Important opinions of the Central Bank of Hungary

Important opinions of the Central Bank of Hungary

MNB provides continuous support

Measures taken to mitigate the economic effects of the coronavirus have caused significant changes for credit institutions as well as their customers. Thus the Central Bank of Hungary seeks to support the day-to-day operations of credit institutions with a new Questions and Answers Platform, which is now updated weekly, and aims to ensure that financial market participants have sufficient understanding of the payment moratorium and other regulatory procedures. The first questions and answers will cover, among other things, overdraft credits, credit cards, housing related savings products, the government interest rate subsidies, financial leasing, mortgage loans, and issues about the APR freeze. We would like to highlight the following issues from the document:

In the absence of a specific statement from customers to maintain repayment through the moratorium, it may be difficult to handle individual customer payments. MNB stated that if the customer pays the amount due under the contract on their own initiative, the behaviour indicates that they do not intend to live with the opportunity of the payment moratorium, though it only applies to the given instalment. Thus, by paying the instalments that are due, each client can indicate to the institutions their intention to make further repayments, on a monthly basis. The Central Bank highlighted that the payment cannot be interpreted as implied conduct with regard to overdrafts, in which case the client's statement is required if they intend to continue repayment despite the moratorium after 18 March 2020.

It has been confirmed by the Central Bank that in order to implement direct debits for loan repayment, the customer's declaration is absolutely necessary if they do not wish to take advantage of the payment moratorium.

According to the Central Bank, in regard to payments from repaying customers, it is a good practice for institutions to provide a grace period of 1-2 days, even up to 5 working days for the payment of monthly instalments, so if a customer pays the monthly instalment within this period, the institution shall consider it to have been completed on time.

The Central Bank confirmed that in the event of non-performance of a customer previously continuing repayment despite the moratorium, the transaction will automatically be subject to the payment moratorium. The same procedure must be followed, if the bank is unable to complete the direct debit under normal conditions while trying to collect the given monthly (maximum by the next instalment).

In the case of revolving loans, the payment moratorium is more complex, so the Central Bank described detailed rules. For example, in the case of products without a maturity date, it is considered a good practice for institutions to provide an opportunity to pay interest and fees accumulated under the payment moratorium in instalments through 12 months after the expiry of the payment moratorium.

The Central Bank also stated that the moratorium extension would also apply to revolving and investment loan agreements maturing by the end of the year. As with other loan agreements maturing during the year, the duration of revolving loans will be extended by at least the amount that would have remained from the original term at the time of the moratorium.

It has also been confirmed that the payment moratorium does not automatically result in the reclassification of the relevant exposures to the default categories under CRR, default or restructured receivables under the relevant Central Bank decree, and the obligatory determination of credit risk growth in accordance with IFRS 9 to Stage 2 reclassifications. For all these exposures, it is necessary to determine the need for reclassification on an individual basis. Regarding the detailed rules of this - expected by the end of 2020Q2 – the Central Bank will issue an executive circular.

The Central Bank also set out details of its expectations regarding information for customers, as well as administration and complaint handling. Complaints can only be handled by phone or in writing during the lockdown period. With regard to customer information related to the payment moratorium, it is a general requirement that credit institutions inform their customers among other things about the following:

- In the case of retail credit, loan or lease agreements and employer loans already disbursed on the basis of contracts existing on March 18, 2020, the customer will automatically receive a deferral of payment, which no further action required.

- The amount to be paid in instalments by the client after the expiration of the moratorium will not increase due to using the moratorium, instead, the duration will be extended after the moratorium.

- The customer has the right to perform under original terms and conditions of the given contract. In this case, the transfer and payment of the customer in accordance with the terms of the contract mean that the customer did not wish to use the moratorium in the given instalment.

- As direct debits for repayments have been stopped by banks due to the payment moratorium, it is necessary to inform the lender of the customer's intention to pay in order to restart it. The bank is obliged to designate appropriate communication channels for the client to signal their intention to pay.

- Even if the customer has continued due payments despite the moratorium, they have the right to opt-in and defer further payments at any time. Also, if the instalment cannot be covered via direct debit due to lack of funds, the rules of the payment moratorium will automatically enter into force for the given loan.

A separate section deals with the APR limit, in which the Central Bank states that the current APR cap of 5.9% does not apply to secured credit and loan agreements, nor to mortgage loans. Regarding duration, the MNB expects that the APR limit applies to loans disbursed on the basis of retail credit card agreements concluded on or after 19 March 2020, but not on the credit card agreements concluded before that date, regardless of when the loan actually taken. If the deadline of 31 December 2020 does not change, in respect of consumer loans affected by the APR limit the APR specified in the business conditions valid at the time of concluding the contract will be applied automatically from 1 January 2021, without any further declaration needed.

In addition to the Questions and Answers, the Central Bank also created a separate sub-page on its website to present the financial response to the epidemic in detail. Even in the current situation, the Central Bank expects market participants to serve their customers in an appropriate quality, emphasizing that the key to financial stability and confidence in the markets is continuous operation, thus, active monitoring of legislation and market conditions and a rapid response from institutions are essential.

A critical issue for business continuity is that 41% of respondents could not replace the 1-month outage of the supplier providing the material / service needed for production, and only 23% could solve the production / service differently. This is made even more severe by the fact that 63% of the respondents experienced supplier disruptions, mostly related to transportation difficulties from the countries most affected by the epidemic: a quarter of the disruptions came from countries with more than 100,000 cases and a quarter from countries with cases between 50,000 and 100,000.

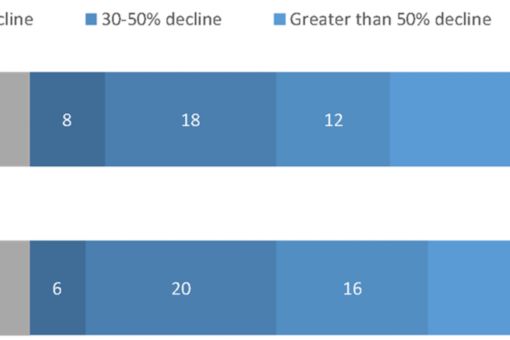

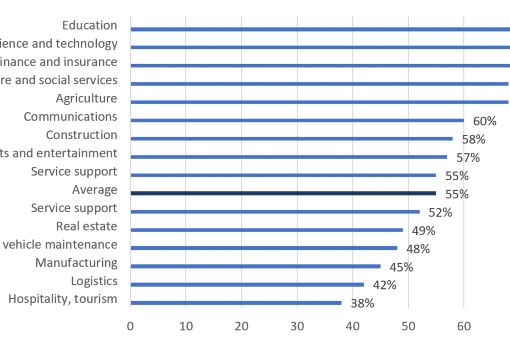

The change in the number of employees can show the current situation of the given enterprise, but also the mid-term outlook of the management. 55% of the respondents do not plan to lay off workers in the short term, but 44% of the respondents see the pre-crisis number of employees as sustainable only for 2 months without improvements in the economic situation. It is an interesting finding that 40% of respondents would like to take out a loan to finance temporary wages, during which they would typically need to finance 3 months’ wage costs.

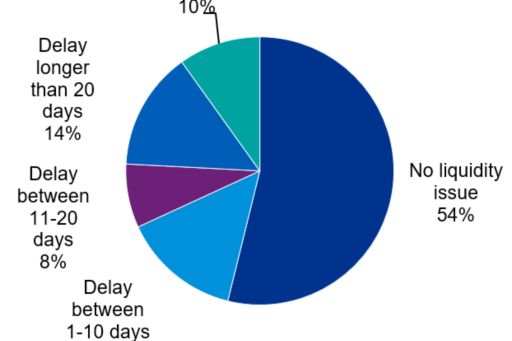

It may also be relevant for credit risk that a large proportion of respondents have not had a payment problem so far, but a third of respondents have been at least 11 days late on a payment. According to the research, the responding companies found paying public charges/taxes and wages the biggest difficulties and the supplier accounts come only in the third place. Especially in the most affected sectors, it is important to note that only about 40% of companies can maintain their solvency for more than a month without income.

Due to the epidemic, nearly one-third of respondents are forced to postpone their planned investments, but despite the crisis, nearly 20% of respondents would take out investment loans, half of them for the full amount planned before the crisis. The companies participating in the research primarily consider favourable interest rates and, secondly, fast administration, to be the most important factors in the current situation, which shows changing customer needs and accelerating expectations.

Sector specificities

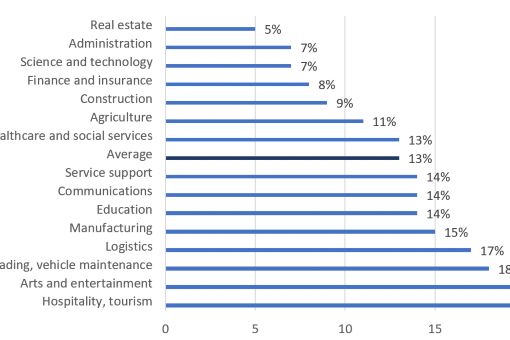

The Covid-19 crisis affected various sectors differently. In some areas, operations have come to a complete halt, some players have limited operations, and there are companies where the production / service process continues uninterrupted. The production / service process has to be stopped for at least 1 month by almost all enterprises engaged in entertainment, leisure activities, accommodation services, and a significant part of catering establishments also stop for more than 1 month, however, so do 41% of manufacturing companies also have to halt for a month. The analysis of downtime is also critical from a credit risk perspective, because firms make virtually no revenue during this period, but fixed costs remain relevant.

These results are also well illustrated by the fact that there is a significant difference in solvency by sector, while only 9% of respondents in the construction industry had a payment delay of more than 20 days, while 20% operating in trade and 23% operating in catering and accommodation services were delaying a payment over 20 days.

There are also significant differences between companies in terms of companies’ expectations about the employment situation. According to the research, for example, 53% of the enterprises operating in the catering industry, 25% of those operating in the manufacturing industry, but only 14% of those operating in the agricultural sector will not be able to meet their wage payment obligations. As a result, the difference is also significant in terms of the planned number of employees, while 71% and 68% of companies engaged in financial insurance or agriculture respectively plan to maintain their current number of employees, 45% in manufacturing and only 38% in hospitality plan to do so.

The Central Bank's research examined a wide range of issues, which shows a significant difference between sectors. An important aspect in the analysis of credit risk, especially due to the limited payment data available due to the payment moratorium, is the examination the effects of the Covid-19 crisis in the national economy and the expected economic situation of the given company/sector. Of course, in addition to assessing the risk to businesses, it is also very important for individual customers to analyse their workplace, but at least the relevant sector. Altogether it is an important task for credit institutions to pay special attention not only to past data, but also to the debtor's future prospects, including the assessment of the labour market sector, when developing credit rating, scoring models.

The current extreme uncertainty makes it more difficult to effectively assess credit risk and monitor loans with previously used methodologies, but maintaining a lending activity with the help of a well-thought-out, thorough analysis of risks is key is crucial from perspectives of both the individual business and the national economy.

© 2026 KPMG Hungária Kft./ KPMG Tanácsadó Kft. / A KPMG Law Tóásó, Béli Ügyvédi Iroda / KPMG Global Services Hungary Kft., a magyar jog alapján bejegyzett korlátolt felelősségű társaság, és egyben a KPMG International Limited („KPMG International”) angol „private company limited by guarantee” társasághoz kapcsolódó független tagtársaságokból álló KPMG globális szervezet tagtársasága. Minden jog fenntartva.

A KPMG globális szervezeti struktúrával kapcsolatos további részletekért kérjük látogassa meg a https://kpmg.com/governance oldalt.