On 29 September 2023, James O'Sullivan, Head of Function – Fund & Firm Authorisations, Funds Supervision Division, delivered a speech regarding the international agenda of the Financial Stability Board (FSB) and the domestic agenda of the Central Bank of Ireland (Central Bank).

Below, the KPMG Risk team have outlined the main points of the speech, considerations for your company and how KPMG can help.

As a prelude to his speech, Mr O’Sullivan shared his observations regarding the current state of play of the European capital markets. He began by pointing out that Europe’s over reliance on bank financing contributed to the difficulties faced by many in obtaining credit following the global financial crisis of 2008. He also spoke about the growing role of non-bank financing which offered the benefit of diversified sources of finance to the euro area real economy including funding the transition to a more sustainable economy.

Mr O’Sullivan pointed out that Ireland had played a significant part in making Europe a hub for funds and had emerged as a headquarters for asset management companies post-Brexit. Although Ireland had traditionally concentrated on liquid products and investment strategies like exchange traded funds (ETFs) and money market funds (MMFs), there have been attempts to attract private debt to Ireland by improving the Irish Investment Limited Partnership legislation and incorporating European long-term investment fund (ELTIF) chapters in the AIF rulebook. He also noted that there is a drive to provide retail investors access to alternative investment strategies that offer long term, less liquid options.

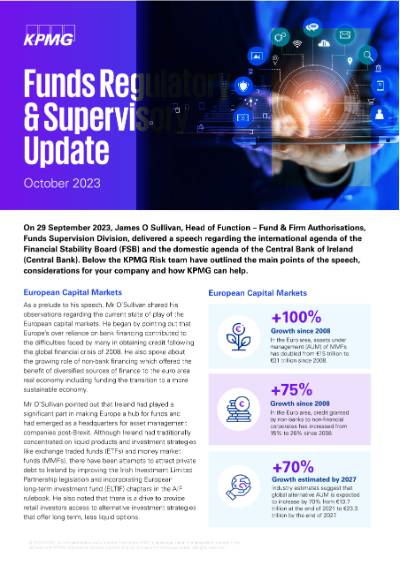

- +100% Growth since 2008

In the Euro area, assets under management (AUM) of MMFs has doubled from €15 trillion to €31 trillion since 2008. - +75% Growth since 2008

In the Euro area, credit granted by non-banks to non-financial corporates has increased from 15% to 26% since 2008. - +70% Growth estimated by 2027

Industry estimates suggest that global alternative AUM is expected to increase by 70% from €13.7 trillion at the end of 2021 to €23.3 trillion by the end of 2027.

When reflecting on the international agenda, Mr O’Sullivan commented that the combination of higher interest rates, higher inflation and lower growth has given rise to increased concern among regulators in relation to sharp price corrections, increased volatility and decreased liquidity. Leverage and liquidity therefore remain a core focus of international regulators.

Mr O’Sullivan remarked that FSB has focussed on the potential systemic risk arising from the nonbank sector and added that this greater emphasis on the non-bank sector, specifically funds and asset management, is a sign of things to come. Over the past year, the FSB and the International Organization of Securities Commissions (IOSCO) have updated their regulatory framework and introduced a bucketing framework for liquidity. Moving forward, the FSB plans to prioritise leverage in the next 12 months and is actively working on addressing this issue.

Following these recent regulatory updates by the FSB and IOSCO, the Central Bank has maintained its focus on liquidity and leverage. These themes remain its key focus as it aims to ensure financial stability in the market.

Considerations for firms

- Is your liquidity framework appropriate for your fund characteristics?

- Have you performed data quality assessments on data sets underpinning your historical scenarios?

- Is your existing liquidity framework, including governance, reporting and oversight procedures fit for purpose?

How KPMG can help

- Designing and integrating a liquidity risk management framework.

- Perform a gap analysis on your existing framework, including governance, reporting and oversight procedures.

- Draft a liquidity Stress Testing (LST) policy, based on the 12 principles in the ESMA LST Guidelines.

Mr O’Sullivan noted when reflecting on the domestic agenda for 2023 the aim was to use a thematic approach to supervising the funds sector to identify and assess sectoral risks to promote higher standards. He also mentioned that two common supervisory actions (CSA) were currently underway, (1) Asset Valuation and (2) Sustainability and Disclosure Risk.

Mr O’Sullivan commented that the Asset Valuation supervisory action was largely completed, with some firms being issued with risk mitigation programmes following their inspection, and that the Central Bank expected to issue an industry letter on this topic by the year-end. The second CSA was broken down into 2 phases. Phase 1 focused on greenwashing risk and is due to conclude by January 2024; whilst Phase 2 focused on sustainability and disclosure issues. Questionnaires for this phase were issued on 15 August 2023, with responses now being reviewed.

In terms of local supervisory initiatives, Mr O’Sullivan remarked that there was a local supervisory initiative ongoing which focused on a thematic review of ETFs to gain a comprehensive understanding of the authorised participants and market makers.

This review involved issuing quantitative and qualitative questionnaires to several ETF management companies, and the responses are currently under review. The aim is to issue an industry wide communication by the end of the year.

It was also noted by Mr O’Sullivan that there are also several mini-thematic reviews being conducted in order to examine the role of (1) non-discretionary investment advisors, and (2) third-party management companies’ conflict of interests, and (3) the use by some investment funds of a fixed operating expense model. It is expected that these mini-thematic reviews will continue to form part of the Central Bank’s regulatory toolkit in the future and target questionnaires on specific risk areas will be utilised by the Central Bank more frequently going forward.

Mr O’Sullivan added that not every thematic review would result in an industry letter.

Considerations for firms

- Are you confident that your fund product disclosures and reporting are aligned with regulatory expectations?

How KPMG can help

- We can assist you with a gap analysis and assessment of any updates of fund prospectuses against regulatory requirements.

- Additionally, we can assist you with a gap analysis and assessment of SFDR, regarding Article 8 and Article 9 funds.

Get in touch

If you have any queries on the international or domestic agenda outlined above, and its impact for your business, please contact our Regulatory team. We'd be delighted to hear from you.

Gillian Kelly

Partner, Head of Consulting

KPMG in Ireland