Overview

The 2021 Budget Statement and Economic Policy highlighted some major Tax Revenue proposals for Government which included the introduction of additional levies to indirect taxes. it is important for businesses to know the implications that these policies have on their businesses as well as their application to avoid default of these laws.

Also, in view of company’s corporate income tax obligations, it is important that tax and finance practitioners across various industries are equipped with the requisite knowledge and skills due to the many rules associated with corporate Income tax calculation and the unpredictable outcome of tax audits.

Latest CJEU, EFTA and ECHR

CJEU decisions on progressive tax on turnover and fines related to advertising tax

On March 3, 2020, the Court of Justice of the European Union (CJEU) rendered its decisions in three cases, (C-482/18), (C-323/18) and (C-75/18), each of which concerned aspects of Hungarian law. The CJEU decided that the EU freedom of establishment does not preclude Member States from levying a progressive tax on turnover, the actual burden of which is mainly borne by companies controlled from another Member State. The Court also ruled that Hungarian advertisement tax penalty regime disproportionately affected companies located in another EU Member State and was therefore contrary to the EU principle of freedom to provide services.

For more information, please refer to Euro Tax Flash Issue 426.

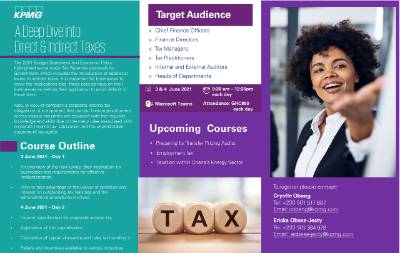

Course Outline

3 June 2021 – Day 1

- An overview of the new levies, their implication on businesses and requirements for effective implementation.

- How to take advantage of the waiver of penalties and interest on outstanding tax liabilities and the administrative procedures involved.

4 June 2021 – Day 2

- Income classification for corporate income tax.

- Application of thin capitalisation.

- Calculation of capital allowance and rules surrounding it.

- Reliefs and incentives available to various industries

Target Audience

- Chief Finance Officers

- Finance Directors

- Tax Managers

- Tax Practitioners

- Internal and External Auditors

- Heads of Departments

Additional Information

- Date: 3 & 4 June 2021

- Time: 9:30 am – 12:30pm each day

- Via: Microsoft Teams

Attendance: GHC850 each day

To register please contact:

Crystle Obeng

Tel: +233 501 517 807

Ericka Obese-Jecty

Tel: +233 501 364 979

Upcoming Courses

- Preparing for Transfer Pricing Audits

- Employment Tax

- Taxation within Ghana’s Energy Sector