Whether you are already claiming the R&D tax credit or just considering your eligibility, it is essential to remember that R&D does not just happen in the laboratory – quite often it is the work a company would consider to be a day-to-day activity: developing a new product; devising or making improvements to a production process; trying out a new material to reduce costs.

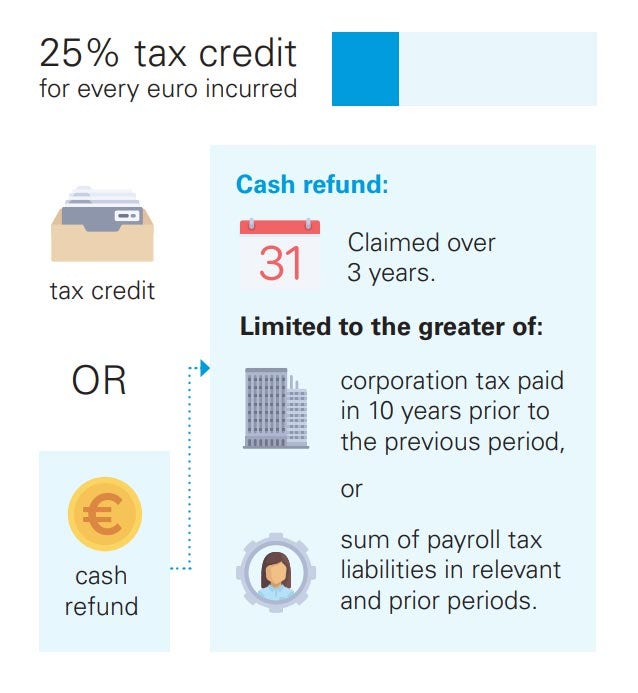

The list is extensive, and with a potential saving of up to 25% of qualifying expenditure, it is worth checking if your activities meet the criteria.