitoring industry needs, strategising to address them and brokering multistakeholder solutions.

Regulators

- Ireland’s move up the value chain requires active facilitation at the regulatory level, necessitating regulatory dynamism and flexibility to ensure the regulatory structure can accommodate sector innovation on products and business models.

- ESG obligations should be imposed and managed with due care for the sector’s overall burden and its need to remain competitive to sustain growth, and facilitated by clarity and consistency around relevant metrics.

Contact us for more

For further information on the issues mentioned above, or any related issues, please contact Jorge Fernandez Revilla, Head of Asset Management.