The big picture

Irish indigenous businesses and entrepreneurs shared their opinions about the tax regime in Ireland and its impact on entrepreneurship and business growth. They identified various challenges and potential solutions associated with the current tax system.

One striking finding was that less than a quarter (24 percent) believed that the tax regime in Ireland encourages entrepreneurship and growth. Camilla Cullinane, Tax Partner at KPMG, acknowledges that our enterprise policy is more crucial than ever in supporting investment in Irish businesses, entrepreneurship, and family businesses.

“Enhancing the Employment Investment Incentive Scheme (EIIS), introducing a reduced rate of Capital Gains Tax (CGT) for founders, private investors, VCs, and other angel investors and enhancing CGT entrepreneur relief are just some of the tax policies which would promote entrepreneurial investment”.

Views on the Irish tax regime

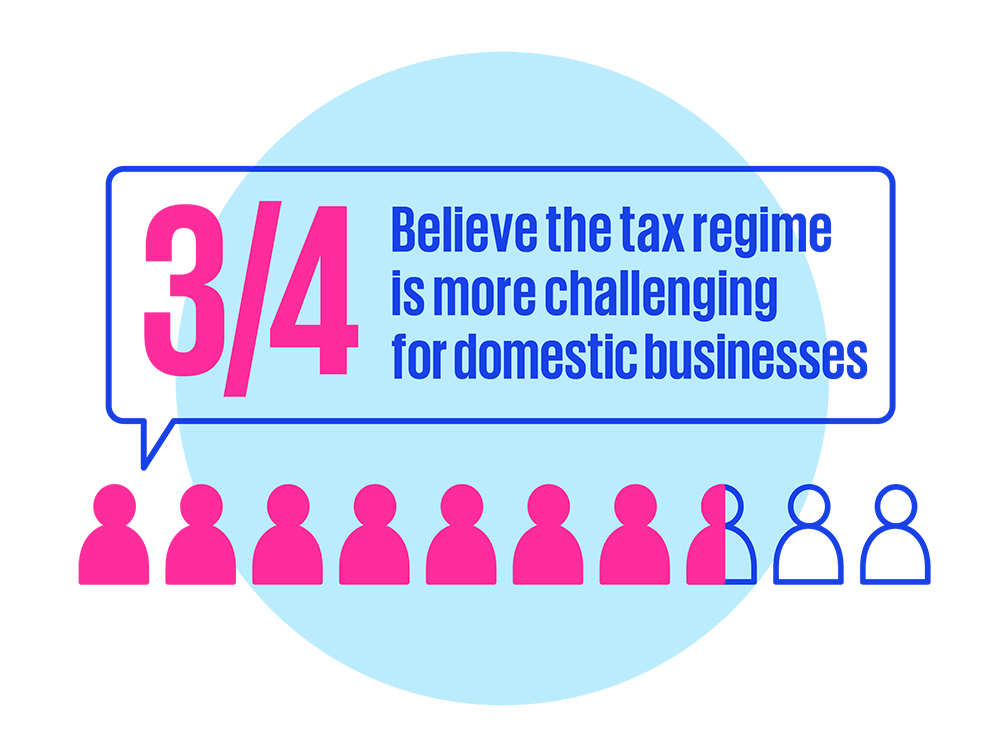

Over half of the respondents (57 percent) expressed concerns about the administrative burden attached to the Irish tax regime, particularly for smaller businesses and entrepreneurs. This indicates that the complexities and requirements of the tax system pose significant challenges for these stakeholders, potentially hindering their growth and impeding their ability to focus on core business activities. Furthermore, three-quarters (75 percent) believe the tax regime is more challenging for domestic businesses.

The research also revealed that an overwhelming majority (74 percent) believed that increasing the rate of employers’ PRSI would significantly impact their businesses. This finding suggests that companies are concerned about the financial implications of such increases, which could affect their ability to create jobs and invest in growth, putting extra pressure on businesses already grappling with rising costs.

Enhancing the EIIS and CGT entrepreneur relief…are just some of the tax policies which would promote entrepreneurial investment.

Easing the burden

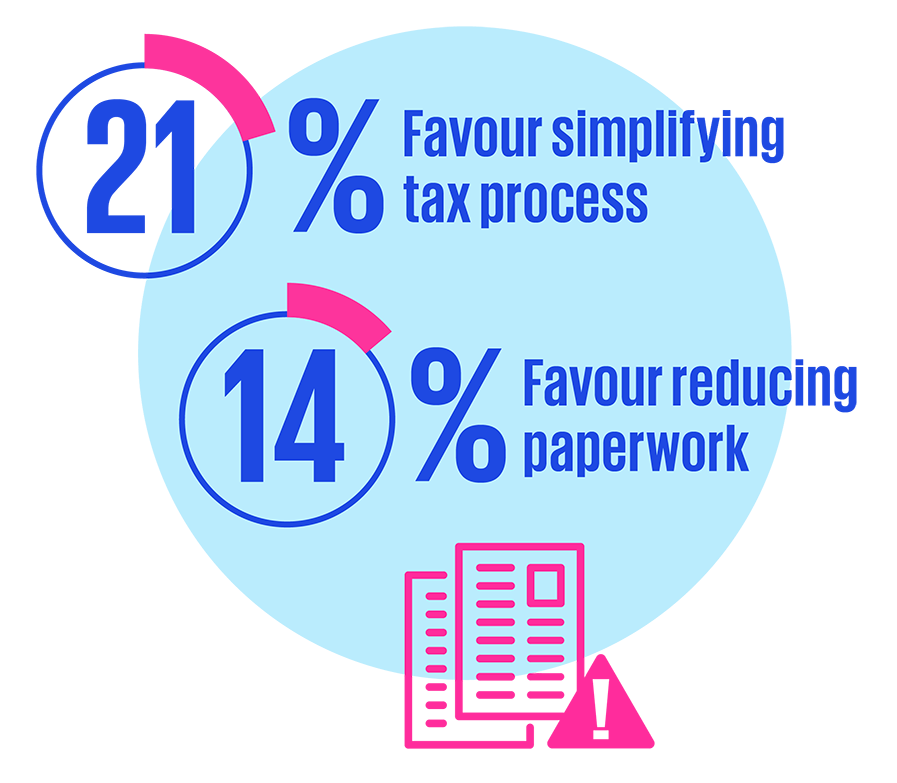

Recommendations to alleviate the administrative burden associated with the Irish tax regime for indigenous businesses and entrepreneurs include simplifying the tax process (21 percent) and reducing the amount of paperwork (14 percent), reflecting in a desire for a more streamlined and accessible tax system conducive to business growth.

Additionally, two-fifths (40 percent) feel that domestic businesses and entrepreneurs are disadvantaged compared to their counterparts both in the UK and other EU countries due to the current tax regime. This suggests that the existing tax policies in Ireland may not be as competitive or supportive as those in neighbouring states, potentially impacting our attractiveness as a location for entrepreneurial ventures.

Budget 2024

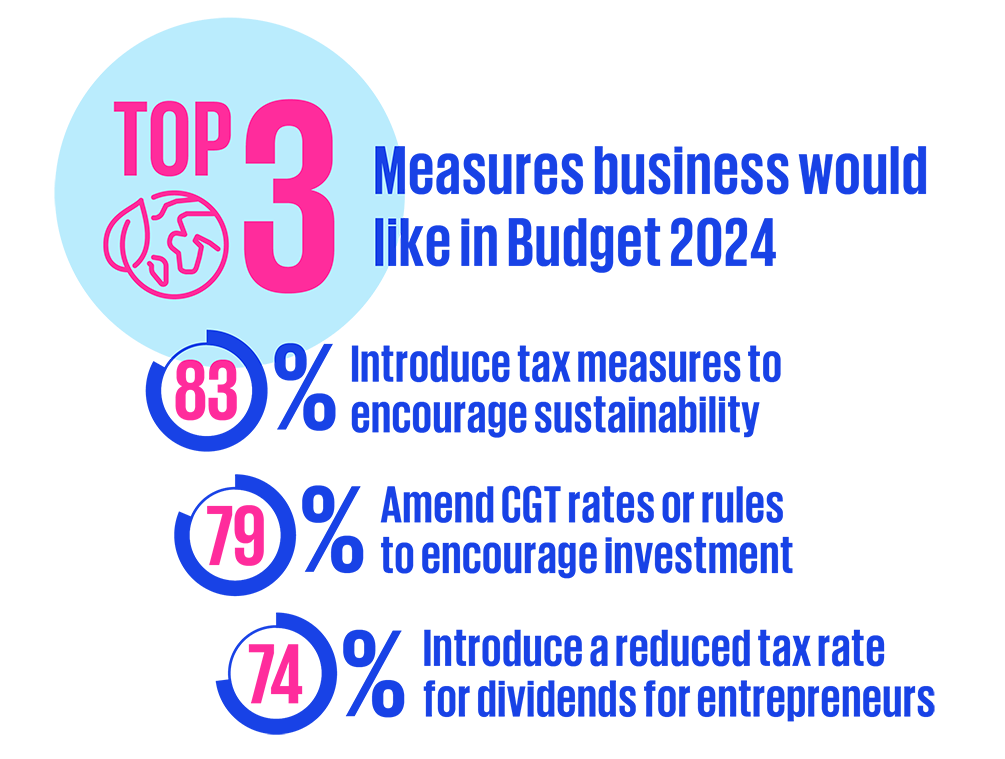

Measures respondents would like to see addressed in Budget 2024 are introducing tax measures to encourage sustainable behaviour (83 percent), amending CGT rates or rules to encourage investment in Irish companies (79 percent), introducing a reduced tax rate for dividends for entrepreneurs (74 percent) and enhancing the EIIS (54 percent).

Respondents also flagged extending the Special Assignee Relief Programme (SARP) to indigenous businesses (35 percent). These suggestions highlight a desire for tax incentives and reforms that stimulate investment, reward entrepreneurship, and promote sustainable business practices.

Our view

Incentivising and supporting domestic entrepreneurship should become a key focus for Irish tax policy to stimulate economic growth, maintain Ireland’s reputation as an international hub for innovation and collaboration, and develop a resilient domestic enterprise sector.

Our tax policy needs to address some key challenges facing the Irish economy, including the housing crisis, the cost of employment, the international war for talent, the impact of inflation, the need to develop more Irish businesses of international scale and our climate change commitments.

Supporting enterprises and entrepreneurs

Domestic businesses require high-performing employees for their companies to thrive. Ireland has made a virtue of having available a deep pool of highly skilled workers with high productivity. If we are to retain this good standing, we will need to pursue tax policies that foster high levels of labour participation. In addition, Ireland’s income tax system needs to continue to encourage individuals to upskill and reskill. With the advent of greater levels of hybrid working, workers have become more mobile. This has brought to the fore the need to ensure that our personal tax regime is attractive relative to what is on offer in other countries and ensure that the personal tax regime is reformed to accommodate the new working practices.

Entrepreneurs, both domestic and foreign, can and do move location based on the business and taxation environment. Entrepreneurial investment can be significantly influenced by targeted, pro-growth tax policies. Ireland’s tax policy should support enterprises and entrepreneurs seeking to access risk capital and talent, which are significant constraints for entrepreneurs in building businesses of scale.