Irish agriculture is under the spotlight as never before, with consumer trends and policy at both national and EU levels creating huge pressure to decarbonise, and increase sustainability more generally, across all sectors, says Christopher Brown, Russell Smyth & Tom McEvoy.

The impact of cattle especially has come in for severe scrutiny, fuelling the growth in flexitarianism as well as dairy and meat alternatives, whilst the best direction for horticulture is also under discussion. For the Irish agri-food sector, these pressures are a clear threat to business as usual, but also a guide to the business of the future. Players that want to thrive must act now to get ahead of the trends that will shape the coming decade.

The writing on the wall

Whilst Irish farming grapples with the turbulence caused by Brexit and Covid-19, it cannot afford to ignore changing attitudes to the carbon impact of dietary choices. Whilst it is a fact that Irish grass-fed beef and dairy herds are amongst the world’s least emissions-intense, it is also true that agriculture is Ireland’s biggest overall emitter, responsible for 37% of the country’s emissions. The colossal growth of leading meat and dairy alternatives in the US, and the mood music from Brussels and Dublin regarding future agricultural policy, make clear that a head-in-the-sand approach to emissions won’t cut it.

The EU’s Green Deal proposal envisages a carbon-neutral EU by 2050, to be achieved through sweeping changes across a range of sectors, with agriculture to the fore. In Dublin, the Green Party has made its participation in government conditional on reducing Ireland’s emissions by 7% a year. The agriculture sector’s contribution to the cuts is a major source of coalition friction as the government prepares to put numbers on legally binding sector reduction targets, which could be as high as 30% by 2030.

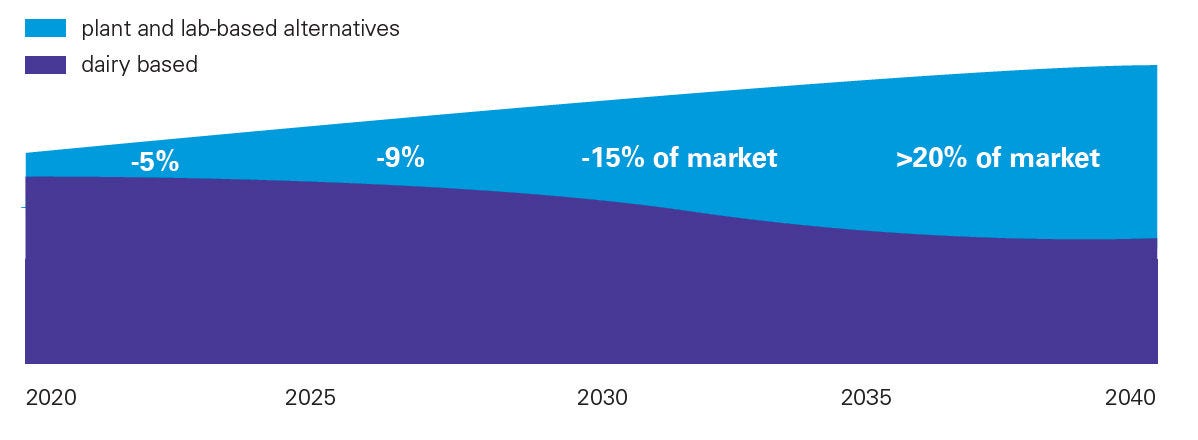

Meanwhile, consumers, especially the young, are abandoning meat and dairy of their own volition as concern mounts about environmental harms, welfare compromises and personal health. In response, major producers like Danone, Tyson, Arla and Valio have all announced their own carbon neutrality targets. Whilst meat and dairy alternatives are growing from a very low base, their direction of travel is clear and, we think, set to continue.

Figure 1: Projected evolution for consumer dairy product category in Western markets

KPMG analysis, industry interviews; note figure not to scale

The carbon opportunity

Whilst decarbonisation brings obvious disruptive challenges for Irish farmers, it also represents huge promise for those that embrace it. The new CAP strategy for Ireland, announced in the Autumn of 2021 and set to run from 2023 to 2027, is funded to the tune of €10 billion, with 25% of direct payments ringfenced for ‘eco schemes’ requiring farmers to demonstrate environmental benefit in order to draw down funding.

Though details of the eco schemes and proposed environmental benefits are yet to be announced, it is clear that farmers being paid for environmental outcomes is a question of when and how, not if. Given Ireland’s commitment to emissions reduction, carbon sequestration will be to the fore.

Of course the government is not the only available source of revenue for farmers who embrace carbon sequestration, with corporate interest in emissions offsets (including voluntary schemes) growing fast. Indeed some Irish farmers are already finding buyers for carbon credits derived from sequestration on their land, and platforms are being built to enable others to do the same.

- Dairy farmer and forestry owner sells carbon credits for €9,000

- Carbon credits trading platform established for farm and forestry

We expect the global market for carbon sequestration to evolve in the near future, fuelled by consumer trends and political commitments to net zero, with the price of carbon expected to become less volatile and rise significantly.

Figure 2: Viewpoints on the potential growth in price per tonne of CO2

| Territory | 2018 actual | 2021 actual | 2030 projection |

|---|---|---|---|

| EUR per tonne of CO2 | |||

| EU | 21 | 79 | 140 |

| US | 15 | 15 | 44 |

| China | 7 | 9 | 21 |

Actuals at year end; EUR rounded to nearest unit at January 2022 FX;

https://tradingeconomics.com/commodity/carbon;

https://carbon-pulse.com/147214/;

https://www.oecd.org/tax/tax-policy/carbon-pricing-united-states.pdf (PDF, 680KB);

Indigo Ag US projection;

https://www.oecd.org/tax/tax-policy/carbon-pricing-china.pdf (PDF, 680KB);

https://www.refinitiv.com/perspectives/future-of-investing-trading/chinas-national-carbon-market-exceeds-expectations/

On the consumer side, our recent work suggests that consumers of the future will be willing to pay a premium for low carbon products, including foodstuffs. Producers that can show and verify the low carbon attributes of their products will enjoy a market edge and the potential to charge higher prices.

This favours domestic producers for less processed goods (e.g. vegetables, top fruit) where international transport can represent a material portion of overall farm-to-fork carbon footprint. However, value-added goods (e.g. infant formula), where much of the carbon footprint comes in processing rather than from transportation, should still be able to overcome their freight-related carbon footprints.

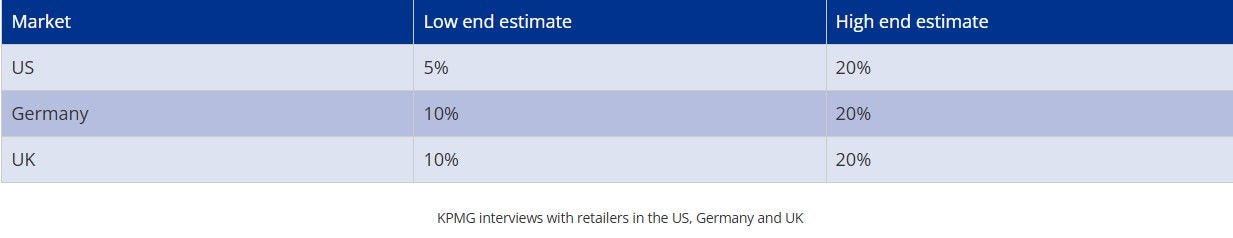

Figure 3: Potential retail price premiums: zero carbon cheese

Set against this backdrop, farmers and their Co-ops beginning to look at ‘farming carbon’ have much to play for, with multiple revenue sources available.

Income streams: how to farm carbon

Whilst much press commentary around the farming sector’s emissions target has focused on herd reduction, those wishing to reduce their farm’s emissions have a range of alternatives. While wind and solar power might get the lion’s share of media imagery, the bulk of emissions reduction on the farm likely involves fertiliser and slurry reduction, selective afforestation, wetland restoration, hedgerow planting, soil fertility improvements and bio digesters.

For many farmers, it will be possible to switch land use on marginal fields profitably and make emissions reductions at the same time, whilst according to Teagasc’s 2020 MACC analysis, a majority of agricultural abatement measures provide a net financial return on investment.

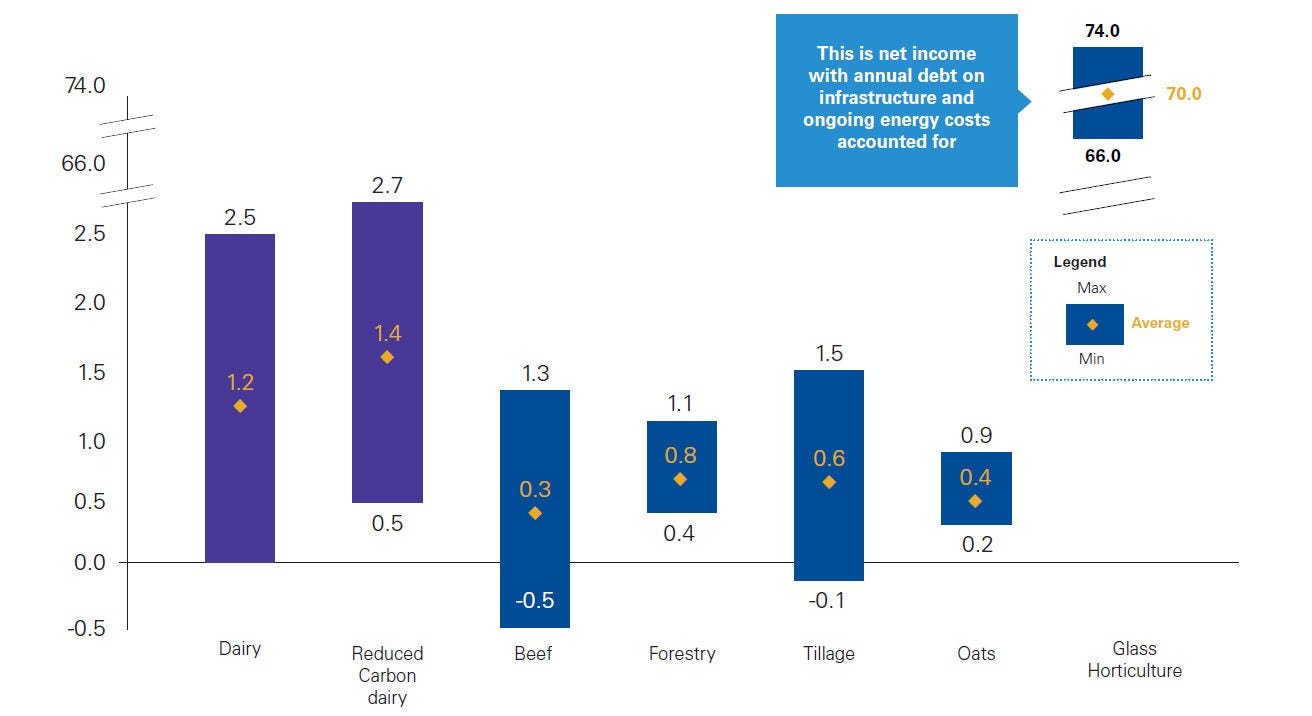

When we independently analysed the typical net income per hectare potential, many beef or dairy farmers, for example, could be financially better off switching their more marginal land to alternative, lower carbon uses. There are few easy choices in life – and the various diversification options each come with their own pros and cons. Forestry, for example, presents fairly predictable, low maintenance income, yet the ease with which felling licenses can be appealed and the legal inflexibility of switching land back out into other uses in future hamper the attractiveness of afforestation in Ireland. Glass horticulture, for example, has significant capex and expertise barriers to entry, yet consistent international experience shows its economic potential once up and running.

Figure 4: Illustrative annualised net income by farmland use, €’000 per hectare, Ireland averages, inclusive of grants

KPMG analysis

The existing horticulture sector, with a farm gate value close to half a billion euro, will be a major factor for the carbon intensity of Ireland’s future agricultural mix, with the Irish government actively encouraging existing producers and new entrants to invest in horticulture technologies.

Ireland’s current horticultural mix is heavily skewed towards traditional low-intensity production models - in a recent survey of producers we found that only 10% currently use hydroponics or vertical farming. This could well be an area of significant change as 28% simultaneously said they would consider investing in hydroponics and 24% in vertical farming, whilst 64% see ‘grown in Ireland’ marketing as a growth and expansion opportunity for their business.

This tallies with Bord Bia research suggesting that over 80% of consumers are in favour of more Irish-sourced fruit and vegetables in supermarkets. (PDF, 5.6MB) One complexity to changing this is caution on being the first (and potentially only) retailer to premiumise local, more seasonal produce. This points to the need for a more coordinated effort across growers and trade bodies with their retail partners.

Are you ready?

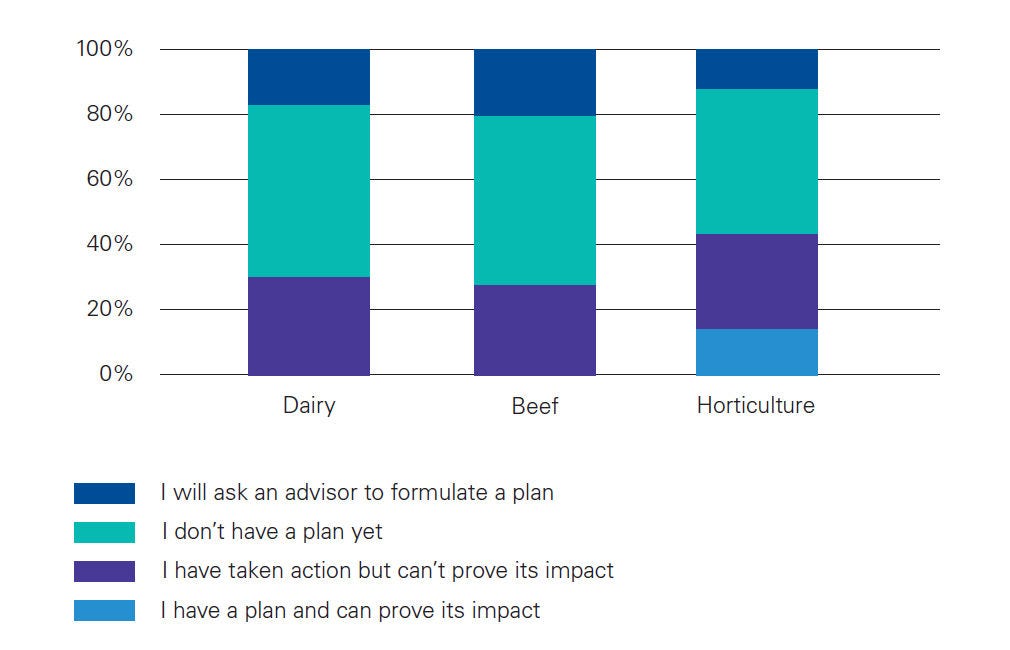

Recent KPMG Ireland surveys of over 800 farmers and horticulturists uncovered a worrying lack of preparedness for the looming changes to Irish agriculture. Of our representative sample across beef and dairy, for example, we found that over 50% do not have a plan to reduce emissions, while close to a third have already taken action but are unable to verify the claimed environmental gains.

Around 20% of farmers intend to ask somebody else what to do in order to make emissions cuts. The picture is slightly more optimistic among horticulturists – but given horticulture is one of the few segments of the Irish economy that can go materially carbon negative, there is clearly still a long way to go.

Figure 5: Responses when asked which statement best describes current preparedness for decarbonisation

KPMG surveys 2021

It is clear that there exists a substantial opportunity to raise awareness, both of the potential monetary gains pertaining to emissions reductions and of the means by which reductions can most efficiently and cost-effectively be realised.

At the same time, qualitative data gleaned from the surveys suggest that many farmers may be holding off from investing resources in environmental outcomes until they can be sure such actions will be rewarded. As such, the means by which environmental gains, whether in terms of biodiversity or emissions reductions, can be verified will be important, as will the carbon sequestration already performed by agricultural assets that is not yet fully understood. The onus therefore shifts back to policy makers to set clear financial incentives to accelerate change, but the private and Co-op sector can also get on the front foot.

Horticulturists most clearly recognise the carbon farming opportunity. According to our survey 80% of them agree to some extent that horticulture has the potential to generate carbon credits. At the same time, less than half of producers feel that there is sufficient information when it comes to sustainable farming practices that might lower carbon emissions.

Yet given Ireland’s export status, it is in dairy where much of the initial attention – and desire to see leadership – lies.

Industry leadership example

A Cork-based dairy processor is aiming to have its manufacturing sites carbon neutral by 2035 and is now sourcing 100% of its electricity from renewable sources. Since 2012, the co-op has been running its Carbery Greener Dairy Programme, which is run in conjunction with Teagasc to map the carbon footprint of its dairy farms supplying milk and also looking at items like biodiversity mapping and water footprint.

Originally working with 12 farms spread throughout its supply catchment, the Carbery Greener Dairy Programme started by measuring water and energy usage, mapping biodiversity on farms and measuring nutrient application levels, as well as profit monitoring the financial performance of each farm.

The programme has led to a 15% reduction in the carbon footprint of participating farms, as well as water efficiencies. The participating farmers have had their learnings recognised by University College Cork through the Retrospective Prior Learning (RPL) mechanism. Carbery are now spearheading a project called Farm Zero C which sees the rapid decarbonisation of a dairy farm in West Cork. The project which takes place near Bandon on a 250-acre farm with 250 cows aims to be climate neutral by 2027.

Conclusions

The pressure on Irish agriculture isn’t going to relent, but the rewards available for carbon sequestration, biodiversity gains and other environmental outcomes are only likely to grow in number. Whilst headlines about a ‘revolution’ in Irish agriculture might sound wide of the mark, there is no doubt that substantial changes are underway, from dairy to horticulture, and that those who ignore it risk being left behind.

Let us consider the practical implications by player type:

- Dairy and/or beef farmers

- Dairy co-ops

- Meat processors

- Retailers

- Horticulturists

- Policymakers, regulatory, government

- Consider diversification into plant and lab-based dairy alternatives, as well as low-carbon-intensity premium and/or blended plant-dairy product ranges

- Understand and communicate carbon intensity of imported plant-based alternatives

- Educate co-op members to ensure general awareness of payments on offer and how to access them, as well as of the range of carbon abatement measures available

- Understand consumer willingness to pay a carbon-lite premium

- Consider the introduction of carbon intensity, biodiversity and animal welfare metrics in setting milk price

- Consider establishing carbon trading markets for members and corporate buyers

- Consider the long-term viability of commitments to process all that members can supply. Milk pricing structures and other incentives can be designed to discourage oversupply and preempt mandated livestock reductions

- Consider actively facilitating the diversification of member farms through coordination, funding and training around profitable ventures that also decarbonise, including horticulture and forestry

- Consider diversification into plant and lab-based dairy alternatives, as well as low-carbon-intensity premium and/or blended plant-dairy product ranges

- Understand and communicate carbon intensity of imported plant-based alternatives

- Educate co-op members to ensure general awareness of payments on offer and how to access them, as well as of the range of carbon abatement measures available

- Understand consumer willingness to pay a carbon-lite premium

- Consider the introduction of carbon intensity, biodiversity and animal welfare metrics in setting milk price

- Consider establishing carbon trading markets for members and corporate buyers

- Consider the long-term viability of commitments to process all that members can supply. Milk pricing structures and other incentives can be designed to discourage oversupply and preempt mandated livestock reductions

- Consider actively facilitating the diversification of member farms through coordination, funding and training around profitable ventures that also decarbonise, including horticulture and forestry

- Consider diversification into plant and lab-based meat alternatives

- Evaluate carbon intensity of meat product ranges throughout the supply chain and opportunities to achieve reductions through product range transition

- Understand and communicate carbon intensity of imported beef and alternatives

- Understand consumer willingness to pay a carbon-lite and/or “grown in Ireland” premium

- Explore ecosystem-wide accreditation schemes as a prerequisite of procurement, to encourage processors and in turn, suppliers, to move en masse into standardised measurement and improvement schemes

- Understand and communicate the carbon intensity of imported alternatives in terms of ‘food miles’ travelled as part of broader “grown in Ireland” marketing

- Leverage the pandemic-established health literacy of the public to promote specific, evidence-based healthcare benefits of fruits and vegetables

- Consider technology options (e.g. vertical farming, carbon capture for glass horticulture) that could help to mitigate rising input costs and reduce carbon intensity per unit output over the medium to longer-term

- Research and understand carbon sequestration potential of agricultural sector more fully

- Research and understand the carbon intensity of local produce vs imported alternatives

- Establish and elaborate measurement and verification norms around environmental goals

- Overhaul of the incentives and disincentives (including felling license and appeals processes, and future land use flexibility) around afforestation

- Consider independent verification for claimed carbon and biodiversity benefits

- Carry out stakeholder engagement to ensure just transition

- Clearly communicate costs of non-compliance with environmental payments scheme, as well as benefits of compliance

- Ensure payments linked to tangible results not only participation to ensure effectiveness

- Where possible incentivise on latest available carbon intensity of farms, rather than their change since an initial baseline (which is putting off quick wins)

- Facilitate areas for mutual collaboration between historically distinct sub-sectors, e.g. matching dairy Co-ops and their members’ need for diversification with the need for capex to modernise and expand Ireland’s horticulture base

About KPMG’s Global Strategy Group

KPMG’s Global Strategy Group works with private, public and not-for-profit organisations to develop and implement strategy from ‘Innovation to Results’ helping clients achieve their goals and objectives.

KPMG Global Strategy professionals develop insights and ideas to address organisational challenges such as growth, operating strategy, cost, deals, digital strategy and independent economic assessments. In Ireland, we are the largest deal and corporate strategy house, working across sectors including financial services, aviation, life sciences, manufacturing, agri-food and technology.

Get in touch

The pace of change is challenging leaders like never before. To find out more about how KPMG perspectives and fresh thinking can help you focus on what’s next for your business or organisation, please get in touch with our team below. We’d be delighted to hear from you.

Contact our team

Media queries

If you’re a media professional and have any questions about this article or would like to speak to one of our experts for background or interview purposes, please don't hesitate to reach out to us. Contact Sandra Farrell of our Communications team for more information.