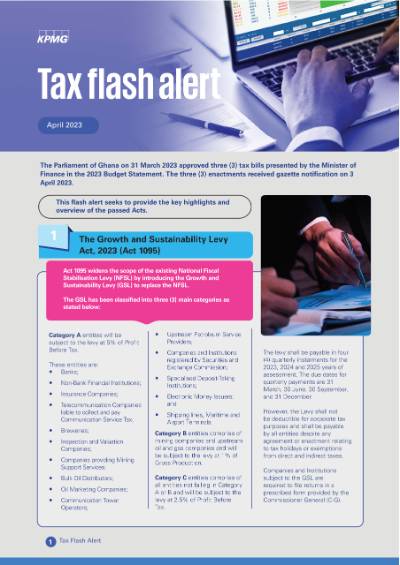

This flash alert seeks to provide the key highlights and overview of the passed Acts.

- The Growth and Sustainability Levy Act, 2023 (Act 1095)

Act 1095 widens the scope of the existing National Fiscal Stabilisation Levy (NFSL) by introducing the Growth and Sustainability Levy (GSL) to replace the NFSL. The GSL has been classified into three (3) main categories as stated below:

Category A entities will be subject to the levy at 5% of Profit Before Tax. These entities are:

• Banks;

• Non-Bank Financial Institutions;

• Insurance Companies;

• Telecommunication companies liable to collect and pay Communication Service Tax; • Breweries;

• Inspection and Valuation Companies;

• Companies providing Mining Support Services;

• Bulk Oil Distributors;

• Oil Marketing Companies;

• Communication Tower Operators;

• Upstream Petroleum Service Providers;

• Companies and Institutions registered by Securities and Exchange Commission;

• Specialised Deposit-Taking Institutions;

• Electronic Money Issuers; and

• Shipping lines, maritime and airport terminals.

Kofi Frempong-Kore

Partner, Head of Tax

KPMG in Ghana