Highlights of the 2021 Expenditure in Advance Of Appropriation

- As required by the Public Financial Management Regulation, 2019, the Government of Ghana through the Minister for Finance is expected to present a three (3) month estimate of expenditure and revenue in advance of appropriation in a year characterised by a major general election.

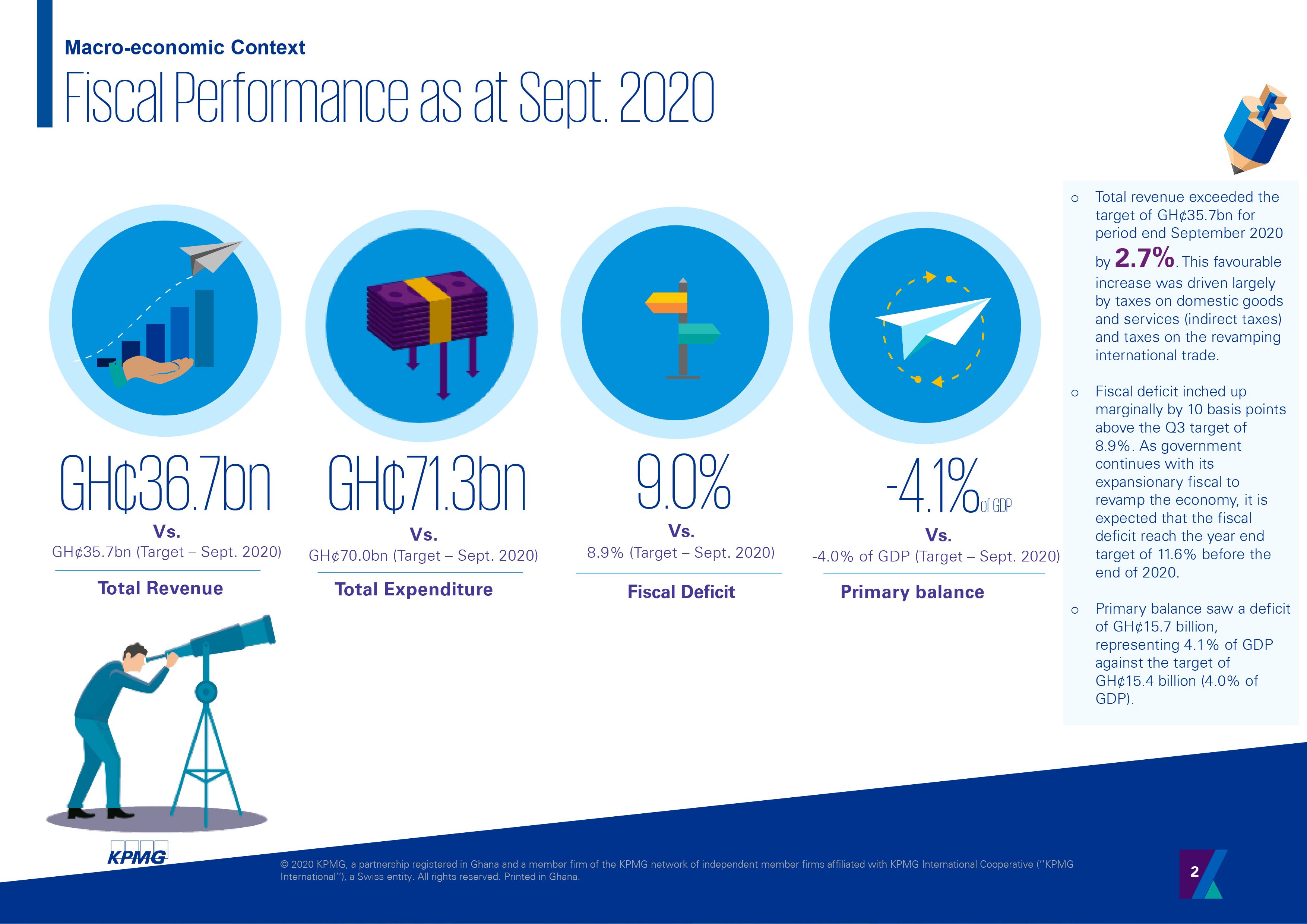

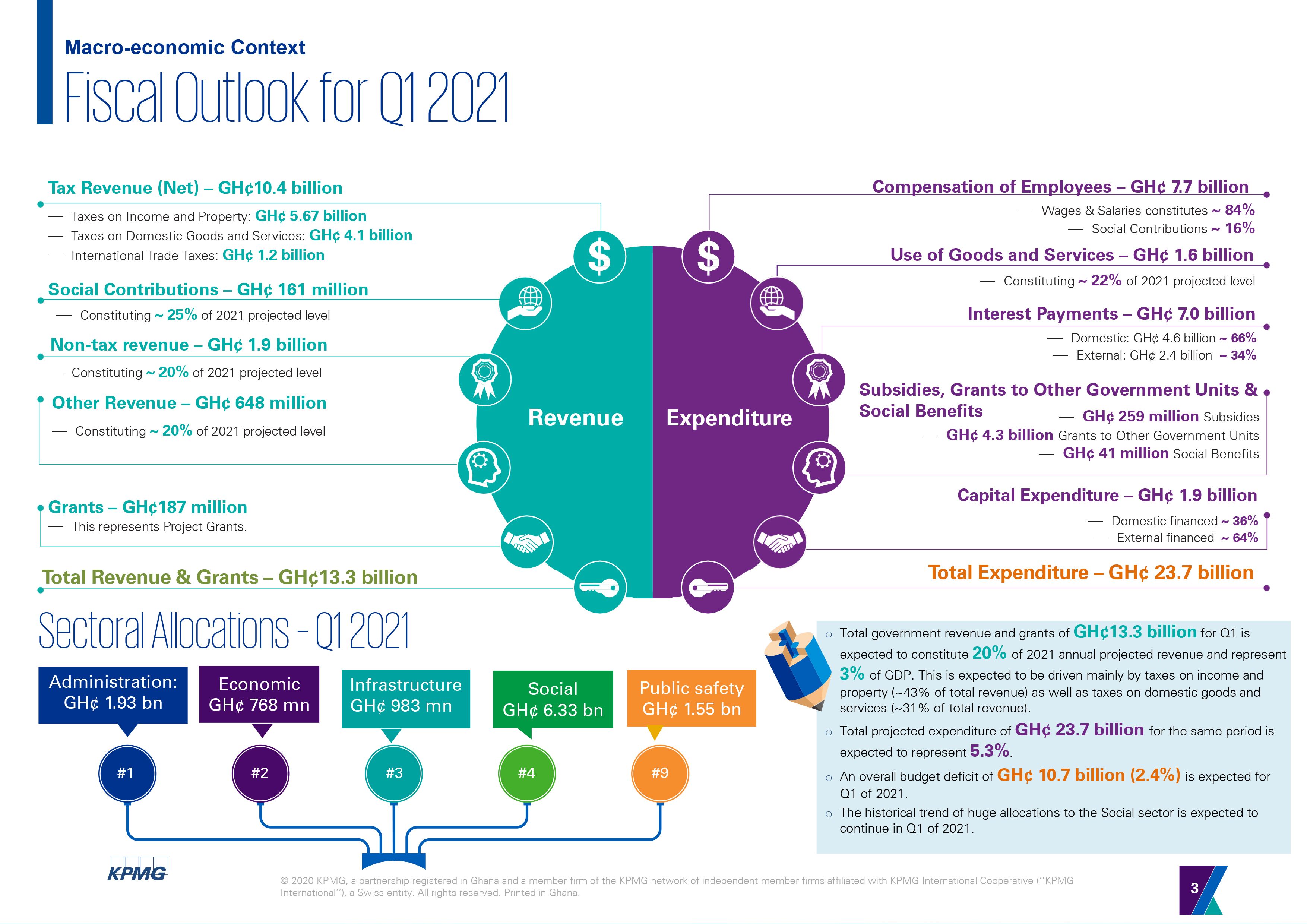

- The highlights capture the key expenditure and revenue items as envisaged for the first quarter of 2021. The document also highlights the performance of the Government with respect to some specific indicators at the end of the third quarter of 2020.

Latest CJEU, EFTA and ECHR

CJEU decisions on progressive tax on turnover and fines related to advertising tax

On March 3, 2020, the Court of Justice of the European Union (CJEU) rendered its decisions in three cases, (C-482/18), (C-323/18) and (C-75/18), each of which concerned aspects of Hungarian law. The CJEU decided that the EU freedom of establishment does not preclude Member States from levying a progressive tax on turnover, the actual burden of which is mainly borne by companies controlled from another Member State. The Court also ruled that Hungarian advertisement tax penalty regime disproportionately affected companies located in another EU Member State and was therefore contrary to the EU principle of freedom to provide services.

For more information, please refer to Euro Tax Flash Issue 426.